Columns

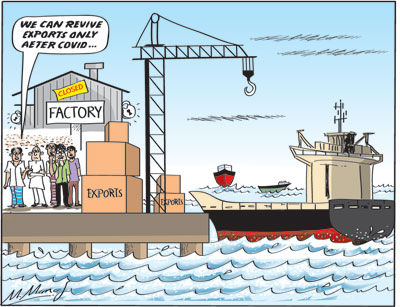

Exports threatened by resurgence of COVID

View(s): Merchandise exports are likely to decline this year despite a revival of global demand. The resurgence of COVID, travel restrictions and the island-wide lockdown from May have restricted the capacity of industries to meet export orders. Consequently, merchandise exports that were expected to increase this year, are likely to fall.

Merchandise exports are likely to decline this year despite a revival of global demand. The resurgence of COVID, travel restrictions and the island-wide lockdown from May have restricted the capacity of industries to meet export orders. Consequently, merchandise exports that were expected to increase this year, are likely to fall.

It is indeed unfortunate that our capacity to export is stifled just as the global economy is reviving and there is a growing demand for the country’s manufactured exports.

Trade deficit

The reduction in exports, together with increased import expenditure on fuel, food and other essentials, are likely to widen the trade deficit and strain the balance of payments this year.

Pre-condition

The containment of COVID in the country is a vital pre-condition for reviving export growth. The success of the current restrictions and the extent and speed of coverage of the vaccine to contain the pandemic will determine the export revival.

Global revival

Global revival

There is a global revival of trade and the demand for our manufactured exports has also increased. This setback to the country’s export production due to the resurgence of COVID is therefore unfortunate.

The uptrend in global export growth and revival of demand for our exports led to expectations of merchandise export earnings exceeding the EDB target of US$ 15 billion for this year. This was owing to the revival of international demand for the country’s pre-COVID exports of apparel, ceramics, electrical goods and other exports that were severely affected by the global recession.

While there are increased export orders for these, the demand for personal protective equipment (PPE) too continued. Therefore, there was a prospect of export earnings reaching about US$ 17 to 18 billion in 2021.

Furthermore, there was the prospect of a revival of global demand for solid tyres, boats,electrical goods and other manufactures that were affected by the global economic disruption later this year and in 2022.

Export performance 2021

The export performance in the first four months of the year, before the new wave of COVID and restrictions, led to an expectation of exports achieving and even exceeding, the Export Development (EDB) target of US$ 15 billion this year. This was especially so as exports increased by nearly 200 percent in April this year when compared to that of the poor export performance of April 2020.

Exports

In the first four months of this year, merchandise exports were about 30 percent higher than in the same period of last year before COVID. Merchandise exports were US$ 3.7 billion in the first four months of this year compared to US$ 2.85 billion in the same period last year. The surge in exports in April this year was as much as 183 percent to reach US$ 799 million.

Export industries, especially apparel, had a revival of export orders. There was a prospect of merchandise exports expanding in the next eight months of the year as there was a resurgence of demand for the country’s manufactured exports from the main markets in the US, UK and the European (EU) countries.

Reversal

These expectations of increased exports have been severely shaken by the resurgence of COVID, travel restrictions and lockdowns from May. The severity of the restrictions and the spread of the infection has disrupted factory production in several regions of the country.

Supply constraints

The export performance this year will be severely affected by supply constraints rather than global demand. With the rapid resurgence of COVID in most parts of the country and the travel restrictions, export manufacturers are finding it difficult to continue production at full capacity and some have had to even close down.

Constraints

The constraints to export growth this year is not depressed international demand for our exports, it is the inability to meet the demand due to factory closures and limited production capacity.

Factory closures

The worst affected by the resurgence of the COVID-19 pandemic has been the country’s premier export: the apparel industry. The current spread of COVID, travel restrictions and lockdown have reduced their production capacity resulting in delays in meeting orders.

Business Times

According to the Business Times article of May 30 by Sunimalee Dias, the apparel industry may be unable to deliver on the US$ 5.1 billion target and may go down to about US$ four billion should the current pandemic conditions continue. The Business Times reported that large numbers of factory workers in various parts of the country were infected with the virus and factories in these areas were functioning at about 65-70 percent capacity. There have also been closures of factories in the Koggala Free Trade Zone due to a widespread outbreak of COVID.

According to reports, factories are running at 40-50 per cent capacity in other areas too due to the rise in COVID-19 infections, travel restrictions and related difficulties. Consequently, orders are delayed and there is a possibility of the next season’s orders being reduced.

Summing up

The resurgence of COVID, travel restrictions and the island-wide lockdown from May have stifled the capacity of industries to meet export orders just as global demand for our exports was reviving. Consequently, merchandise exports that were poised to increase has been thwarted. The apparel industry in particular has had a setback with factory closures and reduced production. The expectation of exports achieving the EDB target of US$ 15 billion this year is unlikely. In fact the EDB is in the process of revising its target downwards.

The reduction in exports together with increased import expenditure on fuel food and other essentials are likely to widen the trade deficit and strain the balance of payments this year. It is indeed unfortunate that our capacity to export is stifled just as the global economy is reviving and there is a growing demand for the country’s manufactured exports.

Conclusion

Although the government is trying to keep the essential economic activities, especially export manufacture going, this does not appear feasible. The significant curtailment of the pandemic in the country by a large proportion of the population being vaccinated is crucial for the economic recovery.

The undue early relaxation of the health restrictions and imprudent policies like permitting tourists could postpone the country’s revival from Covid-19 and even aggravate it.

The containment of COVID in the country is a vital pre-condition for reviving export growth. The success of the current restrictions and the extent and speed of coverage of the vaccine to contain the pandemic will determine the export revival.

Leave a Reply

Post Comment