Columns

How will the economic crisis be resolved?

View(s): The country is in a multiplicity of inter-related and intertwined crises and widespread social upheavals. Apart from solutions to the specific grievances, drastic changes in economic policies are required to ensure financial and economic stability.

The country is in a multiplicity of inter-related and intertwined crises and widespread social upheavals. Apart from solutions to the specific grievances, drastic changes in economic policies are required to ensure financial and economic stability.

Social unrest

Protests and social upheavals due to severe economic difficulties, unavailability of fertiliser, protests against the charging of fees at the Sir John Kotelawala Defence University and arrests of protestors confront the Government.

Political crises

In addition, a political crisis has been brewing within the ruling coalition and within and among the opposition. These have been amply covered by the media for several weeks. The course that these political developments will take is at present as clear as mud. Whatever direction the political developments take, they will have to be drastic, pragmatic and effective. Otherwise, the country would face an economic catastrophe.

Economic crises

The economic crises facing the country are multi-dimensional. The country is heading towards a severe crisis in external finances. External reserves are perilously low and foreign debt repayments and import requirements are eroding them further.

Farmer incomes are dwindling and consumer prices are rising. Poverty, unemployment and hunger are increasing and weak public finances are limiting the capacity of the Government to even implement its policies to alleviate the escalating poverty by providing income support.

Foreign reserves

The depletion of the foreign reserves to as low as US$ four billion at the end of June with the imminent servicing of the foreign debt of around US$ 1.5 billion in a few days’ time, is of immediate concern. The widening of the trade deficit owing to increasing import expenditure is a further threat to the reserves.

Public finances

Public finances

The parlous state of the public finances with the fiscal deficit rising to an unprecedented 11 percent of GDP, while government expenditure on containing COVID is increasing is destabilising the economy. Furthermore, the inadequacy of interventions to reduce the plight of the increasing unemployed and destitute are serious economic problems facing the Government.

Increased imports

Despite stringent import restrictions, imports have increased this year. Food and fuel imports have increased and are likely to increase further later this year. Consequently, the trade deficit would widen to much above last year’s US$ six billion. One could project it to be around US$ seven to eight billion this year. Consequently, the balance of payments deficit at the end of the year will further erode the foreign reserves.

Imports

Fuel imports are likely to increase sharply owing to escalating international prices from about US$ 45 per barrel to about US$ 70. The recent increases in consumer fuel prices will not reduce fuel imports by much as the demand for these are inelastic. A large consumption of fuel is for thermal generation of electricity and public bus and rail transport.

However, the increase in consumer prices of petroleum products would have a bearing on public finances. The public expectation of a reduction in fuel prices, if implemented, will weaken the public finances further, but have little impact on fuel imports.

Food imports

Food import expenditure is increasing due to international prices of grains increasing. Poor harvests of paddy in Yala this year have compounded the problem necessitating increased imports of rice. If the Maha 2021/22 suffers the same fate, then larger rice imports would be needed.

Exports

Export performance has been fairly satisfactory. In the first half of the year export earnings have been better than of last year. On this basis, one could expect export earnings of about US$ 11 billion for this year.

The downside risks to exports is dislocation of manufacturing owing to work disruption by the spread of COVID, the non-availability of raw materials and the threat of losing the GSP plus status in the EU market and similar trade restrictions by the UK and Canada.

Tea exports

Another likely setback is to tea exports. There could be a sharp decline in tea exports as tea production, especially among tea smallholders, who account for about 75 percent of exports of US$ 1.2 billion. Their tea production is threatened by the unavailability of fertiliser. The resolution of this problem is imperative. Chemical fertilisers, weedicides and insecticides should be permitted for tea cultivation.

Debt repayment

The fears that the Government would not be able to meet its debt repayment obligations of US$ 1.5 billion this month, is unfounded. Its reserves of US$ four billion can meet this obligation. There are expectations of a further swap from India of US$ 1.5 billion, an agreed swap of US$ 250 million from Bangladesh and the IMF grant of SDRs of approximately US$ 780 million expected in August.

The Chinese currency swap of Yuan amounting to about US$ 1.5 million, though not part of the reserves, could be used to pay for Chinese imports. This is an important strength to the balance of payments as China is one of Sri Lanka’s main importing countries.

Turning point

These economic conditions have a significant bearing on the political crises and social upheavals. There is considerable uncertainty on what policies the Government would pursue to resolve the country’s formidable economic problems. Will the undefined ‘alternate economic strategies’ take us further and further into an abyss or will the economy be rescued by international assistance?

Radical change

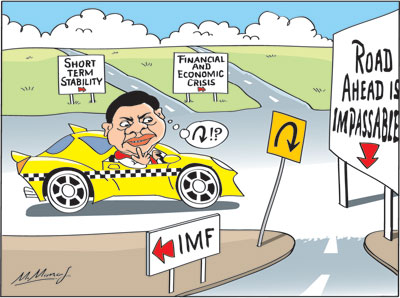

The question uppermost in the minds of most people is whether the appointment of Mr. Basil Rajapaksa as Finance Minister would bring about a radical change in policies that could save the country from the several economic crises facing the country.

There are strong indications that the new Finance Minister would change course and turn to the IMF to rescue the economy. Can the new Finance Minister reverse several key policies to diffuse the widespread demonstrations and protests against many discontents and strengthen the economy with foreign assistance?

Conclusion

The island is in the midst of multidimensional crises. The Government’s priority would no doubt be to diffuse the widespread protests in the country. This may well be the priority of the new Finance Minister. However, reversing the President’s decision to ban fertiliser, which caused turmoil among the large farming population, will be a severe setback to the President’s policy. Similarly, turning to the IMF, which is the most viable solution, too would be a severe affront to him and his economic advisors.

It is not certain whether the new minister is contemplating such policy reversals. Nor is there an indication of what policies he would quell amid the protests and opposition to the Government. Any changes in policies must be aimed at not only dampening protests but bringing relief to people’s livelihoods that have been threatened.

Pursuing economic policies that resolve the political and social upheavals, but aggravate the economic conditions, is not feasible in the state of the economy. Conversely, resolving the economic crisis is a prerequisite to addressing several of the other economic and social deprivations.

Final word

The Government will be able to tide over the immediate foreign debt problem, but the resolution of the perilous state of international reserves can only be resolved with a more sustainable solution. Will the Government take a U turn in policy and turn to the IMF to stabilise the economy?

Leave a Reply

Post Comment