Columns

Addressing fundamental economic issues is imperative

View(s): The country is facing a plethora of economic problems. The one most discussed of these has been the critically low level of the country’s foreign currency reserves. This has drawn the most attention as the import of essential items is being restricted and the day-to-day life of the people is increasingly burdened by scarcities and soaring prices.

The country is facing a plethora of economic problems. The one most discussed of these has been the critically low level of the country’s foreign currency reserves. This has drawn the most attention as the import of essential items is being restricted and the day-to-day life of the people is increasingly burdened by scarcities and soaring prices.

Structural weaknesses

In fact, the foreign currency crisis is a manifestation of structural weaknesses and fragile state of the Sri Lankan economy. The persistent fiscal and trade deficits, enormous losses in state enterprises, wasteful expenditure on unprofitable infrastructure projects are prime examples of economic mismanagement.

Economic problems

The fundamental economic problems include the accumulated and increasing public debt that requires a very high proportion of Government revenue to be used for debt servicing. This starves developmental needs and distorts priorities in public spending.

The correction of these and enhancing productivity are crying needs of the economy. Corruption is a root cause of many of these problems and the inability to solve them.

Foreign reserves

Foreign reserves

However, the crisis in foreign reserves has been the main focus of discussion owing to its severity and impact on the availability of essentials. There has been much debate whether the Government should turn for assistance to the International Monetary Fund (IMF) or not.

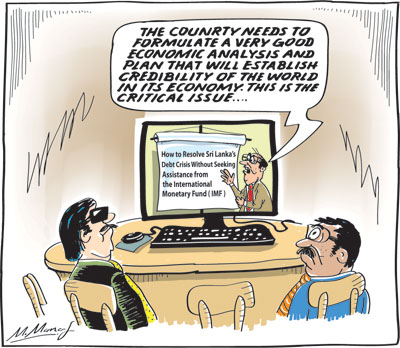

In fact a recent seminar titled “How to resolve Sri Lanka’s debt crisis without seeking assistance from the International Monetary Fund (IMF)” was expected to address this issue. What turned out to be its main thrust and contribution was the vital contribution of Dr. Nishan de Mel that a longer view of the nation’s fundamental economic problems are needed and that a long term sustained strategy was needed.

Advocata Institute seminar

At this seminar, Dr. Nishan De Mel, Executive Director of Verité Research, raised fundamental and critical issues concerning Sri Lanka’s sustained economic development rather than answer the question whether the country should seek IMF assistance to resolve the debt crisis. Yes, IMF is one of the solutions to the current crisis, but what we need is a sound long term strategy based on an economic analysis.

Good economic analysis

Dr. Nishan De Mel hit the nail on the head when he said: “Whatever Sri Lanka decides about dealing with its debt and paying its way through the world, the country needs to formulate a very good economic analysis and a publicly-backed plan that will establish credibility of the world in its economy going forward.” This is the critical issue.

Further, he said: “Such an analysis needs to be thorough and well-structured with the focus on real economic activity and the financial conditions in the economy. That would be the first step to build credibility of the world about the Sri Lankan economy.

Credibility

Dr. de Mel emphasised that it is actually credibility that we lack rather than foreign reserves. If we can build that credibility about us in the countries that we deal with, we may not need assistance from the IMF to resolve our liquidity issue. When such a favourable environment is created and other countries repose their trust in Sri Lanka’s economy, its sovereign credit ratings would see an upgrade and Sri Lanka would be able to raise funds at the international capital market at reasonable interest rates, The skill we need for this is to present an analysis and a plan and then demonstrate our commitment to stick to it.”

Plan

Further he said: “Whatever Sri Lanka decides about dealing with its debt and paying its way through the world, the country needs to formulate a very good economic analysis and a publicly-backed plan that will establish credibility of the world in its economy going forward.” This was the important thrust of Dr. Nishan de Mel’s presentation at the Advocata Institute seminar.

Paramount need

The paramount need for the country’s economic recovery is an analysis of the causes for the economic crisis and well thought out plan for stabilisation of the economy and a longer vision for economic development. Policy formulation he said lacked addressing the core issues of the economy.

The fundamental weaknesses, he stressed, was the inability to have a longer perspective and vision to resolve the core problems in the economy.

Obita dicta

In addition, we may add that the government’s ill-considered policies have weakened the Government’s finances and capacity to resolve issues. They have even aggravated the weaknesses in the economy by reducing production, employment, incomes and livelihoods of people. The weakening of the country’s fiscal position and the reduction in agricultural production are prime examples of these mistakes.

These mistakes are in a context of a rapid spreading COVID pandemic that increases Government expenditure on vaccines, health care and needed Government interventions to alleviate the increasing poverty and deprivations of the unemployed and destitute. In this context of increased Government expenditure, instead of enhancing Government revenue, it has reduced Government revenue. The fiscal deficit is expected to rise to a phenomenal 14 per cent of GDP this year. This is a serious destabilising factor in the economy.

Firefighting

What we have witnessed this year is a firefighting exercise; Finding solutions to emerging critical problems, especially the repayment of debt and replenishing the perilously low foreign reserves of the country by various palliatives. Currency swaps, lines of credit and loans to buttress the reserves that have fallen to less than US$ three billion are the Government’s economic preoccupations. These foreign currency arrangements are undoubtedly critically important in the current crisis, but do not solve the fundamental problems of the economy.

Concluding reflection

Is there recognition that the country lacks a long run vision of the country’s economic and social development? Are the decision makers deciding policy on their whims and fancies rather than rational long run economic and social interest?

Is there a political resole to face up to the severity of the economic problems and take bold decisions? Do we have a form of Government that could take decisions in a scientific and rational manner rather than for short run political advantage?

Regrettably the dictum that good economics is bad politics in the short run and good politics only in the long run is a truism.

Leave a Reply

Post Comment