Columns

Economic and financial backdrop of Budget 2021

View(s): The Budget for 2020 that was presented in Parliament last Thursday was passed without a vote but much controversy. It was the first time that a budget was presented at the end of the year rather than ahead of it.

The Budget for 2020 that was presented in Parliament last Thursday was passed without a vote but much controversy. It was the first time that a budget was presented at the end of the year rather than ahead of it.

The budget for 2021 will be presented next Tuesday. Never in the history of Sri Lanka has a budget been presented in such grim economic conditions and an environment of uncertainty as the budget for 2021.

Economic backdrop

The budget for 2021 is being presented for a year that follows two years of poor economic performance. In 2019 the economy recorded one of the lowest rates of growth of 2.3 percent. The economy retrogressed this year mainly owing to the impact of COVID-19 and is expected to be one of negative growth.

The Central Bank of Sri Lanka (CBSL) is hopeful that the economy would register only a 1.6 negative growth. Other projections estimate it at between 2.5 to four percent. Even in the first quarter of 2020, when the corona affected the economy only marginally, the economy declined by 1.6 percent.

Impact of COVID

The impact of the curfew and economic dislocation in the next three quarters would undoubtedly drag the economy down. The restriction of imports too would affect several sectors of the economy. This year’s economic growth will undoubtedly be negative, perhaps by two to three or four percent.

The COVID virus that infected people in the country since March this year has dislocated the economy and reduced output. Consequently it would result in lower revenue for the government. This autonomous reduction in revenue has been enhanced by a reduction in taxes to give a stimulus to production.

Loss of revenue

The economic rationale for this is understandable, but its adverse impact on revenue is certain. In addition import controls have dealt a severe blow to import taxes that are an important source of government revenue. Tax revenues have fallen short this year due to lower collection of personal and corporate income taxes as well as value-added and import taxes.

The fiscal stimulus package that was implemented in November 2019 reduced the VAT rate and increased the registration threshold. The import controls reduced revenues from import duties significantly. The slow growth of the economy has also resulted in reduced tax revenues this year. It is in this backdrop of reduced revenues that budgetary expenditure has to be designed.

Expenditure

Expenditure

On the other hand, government expenditure has increased. The employment of unemployed graduates, payment of outstanding bills, subsidising of banks to meet interest short-falls, fertiliser subsidy, expenditure on food and cash payments and food to the unemployed and poor workers that have been deprived of their incomes and livelihoods have increased government expenditure. These are in addition to the government’s committed expenditures for salaries, pensions, debt repayments, interest payments and transfers to loss making state enterprises.

Fiscal implications

The fiscal implications of the shortfall in revenue and increased expenditure is an unprecedented fiscal deficit in 2020. The Treasury estimates the fiscal deficit to be nine percent of GDP. However, this appears to be an underestimate. It is more likely to balloon to about ten percent or more of GDP. Another reason for this increase in the fiscal deficit: GDP ratio is the shrinkage in the GDP that is the denominator in the calculation of the fiscal deficit ratio.

Tough task

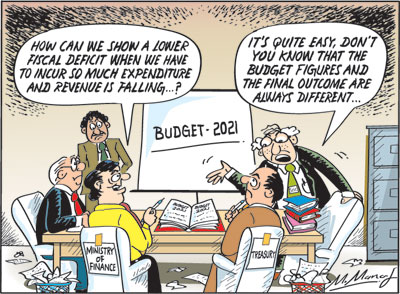

The Finance ministry, Treasury and the Central Bank of Sri Lanka are fully aware of the need to reduce the fiscal deficit. The treasury is of the view that it should be brought down to 4 percent of GDP gradually, perhaps by 2023. However, one thing is certain: a lower fiscal deficit is impossible in 2021.

Fiscal deficit

Whatever figures are presented in the Budget for 2021 on Tuesday, the grim reality is that the fiscal deficit is likely to be at least seven to eight percent of GDP in 2021. While the prevailing economic conditions are not conducive to obtaining higher revenue, the additional expenditure in the control of COVID and relief measures would increase government expenditure. Furthermore if the government is to implement its development program of improving rural infrastructure—roads, water supply, sanitation and electricity—government expenditure would increase enormously and the fiscal deficit would widen.

Next year

The year ahead for which this budget is presented is full of uncertainty. The economic disruption of 2020 will continue into 2021 making revenue collection meagre and uncertain and public expenditure extensive and high. The expenditure to contain the spread of the virus, as well as the relief measures to alleviate those who have no incomes and prevent starvation are large, though inadequate. Besides this, the government expects to fulfil its promise to develop rural infrastructure.

Empowerment

The government expects to give priority to providing immediate relief to people of low income families, uplifting of the rural economy, fulfilling the housing needs of the public, providing drinking water to all, renovation and improving of 100,000 km of roads and aquatic resources and irrigation are expected to be financed by the budget. These are essential expenditures for the economic and social uplifting of the country. However their expenditure is immense and unbearable in the current context of low and uncertain revenue. How will these be financed?

Foreign assistance

It is advisable to obtain foreign assistance to finance these projects. The government should seek funding of these projects from multilateral agencies and friendly governments. The World Bank and the Asian Development Bank in particular and foreign governments that provide the finances at very low interest rates on long term repayment conditions should be the sources of financing these. This would not only not burden the budget, but also provide initial relief to the balance of payments.

Summary and conclusion

The backdrop of the 2021 budget is the resurgence of the COVID pandemic around the world and in the Island. The containment of the corona epidemic is the foremost priority. Since the duration and spread of the epidemic globally and in the country are unknown, the budgetary outcome in 2021 is highly conjectural. What is certain is that the government’s expenditure will surpass its revenue collection by a huge amount and destabilise the economy in the years ahead. Foreign assistance is essential to contain the imminent adverse economic consequences.

Leave a Reply

Post Comment