Columns

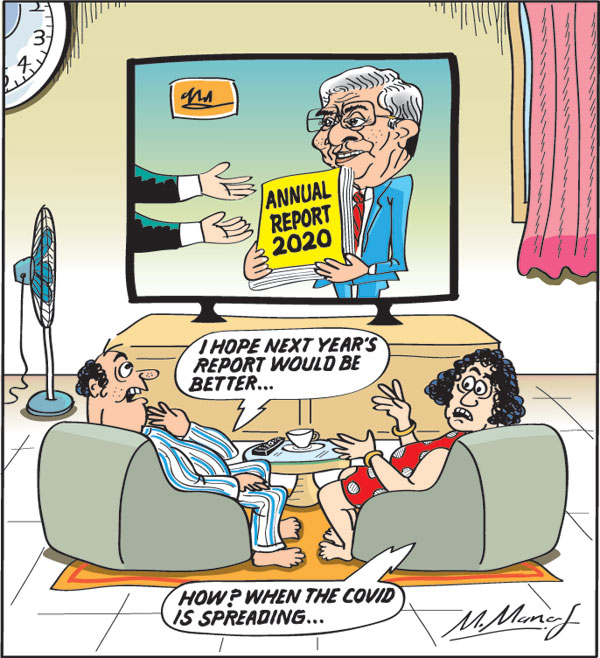

Reviewing a lost year and expecting an economic revival

View(s): The “Sri Lankan economy contracted by 3.6 per cent in real terms in 2020, recording the deepest recession since independence” according to the 2020 Central Bank Annual Report.

The “Sri Lankan economy contracted by 3.6 per cent in real terms in 2020, recording the deepest recession since independence” according to the 2020 Central Bank Annual Report.

On the other hand, the Central Bank expects the economy to bouncing back in 2021: “The Sri Lankan economy is expected to rebound strongly in 2021 and sustain the high growth momentum over the medium term, buoyed by growth oriented policy support.”

Global context

In March 2020 the COVID-19 pandemic struck the world economy in numerous ways. The containment of the pandemic became the foremost priority to avoid a precipitous global economic downturn that seemed inevitable. Global economic growth fell sharply.

This global context impacted heavily on Sri Lanka’s export and tourist dependent economy. Sri Lanka’s economic growth shrunk by 3.6 percent, employment and incomes fell drastically and poverty increased.

In the words of the Annual Report “Mobility restrictions and other containment measures imposed locally and internationally, with a view to preventing the spread of COVID-19, hampered real economic activity across all sectors.”

Three sectors

Three sectors

There was a sharp contraction in the industry due to a significant slowdown in manufacturing and construction. Services contracted sharply and agricultural production fell despite favourable weather. (Annual Report 2020)

Incomes

Sri Lanka’s GDP per capita declined to US$ 3,682 in 2020 from US$ 3,852 in the previous year. The size of the economy fell to US$ 80.7 billion in 2020 from US$ 84.0 billion in 2019. The per capita income of US$ 3852 million last year was below the threshold for a high middle income level of US$ 4000 reached earlier.

Unemployment and poverty

The Central Bank Annual Report for 2020 seeks to capture this story of last year’s economic collapse in facts and figures. According to it, the economy shrunk by 3.6 percent, unemployment increased to five percent and poverty increased. In fact the actual plight of people is likely much worse than statistics could capture. The statistics are best taken as ordinal indicators of last year’s economic depression rather than cardinal measures.

Unemployment was rampant, incomes dwindled and poverty and hunger was widespread. Government’s free food packages and allowances tried to alleviate the tragic conditions of a large number of persons deprived of their livelihoods, though inadequately.

The global downturn jolted the country’s export-dependent economy severely. The loss of markets for manufactured exports and cessation of tourism were the severest external shocks.

Export resilience

The resilience and adaptability of the country’s export manufacturing industries was noteworthy. “The slump in merchandise exports due to the mobility restrictions and lockdown measures was swiftly overcome, demonstrating the resilience of Sri Lankan exporters.” (Annual Report 2020).

Furthermore, the Report underscores the rebound in export earnings “ within a relatively short span of time to reach pre-pandemic levels.”

This revival of exports was achieved by exporters diversifying into the new demand for personal protective equipment such as surgical gloves, rubber gloves and masks.

Consequently exports dipped only slightly last year compared to pre-COVID 2019.

Import restrictions

Facing low foreign exchange reserves, large foreign debt repayment obligations and expectation of an export decline, the government adopted measures to curtail non-essential imports. This together with the significantly low global petroleum prices, helped reduce import expenditure and reduce the trade deficit from US$ eight billion in 2019 to US$ six billion in 2020.

Balance of payments

Despite the reduced trade deficit, the balance of payments deteriorated last year owing to reduced incomes from services and net capital outflows. The saving grace was that workers’ remittances that have been the most important strength to the balance of payments for several years, increased last year.

In 2020, there was a balance of payments deficit of US$ 2.3 billion compared to a surplus of US$ 877 million in 2019. Net capital outflows were mainly responsible for this deterioration. The expected revival of tourism did not materialize. Workers’ remittances that were expected to decrease, increased to US$ 7.1 billion.

Tourism

Tourism that was expected to rebound after the setback of the Easter Sunday terrorist attacks was “severely affected by global travel restrictions.” The global spread of the virus and in Sri Lanka led to negligible tourist arrivals and earnings.

Other services

In contrast, other earnings from services and workers’ remittances increased. Foreign inflows from services relating to Information Technology and Business Process Outsourcing (IT/BPO) sector, increased significantly. A new source of foreign earnings was the surge in novel work arrangements amidst the pandemic. Surprisingly workers’ remittances recorded a notable recovery during 2020, despite the decline witnessed at the onset of the pandemic to US$ 7.1 billion. External reserves were US$ 5.7 billion at end 2020.

Fiscal outturn

The adverse impacts of the COVID pandemic had serious repercussions for the fiscal outturn. The trend of increasing fiscal deficits in recent years, especially since 2018, was compounded by the responses to COVID that “resulted in lower-than-expected revenue mobilisation and high recurrent expenditure.”

The increased recurrent expenditure and shortfall in revenue curtailed capital expenditure and limited fiscal space to alleviate the impact of the pandemic on economic activity as well as essential social expenditure.

The overall budget deficit at 11.1 per cent of GDP in 2020 was extremely high. The outstanding public debt increased to 101.0 per cent of GDP at end 2020, from 86.8 per cent of GDP at end 2019.

Fiscal challenges

Especially significant was the Central Bank’s attention to these fiscal challenges. ahead that requires to be addressed by the Government. “The fiscal weaknesses of the country have been aggravated by the persistently low revenue, rigid and increasing recurrent expenditure, rising gross financing needs and the resultant elevated debt level, as well as the need to improve the financial performance of State-Owned Business Enterprises (SOBEs).”

Policy prescriptions

The Central Bank advises: “Policy adjustments in the period ahead must give due consideration to the fact that the COVID-19 pandemic has had a disproportionate impact on underprivileged segments of the population and has aggravated inequalities, not only related to income, but also in relation to other aspects that affect socio-economic wellbeing in the short run and productivity in the long run.”

Economic prospects

The Central Bank is quite optimistic of the economy bouncing back in 2021. It states, ”The Sri Lankan economy is expected to rebound strongly in 2021 and sustain the high growth momentum over the medium term, buoyed by growth oriented policy support.

While addressing near term vulnerabilities stemming from the pandemic remains an immediate priority, resolving the persistent structural impediments that hinder the country’s long term growth prospects is essential in the period ahead.

Concluding reflection

This expectation of economic rebound was based on the prospect of a global economic recovery that would enhance the country’s exports and revive global travel and tourism. This is unlikely with the increasing spread of the virus in the country as well as its spreading in other parts of the world.

We must hope for appropriate policy responses that would mitigate the global and local setbacks and find ways and means of increasing production in the country.

Reviewing a lost year and expecting an economic revival

Leave a Reply

Post Comment