Columns

Prospects of economic growth and external finances in 2021

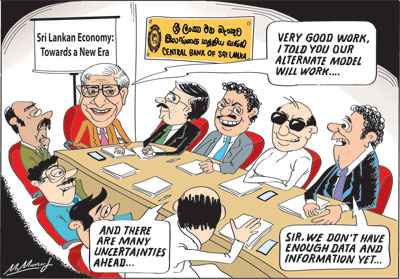

View(s): The Central Bank of Sri Lanka (CBSL) expects a significant economic recovery this year. The economy is expected to grow by six percent. All three sectors of the economy are expected to grow and a balance of payments surplus is forecast for 2021.

The Central Bank of Sri Lanka (CBSL) expects a significant economic recovery this year. The economy is expected to grow by six percent. All three sectors of the economy are expected to grow and a balance of payments surplus is forecast for 2021.

Economic growth

The CBSL’s forecast of the economy’s growth by six percent this year is above the expectations of the ADB, World Bank and IMF that forecast growth of between 3.5 to 5.3 percent. The Central Bank’s expectations are based on the economic performance in the first two months, on other recent favourable economic developments and expectations of a global economic recovery. They do not appear to take into account possible reversals, threats and global setbacks.

Growth realistic?

The projected growth of six percent for this year is a reasonable expectation. In fact, it is not much of an achievement given the negative growth of last year and the low growth in 2019. A growth of six percent is realistic, but inadequate. It would barely catch up the recent economic stagnation. We are ‘running to be in the same place.’ However, given uncertainties in the containment of COVID internationally and in the island and the expected global economic recovery of five percent, a higher growth is unrealistic.

Sources of growth

This year’s economic growth is based on expectations of growth in all three sectors of the economy: agriculture, industry (including construction) and services.

Agriculture

The agriculture sector’s growth is based on expectations of increased production in tea, paddy and rubber production. The paddy harvest is expected to be only slightly lower than last year’s bumper harvest of 330,000 metric tonnes at about 300,000 metric tons. The Yala harvest this year is unpredictable till the monsoon rains in May.

The Central Bank’s expectation of growth in other crops is less likely. Although there has been an increase in tea and rubber production in the first two months, the capacity to increased tea production on the estates is limited owing to structural problems. The entirety of an increase in tea production would have to come from small holder cultivation that accounts for about 70 percent of tea output. Similarly, the capacity of increasing natural rubber production is limited. Only long term investment in these tree crops could achieve an increase.

The decrease in coconut production is amply demonstrated by the high prices and imports of coconut kernel and coconut oil. An increase in other food crops, especially maize, is doubtful this year owing to pest damage and climate-related setbacks. In any case, agriculture accounts for only about seven to eight percent of GDP.

Manufacturing

Manufacturing

The most promising sector is manufacturing as its growth is expected to be stimulated by the increase in international demand for the country’s apparel and rubber goods exports, in addition to a continued increase in personal protective equipment (PPE).

These exports may decrease in the latter part of the year when the global spread of COVID diminishes with increased vaccination. At the same time, there could be a revival of demand for our usual manufactured exports, including heavy duty tyres and apparel.

Services

A significant growth in services are expected. Earnings from ICT services from abroad are likely to increase as there has been a recovery in ICT services after a setback. Last year (2020) they increased to US$ 971 million from US$ 899 million in 2019. Earnings from ICT services have a potential to exceed US$ one billion in 2021 if global economic recovery gains momentum.

Earnings from tourism too would grow with the gradual growth in tourism, especially in the latter part of the year. Tourist earnings of US $ 1.5 billion is expected if global travel and tourism recovers. The containment of COVID in the Island is as important as the global recovery from the pandemic.

External finances

The Central Bank forecasts a significant improvement in the external finances. It expects the trade deficit to narrow and the reduced deficit to be more than offset by workers’ remittances, earnings from tourism and earnings from ICT services.

The expectation of a reduction in the trade deficit is unrealistic. The trade deficit is likely to widen owing to increased import expenditure. Nevertheless, the trade deficit is likely to be offset by earnings from services to result in a balance of payments surplus. However, the magnitude of the BOP surplus is uncertain.

Trade balance

The global economic recovery has significant downside impacts on the trade balance. In as much as the demand for the country’s industrial exports are likely to increase, import expenditure is likely to escalate.

Already the international price of fuel, fertiliser and other raw materials and basic foods have increased. Fuel prices that averaged about US$ 30 per barrel for most part of 2020, have increased to US$ 60 to 70 this year. Fuel prices are likely to increase as the world economy revives.

Increased import expenditure

In fact, most commodity prices will increase this year. Consequently, imports of fuel, fertiliser, chemicals, wheat, raw materials would increase. In as far as inputs for industry are concerned, there would be commensurate compensatory increases in export prices.

The bottom line is that the country’s import expenditure is likely to increase significantly this year in spite of import controls. Import expenditure is likely to exceed US$ 18 billion.

If merchandise exports increase to the EDB target of US$ 12 billion, the trade deficit is likely to be about US$ six billion. We expect exports to fare better to around US$ 15 billion, but imports could exceed US$ 18 billion. A trade deficit of over US$ six billion is likely.

Balance of payments

In spite of this, there could be a balance of payments surplus. While tourist earnings and earnings from ICT services could bring in around US$ 2.5 billion, a critical issue is whether the expectation of workers’ remittances to increase to over US$ seven billion is realistic. This is unlikely.

Workers’ remittances

There is considerable uncertainty on how much this year’s remittances would be. Last year’s increase in remittances is difficult to explain as workers were returning to the country. One explanation is that returning workers were remitting their accumulative savings through official channels rather than informal channels. If this is so, we could expect remittances to decrease as the number of workers abroad are declining.

On the other hand, it is suggested that expats in developed countries have increased their remittances to help their relations in financial difficulties. Either explanation leaves some doubt on the expectation of remittances to reach over US$ seven billion this year. It is hazardous to make an estimate of remittances, but a fall in remittances would cause a serious dent in the balance of payments.

In conclusion

Only time will tell whether the expectations of the Central Bank for 2021 will materialise. In as much as there are silver linings in the dark clouds of the economy, there is much global economic uncertainty and external shocks that could impact adversely on the economy.

Leave a Reply

Post Comment