Columns

Lanka’s foreign debt trap

View(s): The recent controversies raised by the two international rating agencies, Fitch and Moody’s, have once again focused attention on our debt sustainability. Is Sri Lanka’s foreign debt sustainable? Are we in a foreign debt trap?

The recent controversies raised by the two international rating agencies, Fitch and Moody’s, have once again focused attention on our debt sustainability. Is Sri Lanka’s foreign debt sustainable? Are we in a foreign debt trap?

Debt profile

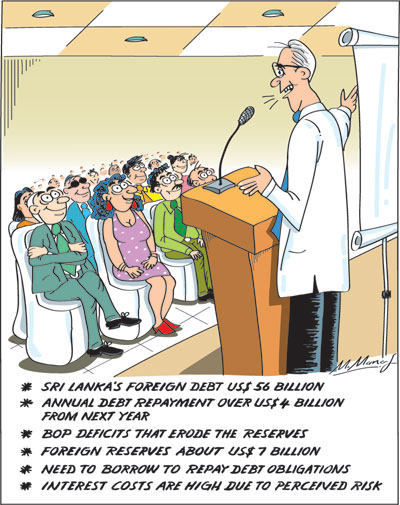

Sri Lanka’s foreign debt is estimated at US$ 56 billion, which is about 86 percent of GDP. Next year’s debt repayment obligations are about US$ 4.5 billion and about this amount is due in the following years. The country’s foreign reserves were US$ seven billion at the end of August. The balance of payments this year is likely to be between US$ 1.5 to two billion. These facts and figures are undisputable.

Debt repayment

In this context, the repayment of debt requires further foreign borrowing. The economy is in a debt trap as it has to borrow to meet its debt repayment obligations: capital and interest.

Controversy

Despite these facts being undisputed, the recent Fitch and Moody’s downgrading of the Sri Lankan economy to an unstable one sparked much controversy. The Treasury and the Central Bank of Sri Lanka (CBSL) have argued that the country’s downgrading is “unwarranted” as the economy is on a path of recovery. The trade deficit has been narrowed by a reduction of imports and a recovery of exports since May-June. Monthly average exports have been about US$ one billion.

Response

Furthermore, the official response to the international ratings that downgraded the economy was that the country had successfully contained the COVID-19 pandemic and the economy was recovering. Exports had recovered since June and imports were reduced. Consequently the trade deficit was expected to be reduced to about US$ 5.8 billion. However, owing to negligible tourist earnings and lower workers’ remittances, the balance of payments is likely to be in deficit by about US$ two billion. Therefore there would be an erosion in the foreign reserves that could be boosted only by foreign borrowing.

Further borrowing

Further borrowing

The government is confident of meeting the debt obligations with its “sufficient reserves.” It is exploring a number of borrowing options to boost foreign exchange reserves. These include a US$ one billion SWAP agreement with India and a US$ 700 million of a US$ 1.2 billion syndicated loan from the China Development Bank. The first US$ 500 million of this loan was obtained in March 2020. It is expecting funds from a Samurai bond from Japan. There is also expectations of project loans that would be temporary injections of funds to the reserves.

IMF

The request for US$ 700 billion from the International Monetary Fund (IMF) has however not been given most probably due to the noncompliance with the IMF conditions. Obtaining IMF assistance is important as it is at very low interest, repayment is over a reasonably long period and it would boost international confidence in Sri Lanka.

Admittedly, the country has an unblemished record of never defaulting on meeting its debt obligations The Treasury and CBSL assures that the country is in a position to repay the large foreign debt obligations next year by several international borrowings that are being negotiated and under discussion.

Debt escalation

Undoubtedly next year’s repayment would be by further foreign borrowing. Therein lies the problem. We are in a foreign debt trap as we have to borrow to repay debt. The foreign debt is growing, debt repayment obligations are increasing and the costs of borrowing are rising.

As in the past, further borrowing increases the country’s debt and debt servicing costs. What is needed is reduction of this debt burden by policies that would enhance foreign earnings rather than continue to borrow to repay debt obligations.

Immediate relief

The immediate resolution of the problem requires moratoria on debt repayments, concessionary credit from friendly countries and multilateral financial assistance especially from the IMF would also boost confidence among international lenders. Obtaining the assistance of the IMF is crucial to inspire confidence in the Sri Lankan economy.

Essential policies

There is no doubt that the country is in a foreign debt trap as we have to borrow to repay our debt obligations. Given this perilous state of our external finances that are reflected in the Fitch and Moody ratings, the costs of commercial borrowing would be high. Therefore as far as possible the government should attempt to obtain loans from friendly foreign countries and multilateral agencies at favourable conditions. Obtaining the assistance of the IMF would assist in obtaining funds on more favourable terms.

Summing up

There is little doubt that the country would be able to repay its debt obligations of US$ 4.5 billion next year. Hopefully this would be effected with the least amount of high cost commercial borrowing. Borrowing to repay compounds the debt problem, as it has been the case in the past.

The foreign debt is unsustainable as the country has to continue borrowing to repay debt. We have to escape this debt trap by strengthening the balance of payments. Enhancing exports is the best strategy to achieve this.

The trade balance has been reduced this year by curtailing non-essential imports. Import restrictions must be carefully considered as imports are needed for the country’s exports.

The reduction in imports have been also been due to a sharp decrease in oil prices. Low fuel prices in the coming months are essential to contain import expenditure.

Final word

We must ensure that foreign borrowing is for investments that increase tradable goods or services that generate foreign earnings. Other essential infrastructure investments must be project loans that have a very long period of repayment and interest costs are very low as in the case of Japanese funding of projects and assistance given by multi-lateral agencies like the IMF, World Bank and the Asian Development Bank (ADB).

Fiscal monetary and other government policies must focus on policies that decrease import expenditure and increase merchandise exports and earnings from services that reduces the large foreign debt.

Leave a Reply

Post Comment