Columns

Is there an improvement in our external finances and indebtedness?

View(s): The currency swap of US$ 500 million with the Peoples’ Bank of China, an expected loan of US$ 500 million from the Chinese Development Bank and other expected foreign assistance are expected to enhance the country’s foreign reserves. At the end of February foreign reserves were US$ 4.6 billion, while foreign debt had risen to US$ 55 billion. Debt repayments during the course of this year are estimated at US$ 6.1 billion.

The currency swap of US$ 500 million with the Peoples’ Bank of China, an expected loan of US$ 500 million from the Chinese Development Bank and other expected foreign assistance are expected to enhance the country’s foreign reserves. At the end of February foreign reserves were US$ 4.6 billion, while foreign debt had risen to US$ 55 billion. Debt repayments during the course of this year are estimated at US$ 6.1 billion.

Further expectations

The country has averted an extremely precarious vulnerability in external finances by these loans, despite the low foreign reserves in recent months. The Government is also seeking assistance from other countries as currency swaps or credit lines for vital imports.

Furthermore, the government expects, “A strong pipeline of foreign direct investment inflows from the Colombo Port City investments”. When would this be?

Special Drawing Rights (SDRs)

There would be an improvement in the balance of payments due to an International Monetary Fund (IMF) decision to issue additional Special Drawing Rights (SDRs) of about US$ 800 million. This decision of the IMF to issue these SDRs is a significant fortuitous strengthening of the reserves as it is an outright grant that does not have to be repaid, unlike currency swaps, loans and other foreign borrowing.

Trade and balance of payments

There is an expectation of an improvement in the balance of payments this year, despite a higher trade deficit. Although manufactured exports are likely to increase with the global economic recovery, the trade deficit is likely to widen owing to increased import expenditure.

Although a higher trade deficit is likely this year than that of last year, increased earnings from services are expected to offset the trade deficit to achieve a balance of payments surplus this year. There are expectations of continued high workers’ remittances and a recovery in tourism.

Remittances

There have been increases in workers’ remittances last year that has continued in the first two months of this year when we received US$ 1.2 billion. If this continues, remittances could exceed US$ 7 billion this year and make a substantial difference to the balance of payments. However, there is no certainty in this.

Tourism

Tourist earnings of US$ 1.5 billion are expected this year. These too are uncertain due to the resurgence of COVID and restrictions in international travel. Increased earnings from ICT services could make a useful contribution to the balance of payments. A balance of payments surplus this year would certainly strengthen the foreign reserves and assist in repaying the foreign debt obligations in the coming months.

External financial vulnerability

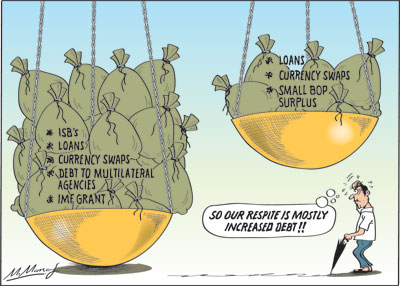

In spite of the relief provided by the currency swaps and loans, the external financial vulnerability continues to grow. These immediate relief measures were important to stave off the possibility of not meeting the country’s international debt repayment obligations. They were an essential palliative for the immediate resolution of the debt repayment crisis. Yet, these roll over facilities have increased the country’s debt stock and future debt repayment obligations.

Resolution of problem

Resolution of problem

The really effective and sustainable resolution of the country’s debt problem lies in achieving recurrent balance of payments surpluses. To achieve these there has to be a resurgence of exports, continued high inflows of remittances and a revival of tourism.

Import restriction policy

The containment of the trade balance by stringent import controls is not a realistic and sustainable option as it affects export manufacture adversely. In addition, there are limits to import restrictions as the bulk of the country’s imports are intermediate and capital goods. For instance, in February this year, in spite of stringent import controls, about 80 percent of imports were intermediate and capital goods essential for domestic production. They include fuel, fertiliser, chemicals, raw materials and machinery for manufacture. The curtailment of these imports would endanger production and exports. Therefore, only imports that do not affect production of goods and services should be restricted. This is often difficult.

Increased indebtedness

The current strategy of borrowing in various forms invariably results in an increase in Sri Lanka’s international indebtedness. This is so in respect of the country’s total government debt too. The high ratio of domestic debt to GDP implies a lack of fiscal space to spend on the priority areas for the country’s social and economic development.

Conclusion

The averting of the debt repayment crisis by currency swaps and loans was an immediate and essential means of remedying the crisis in external finances. However, it increases the country’s debt and future debt repayment obligations. The durable solution to the nation’s external financial vulnerability is the achievement of recurrent surpluses in the balance of payments. A significant improvement in the balance of payments must be achieved by increased exports and earnings from services.

The Sri Lankan economy has been, is and will be a trade dependent economy. As an import-export economy, its prosperity and indeed its survival depends on its export competitiveness. Sri Lanka must “export or perish.”

Leave a Reply

Post Comment