Columns

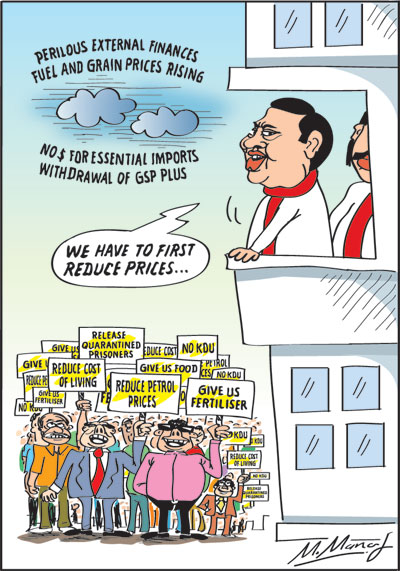

How will the economic crisis be resolved?

View(s): Everyone is aware that the country is in an economic crisis. Especially that we are facing a severe crisis in foreign finances. Low foreign reserves have to meet foreign debt repayment obligations and pay for essential imports. When and how will the Government resolve the crisis in external finances?

Everyone is aware that the country is in an economic crisis. Especially that we are facing a severe crisis in foreign finances. Low foreign reserves have to meet foreign debt repayment obligations and pay for essential imports. When and how will the Government resolve the crisis in external finances?

Problems compounded

The difficulties in external finances have been compounded by denying fertiliser to farmers. The consequent reduction in agricultural output is decreasing food availability, necessitating food imports and reducing exports. The unavailability of fertiliser for smallholder tea cultivation is threatening their livelihoods, reducing tea production and tea exports. The reduction of tea export earnings from about US$ 1.2 billion a year will be a severe erosion of export earnings.

Food imports

The unavailability of fertiliser will reduce food production and increase food import needs. In short increased import expenditure and reduced export earnings could erode foreign reserves to even a more perilous state.

Future

The full impacts of the current policies is yet to be seen. Severe hardships are likely later this year and in the next, unless the perilous foreign exchange crisis is resolved by foreign assistance.

Prices and shortages

Rising prices and shortages of food and essentials like medicines are inevitable. The unavailability of raw materials and spare parts for industry could reduce exports. The further spread of COVID and shortages of raw materials could jeopardise production of manufactured exports.

Threats

Furthermore, there are severe threats on the horizon that could aggravate the depleting foreign reserves and cause unbearable hardships to people. The withdrawal of the GSP plus concession for exports by the European Union (EU) countries and similar actions by the UK, USA and Canada would be a severe setback to exports.

Public finances

On the other hand, the state of public finances and inflationary pressures caused by monetary expansion would lead to severe financial difficulties for the government and deprivations to people, whose livelihoods are threatened by unemployment and loss of incomes. The possibility of another wave of the COVID could pose further threats to the economy by increasing the current high health costs and denying the destitute of government assistance.

Second half

Second half

These adverse developments are expected in the second half of this year and in 2022. Paradoxically, the adverse impact on the balance of payments this year has been the increasing import expenditure in spite of restrictions on imports. The second half of this year is likely to witness a widening of the trade deficit owing to increasing import expenditure on food, fuel essential raw materials and reduced agricultural exports. If further restrictions are imposed to counteract this, economic problems would be further aggravated.

Economic facts

The foreign reserves have depleted to as low as US$ four billion at the end of June. The foreign debt repayment of US$ one billion in a few days and expenditure on fuel and essential imports of food and raw material are likely to reduce foreign reserves to dangerous levels.

Public finances

The parlous state of the public finances with the fiscal deficit rising to an unprecedented 11 percent of GDP, while government expenditure on containing COVID is increasing are destabilising the economy. Furthermore, the inadequacy of interventions to reduce the plight of the increasing unemployed and destitute are serious economic and social problems facing the government.

Increased imports

Despite stringent import restrictions, imports have increased this year. Food and fuel imports have increased and are likely to increase further later this year. Consequently, the trade deficit would widen to much above last year’s US$ six billion. One expects it would be around US$ eight billion or more this year. Consequently, the balance of payments deficit at the end of the year will further erode the foreign reserves.

Imports

Fuel imports are likely to increase sharply owing to escalating international prices from about US$ 45 per barrel to about US$ 70. The recent increases in consumer fuel prices will not reduce fuel imports by much as the demand for these are inelastic. A large consumption of fuel is for thermal generation of electricity and public bus and rail transport.

Imports increasing

Import expenditure increasing in spite of import restrictions is a paradox that needs an explanation. The main reason for the increasing import expenditure is the escalation of international prices of fuel and food.

Fuel accounts for about 25 percent of total imports. International prices of fuel are increasing with the global economic recovery. Fuel prices that fell to US$ 30 per barrel and averaged around US$ 45 per barrel last year has risen to US$ 70 currently. Consequently, fuel import expenditure this year could be nearly double that of last year.

Food imports

Expenditure on food imports too have increased in spite of import restrictions owing to higher imports of rice and wheat. While there is a significant increase in prices of grains internationally, rice import volumes have increased owing to a shortfall in production, in spite of contrary reports of a bumper Maha harvest in 2020/21. The certain decrease in the Yala harvest this year would necessitate further increases in rice and wheat imports.

When and how?

How and when does the country extricate herself from this parlous state of external finances? Will the country use make shift arrangements and costly foreign borrowing to resolve immediate financial difficulties as and when facing a crisis? These are the questions uppermost in people’s minds.

Three paths

There are three paths to resolve the nation’s current economic crises. First, a makeshift arrangement to borrow from countries or come to currency arrangements to tide over immediate difficulties and keep limping along as we have done recently.

Second, borrow short term at high cost by issuing International Sovereign Bonds (ISBs).

Third, obtain assistance of the International Monetary Fund (IMF) by coming to an extended fund facility. Such a facility will be a long term accommodation in several tranches (instalments) at low interest. Such an arrangement would boost confidence in the economy and enable us to borrow on more favourable terms.

Resistance

Why then is there such resistance by the Government, Central Bank and economic advisors to going to the IMF?

The IMF facility is given on conditions that the Government follows prudent principles of good economic management. It would reject the current stringent import controls and most important come to an arrangement for a phased reduction of the current massive fiscal deficit of about 14 percent of GDP. Such fiscal consolidation would be in the interest of economic stability and growth that are the stated objectives of the Central Bank.

There may be certain hardships and difficulties consequent on following the IMF prescription, but these are inevitable in the current economic impasse. Hard times are inevitable with or without an IMF arrangement.

Leave a Reply

Post Comment