Columns

Increasing exports vital to improve 2021 trade balance and balance of payments

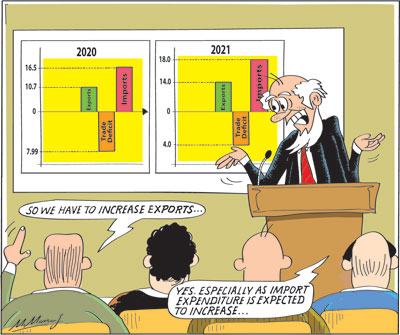

View(s): A significant increase in exports is vital to improve this year’s trade balance and balance of payments, as imports that decreased significantly last year, are expected to increase substantially this year.

A significant increase in exports is vital to improve this year’s trade balance and balance of payments, as imports that decreased significantly last year, are expected to increase substantially this year.

Export earnings should exceed US$ 12 billion to achieve a better balance of trade outcome than last year’s trade deficit of US$ six billion as imports would increase to about US$ 18 billion. This significant increase in import expenditure this year is despite import restrictions.

Economic context

Last year’s trade deficit was reduced by US$ two billion compared to that of 2019, owing to a large decrease in imports of about US$ four billion. This reduction in imports was larger than the decrease in exports of about US$ two billion.

The reduction in the trade deficit by US$ two billion was due to a decrease in imports owing to import restrictions and low international prices of fuel. In contrast, this year’s imports are likely to increase owing to higher imports of fuel, food and raw materials for industry. Imports could even exceed US$ 18 billion projected for this year.

It is in this context that a substantial export growth is needed to offset the increase in imports. Providentially, such an increase in exports is possible owing to the gradual recovery of the international economy. However, there are some threats too.

It is in this context that a substantial export growth is needed to offset the increase in imports. Providentially, such an increase in exports is possible owing to the gradual recovery of the international economy. However, there are some threats too.

Expectations

What are the expectations of the trade balance and balance of payments this year?

The answers to three questions are pertinent for this year’s trade performance.

First, can the import bill be restrained to around last year’s US$ 16 billion?

Second, could exports be increased this year to over US$ 12 billion from US$ ten billion in 2020?

Third, will the trade gap widen from that of last year and by how much?

Increase in imports

As discussed in last Sunday’s column, there is no possibility of containing imports to last year’s US$ 16 billion owing to the rise in international fuel prices. Imports are likely to exceed US$ 17.5 billion as fuel imports are likely to increase from US$ 2.5 billion last year to US$ four billion or more this year due to a doubling of international oil prices, the revival of manufactures requiring higher imports of raw materials for industry and a likely shortfall in paddy and maize production due to climate related reasons that may necessitate imports of rice and maize.

Exports

The answer to the second question as to whether exports could be increased this year, is an affirmative yes, as global demand for exports is increasing. Fortunately, the gradual revival of the global economy provides an opportunity to increase manufactured exports. In December 2020 exports increased to nearly US$ one billion, due to a recovery from the disruption of manufacturing and increased international demand, due to COVID. Exports can exceed US$ 12 billion if this momentum continues.

EDB expectations

The Export Development Board (EDB) has a merchandise export target of US$ 12 billion for this year. However, the export performance of last December and information that there is increased demand for apparel and rubber manufactures, lends support to higher expectations of export earnings of about US$ 15 to 16 billion. Such an export growth would reduce the trade deficit from that of last year.

Threats

However, there are threats to such an export growth. Foremost among them is the possibility of individual countries or group of countries, such as the European Union (EU) imposing trade sanctions. Then the country’s factories. ports and other services should function at full capacity without the spread of COVID-19. The global containment of the pandemic and global economic recovery is also of significance to enhance exports.

Agricultural exports that have been declining are not likely to revive, especially due to the current disruption on estates. A long term strategy to increase production is crucial to increase agricultural exports.

Trade balance

As to whether the trade gap would widen from that of last year depends very largely on whether the expected increase in exports would materialise. If exports could be increased to US$ 18 billion, a smaller trade deficit or even a small trade surplus could be achieved.

Balance of payments

The containment of the trade deficit will have an important bearing on the balance of payments. A trade surplus, however small will ease the balance of payments significantly.

Three other factors will have a bearing on this year’s balance of payments. These are whether workers’ remittances that increased last year to US$ 7.1 billion will be at about this level or if they were to decrease by how much Is significant.

The government expects last year’s increase in remittances to continue. If remittances are around US$ seven billion they would be a significant boost to the balance of payments.

It is however unlikely. Remittances are likely to decrease by at least a billion or two as the migrant workforce is decreasing.

The second most important question is whether the tourism industry adversely affected by the COVID-19 pandemic last year will revive to contribute about US$ two to 2.5 billion this year. While there has been a slight increase in tourist arrivals, in the first two months of this year, a significant increase could be expected only in the latter part of the year. A realistic estimate is around US$ 1.5 to two billion. This too, will have a very favourable impact on this year’s balance of payments.

Capital flows

The third vital issue is whether there would be capital inflows by way of foreign investments, loans and other foreign assistance. In fact capital outflows are expected to be large. Debt repayments alone would absorb US$ 4.5 billion.

However the extent of foreign assistance and investment remain shrouded in mystery with government spokesman being very optimistic.

Conclusion

The country’s external finances are fragile with reserves falling to US$ 5 billion at the end of last year. With debt repayments exceeding US$ four billion, the performance of the trade and balance of payments is crucial.

The government has repeatedly assured us that a facility of about US$ 1.5 billion has been negotiated with China and that the People’s Bank of China (China’s Central Bank) would provide this facility soon. Whether this is adequate depends on the earlier discussed prospects in the trade and balance of payments this year.

As the country’s import expenditure is likely to increase this year, the balance of trade can be contained only by an increase in exports. The gradual global economic recovery holds out prospects for a significant increase in industrial exports this year. The international demand for the country’s apparel and rubber goods exports have begun to increase.

If exports could increase to US$ 16 billion, this year’s trade could be small and would help in the balance of payments outcome that is much dependent on workers’ remittances, earnings from tourism and capital inflows.

Leave a Reply

Post Comment