Columns

Opportunities and threats of global economic recovery

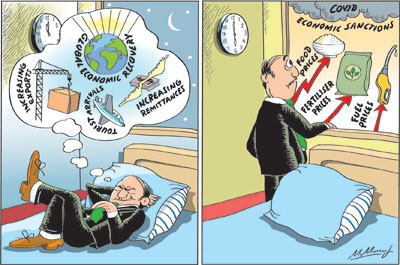

View(s): The gradual recovery of the global economy brings with it benefits, disadvantages, opportunities and challenges. It provides Sri Lanka’s export-import economy with both opportunities for export growth and also brings with it external shocks and disadvantages as prices of essential imports are likely to increase.

The gradual recovery of the global economy brings with it benefits, disadvantages, opportunities and challenges. It provides Sri Lanka’s export-import economy with both opportunities for export growth and also brings with it external shocks and disadvantages as prices of essential imports are likely to increase.

On balance

However, on balance, the global economic recovery confers more benefits and opportunities than setbacks. This is especially so with respect to merchandise exports and earnings from services.

If there are increased earnings from ICT services, workers’ remittances are at around last year’s amount and there is a revival of tourism at the end of the year, there is a prospect of this year’s balance of payments being in surplus and enhancing the foreign reserves at years’ end.

The increased expenditure on essential imports would however be a strain on the trade balance. There are also many uncertainties in the expectations on ICT Services, workers’ remittances and tourist earnings that could contribute much to the balance of payments.

The COVID pandemic

Despite the increasing optimism of a COVID free world, there are fears that the pandemic will not pass away easily. There are fears of increasing spread of COVID in some countries and lockdowns in the countries that matter.

The global economic recovery is possible only after the COVID pandemic is eliminated globally. The world would be completely safe only when it is eliminated in the entire world.

As Geoffrey Okamoto, First Deputy Managing Director of the IMF said recently, “this pandemic will only really be over when it is over for everyone.”

Mr. Okamoto said the economic recovery is still uncertain “incomplete and unequal.”

“It is incomplete because despite a stronger than expected recovery in the second half of 2020, GDP remains well below pre-pandemic trends in most countries. The recovery paths have also been different across countries, as well as across sectors,” he said.

Global economic recovery

Global economic recovery

The latest IMF forecast of global economic recovery in April was more optimistic than at the beginning of the year. It forecasted a global economic growth of 6.6 percent.

China was expected to grow by 8.8 percent, while the US was expected to grow at 6.4 percent. India was expected to recover to a growth of 12.5 percent this year.

Opportunities

The economic recovery of Western countries, in particular, would enhance the demand for Sri Lanka’s manufactured exports. China’s speedier recovery could also enhance certain exports and tourism. It provides new opportunities for exports and increased trade.

Economic recovery will vary widely in different regions. The fastest recovery is expected from China and East Asia, South Korea, Vietnam and Japan. These countries are expected to be near normal later this year.

Uncertainty

Nevertheless, there is no certainty that global economic growth will accelerate until the pandemic is eliminated globally. There have also been set-backs to the economic recovery. Germany’s lockdown, the banning of vaccines by France, Spain, Germany and several other European countries makes the containment of the pandemic uncertain.

Furthermore, the unavailability of the vaccine in many countries and a sizeable extent of the pandemic in some continents add to the skepticism of its elimination. New mutations of the virus in various countries and their spreading to other countries have also been a severe setback to expectations of controlling the virus.

Economic recovery

Despite these reservations, the global economy will revive to some extent and the global demand for goods and services would increase. There is evidence that in the first two months of this year there was an upsurge in international demand for apparel, rubber goods and PPE items. We expect this demand to increase in the coming months.

Tourism

The revival of travel and tourism will take a longer time as conditions in the country of origin and of the destination would matter. Furthermore, we should adopt a cautious approach to the expansion of tourism. Lack of vigilance in tourists coming into the country could be a serious health hazard that would impact on the economy as last year.

Downside

The global economic recovery has significant downside impacts on the Sri Lankan economy. In as much as the demand for the country’s industrial exports are likely to increase, import expenditure is likely to escalate owing to higher prices.

Already international prices of fuel, fertiliser and other raw materials and basic foods have increased. Fuel prices that averaged about US$ 30 per barrel for most part of 2020, increased to above US$ 60 this year. Fuel prices are likely to increase further as the world economy revives. They are also likely to fluctuate, as always, but not reach the low prices of 2020.

Import prices

In fact, commodity prices for most part will increase this year. Consequently, imports of fuel, fertiliser, chemicals, wheat, raw materials would increase. In as far as inputs for industry are concerned, there would be commensurate compensatory increases in export prices. It is therefore critical that imports of raw materials for industry are not affected by import restrictions. The bottom line is that the country’s import expenditure is likely to increase significantly this year in spite of import controls.

In all probability, the global economy is likely to recover, though the nature and pace of it is uncertain. The extent of the control of the pandemic would be a determinant of the pace of such growth.

Sri Lanka’s exports are likely to benefit. On the other hand, import expenditure is likely to increase and cause a higher trade deficit. If workers’ remittances remain at last year’s US$ 7.1 billion and tourism revives, the balance of payments could be in surplus. Uncertainties in these are however serious concerns.

Remittances

Last year’s increase in workers’ remittances is difficult to explain as workers were returning to the country. One explanation is that returning workers are remitting their accumulated savings through official channels rather than informal channels. If this is so, we could expect remittances to decline as the number of workers abroad are declining.

On the other hand, it is suggested that expats in developed countries have increased their remittances to help their relations in financial difficulties. Either explanation leaves some doubt on the expectation of remittances to reach over US$ seven billion this year.

Remittances in the first three months of this year are estimated at about US$ 1.5 billion. This is indicative of a decline this year.

It is hazardous to make an estimate of remittances, but a fall in remittances would cause a serious dent in the balance of payments. Hopefully, remittances will not fall below US$ five billion this year.

Serious threat

Furthermore, the threat of economic sanctions as a consequence of the UNHRC resolution on human rights violations poses a huge threat to the economy. Economic sanctions by Western countries that are the main markets for our exports would negate the benefits of the global economic recovery.

Concluding reflection

Merchandise exports, have to be increased significantly to contain the trade deficit to as low a gap as possible as there would be a significant increase in import expenditure. The expectation of continued increases in remittances and the revival of earning from tourism, if realised, would strengthen the balance of payments and external finances.

The country’s hopes are that there would be a global containment of COVID and a robust world economic recovery that would enable a revival of Sri Lanka’s economic growth. It is most important that the government’s diplomacy would eliminate the threat of economic sanctions.

Leave a Reply

Post Comment