Columns

Resolving external financial vulnerability dominant economic concern

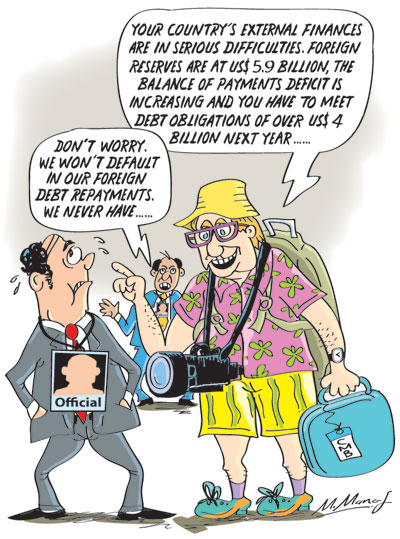

View(s): The paramount economic concern is how the country would be able to meet its foreign debt obligations in 2021 and then annually till 2024, when the country’s foreign reserves are depleting and the balance of payments is deteriorating.

The paramount economic concern is how the country would be able to meet its foreign debt obligations in 2021 and then annually till 2024, when the country’s foreign reserves are depleting and the balance of payments is deteriorating.

Confident

Three international rating agencies have downgraded the country’s risk ratings to a high risk country. In response, official statements have indicated the Government is confident of meeting its debt obligations of around US$ four to 4.5 billion next year despite the country’s low external reserves and deteriorating balance of payments (BOP).

Implication

Does the government’s confidence imply that there are assurances of substantial BOP support from foreign countries and multilateral institutions? Is the Government’s confidence based on such assurances or other means of strengthening the foreign reserves? The prospect of the balance of payments improving and strengthening foreign reserves is however unrealistic in the current global and domestic economic environment.

Reserves

Reserves

What is certain is that the country’s foreign reserves are inadequate and there is little or no prospects of an improvement in the balance of payments next year to meet the large debt repayment in the current fragile state of external finances.

External finances

What is the country’s state of external finances? The balance of payments deficit is increasing, external reserves are decreasing and the cost of borrowing has risen. In contrast to last year’s small balance of payments surplus of US$ 377 million, this year’s balance of payments is expected to record a deficit of between US$ two to 2.5 billion.

The BOP deficit was US$ 2.1 billion, or more precisely, US$ 2082 million, at the end of October this year, compared to a surplus of US$ 667 at the end of October 2019. A deterioration of US$ 2.7 billion in the 12 months.

Balance of Payments

This deterioration in the balance of payments has been despite a reduction of the trade deficit to US$ 4.85 billion from US$ 6.45 billion in the ten months of last year and was achieved by a restriction of imports and the reduction in fuel imports at lower prices.

Exports

However, despite a revival and diversification of exports after COVID disrupted global trade, exports have declined by 16 percent from nearly US$ ten billion in the ten months of 2019 to US$ 8.3 billion in the ten months of this year.

In October exports declined owing to the dislocation in export production owing to the second wave of COVID. According to the Central Bank, “exports dropped in October 2020 due to the disruptions to local production and support services following the resurgence of COVID-19 cases since early October and weak demand from foreign buyers.”

This does not augur well for future exports.

Trade deficit

The trade deficit was reduced to US$ 4.85 billion at the end of October 2020 from US$ 6.45 billion at the end of October 2019. This US$ 1.6 billion lower trade deficit in the ten months of this year is significant. Nevertheless, for the same period, the balance of payments deficit increased to US$ 2.1 billion. This increase in the BOP deficit at the end of October 2020 was owing to a large fall in tourist earnings and net outflow of capital.

Reserves

Foreign reserves have been on a declining trend this year. At the end of October, after the repayment of an International Sovereign Bond (ISB) of US$ one billion, foreign reserves had fallen to US$ 5.9 billion. They have fallen further to US$ 4.9 billion at the end of November. At year’s end it is likely to be less than US$ four billion, unless there are capital inflows.

Foreign debt

On the other hand, the foreign debt repayment is estimated at US$ four to 4.5 billion in 2021 and about US$ 23 billion for 2021-24. The critical issue is whether we could meet such obligations without international assistance.

Threat

These features of the external finances are a serious threat to the capacity of the country to meet the debt repayments of about US$ 4.5 billion next year. Furthermore, the weakening trend in the balance of payments is likely to gain in momentum for several reasons. These are the likely fall in workers’ remittances, the continued low tourist earnings and the net capital outflows.

Remittances

The current surge in workers’ remittances is likely to decrease as repatriation of accumulated savings decline and workers employed abroad decrease in the foreseeable future.

International rating

Meanwhile international rating agencies have downgraded the island’s economy to a critical level owing to the risks posed by this predicament in external finances. In response, the Government and the Central Bank, have pointed out that the county has never defaulted in its debt repayments and that the economic program and plans of the government would generate a GDP growth of six percent next year.

It has however not disclosed by what means it would meet these debt obligations nor is there a willingness to approach international agencies for assistance on soft terms. This is worrisome.

Confident

Despite the unfavourable state of external finances, the government is confident it could meet its foreign debt obligations. The Central Bank points out that after meeting its foreign debt obligations of US$ one billion last month, it has foreign reserves of US$ 5.9 billion. These together with other arrangements to augment foreign reserves are likely to meet the foreign debt obligations in 2021.

However considering the weak external finances of the country and large debt repayments, it is advisable to seek moratoria on foreign debt that over 25 other countries have obtained and to seek concessionary financial assistance from multilateral financial agencies.

Conclusion

Recognising the critically dangerous condition of the country’s external finances is the first step towards finding solutions. We hope a realistic assessment of the external finances will be followed by pragmatic policies to resolve the country’s debt repayment.

Finally, we hope conditions in the country and globally will improve to strengthen the external finances.

Leave a Reply

Post Comment