Columns

Resolving the perilous external financial vulnerability

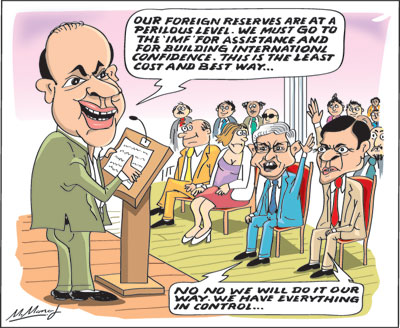

View(s): Although the country’s external financial vulnerability is increasing, there is considerable complacency and confidence among officials that it would be resolved. The repetitive refrain has been that the country has always met its debt obligations and it will do so now. We are told that the nation’s external finances are under control and that the government has its own way of resolving it.

Although the country’s external financial vulnerability is increasing, there is considerable complacency and confidence among officials that it would be resolved. The repetitive refrain has been that the country has always met its debt obligations and it will do so now. We are told that the nation’s external finances are under control and that the government has its own way of resolving it.

Recognising the problem

There is no acknowledgement of the crisis in the external finances, nor an indication of how the country would be able to repay her debt obligations, except that the Central Bank of Sri Lanka expects a foreign currency swap of US$ 1.5 billion soon. Recognising the gravity of the problem is the first step towards the resolution of the crisis.

Facts and figures

The plain facts of our external finances indicate the gravity of the crisis. Foreign debt obligations this year are estimated at about US$ 4.5 billion, while foreign reserves were only US$ 4.1 billion. The country’s external reserves that fell to US$ 5.7 billion at the end of 2020, have fallen precipitously to US$ 4.1 billion at the end of January according to the Central Bank of Sri Lanka.

On the other hand, the debt repayment obligations are estimated at about US$ 4.5 billion this year. This is higher than the foreign reserves of the country and the trade deficit is likely to increase during the course of the year, despite further import restrictions.

Prospect

Prospect

The prospect of the country coming to a currency swap arrangement of US$ 1.5 billion for 18 months with China is the expected immediate relief. The conditions underlying such an arrangement is not known.

Balance of payments

Last year’s balance of payments deficit increased to US$ 2.327 billion compared to a small surplus of US$ 771 million in 2019. In spite of this serious deterioration in the balance of payments, the focus has been on the low trade deficit of US$ 6.3 billion last year that was achieved by import controls and reduced prices of oil.

The reduced expenditure on oil imports was mainly due to the fall in international prices to about US$ 32 per barrel owing to lesser international demand for oil. This will not be so this year as oil prices are touching US$ 60 per barrel and forecast to increase further as the global economy picks up.

Fuel imports

Fuel imports were about US$ 1.4 billion less last year mainly due to lower prices. It was US$ 2.54 billion in 2020 compared to US$ 3.89 billion in 2019. This year’s fuel imports that are likely to cost about US$ four billion would make a serious dent in the balance of payments.

Recognise facts

These facts must be recognised. The gravity of the situation in the external finances must be a foremost concern of the government.

The reasons for the current external vulnerability are many. They are not necessarily any fault of the present government. However, the recognition of the problem and its resolution is the responsibility of the Government. The government must adopt the least cost solution to it.

China’s assistance

Indications are that the government expects assistance from China in the form of a currency swap arrangement for US$ 1.5 billion. This is a temporary palliative. It would require to be repaid perhaps in about a year or 18 months. The government is asking other countries too to give currency swaps that would amount to US$ four to five billion. These are however unlikely without an agreement with the International Monetary Fund (IMF). The Government is adamant on not securing IMF assistance for wrong reasons.

Multilateral assistance

Many economists have urged the government to seek multilateral assistance, especially from the IMF. They have pointed out that IMF finances would be at low interest rates and repayable over a long period. Even more important is the benefit such IMF involvement brings with it. It is for these reasons that the Pathfinder Foundation has advised the government to seek IMF assistance.

Pathfinder foundation

In this financial crisis, the Pathfinder Foundation, a policy think tank, has urged the Government to seek assistance from the International Monetary Fund (IMF).Its recommendation is based on the realities of the debt and external finances of the country and global financial dynamics.

IMF assistance

In the past we have been able to meet perilous exchange reserve positions because the IMF rescued us 16 times before. It is not only the finances of the IMF that matters, It is the assurance to our creditors that we will handle the situation in a economically sound and feasible way through a programme that will induce a disciplined way to handle the Country’s finances.

Credibility

The existence of an IMF programme signals our creditors that we would be able to pay the debt in a proper and well organised way. A single country, even as important as China, will not be able to convince our creditors.

Alternate ways

Seeking “alternative means” as promised by the Governor of the Central Bank of Sri Lanka, would cause a bigger crisis for us, as it depends on import controls and stringent control of the economy reminiscent of the 1970-77 period when the then coalition government’s policies created huge shortages of basic items: basic foods, medicines and clothing. The country produced high cost inferior products and industries performed with underutilized capacities (Central Bank Annual Reports 1975 and 1976).

Low growth

The 1970-77 regime was one of the lowest periods of economic growth. The economy grew by only 2.9 percent in 1970-74 and by 3.3 percent in 1975-77. The economic difficulties of the 1970-77 period undoubtedly paved the way for the resounding UNP victory in 1977.

Summary

The external finances of the country is in dire straits. The debt repayment obligations of about US$ 4.5 billion this year is more than the current reserves of US$ 4.1 billion. In this context of the country’s external finances, the expected currency swap of US$ 1.5 billion is inadequate, especially as the trade deficit is likely to deteriorate.

Way Forward

The only way forward in this crisis is to seek IMF assistance. This the Government has stubbornly rejected. Why are we not resorting to the least cost sources of borrowing to resolve our crisis?

Are we intent on ushering in a period of extreme economic austerity.

Leave a Reply

Post Comment