Columns

Fiscal consolidation an economic prerequisite and priority for development

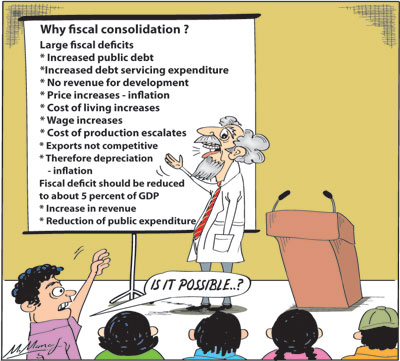

View(s): The massive parliamentary electoral victory of the Sri Lanka Podu Peramuna (SLPP) led by Prime Minister Mahinda Rajapaksa would ensure political stability so vital for economic development. One of the foremost tasks of the new government would be the progressive reduction of the fiscal deficit (fiscal consolidation) that is a prerequisite for economic stabilisation and growth.

The massive parliamentary electoral victory of the Sri Lanka Podu Peramuna (SLPP) led by Prime Minister Mahinda Rajapaksa would ensure political stability so vital for economic development. One of the foremost tasks of the new government would be the progressive reduction of the fiscal deficit (fiscal consolidation) that is a prerequisite for economic stabilisation and growth.

Fiscal deficit

The fiscal deficit that has probably increased to about nine percent of GDP would require to be halved in 2021-22 to stabilise the economy and enable economic growth. However fiscal consolidation has been an elusive objective owing to political compulsions of electoral politics.

Fiscal deficits 2015-2019

The fiscal deficit reached 7.6 percent of GDP in 2015 owing to extravagant public expenditure of the government to gain political support for the August 2015 parliamentary election. It was so the previous year too when the government indulged in a spending spree to gain votes in the Presidential election of January 2015.

The fiscal deft was brought down to 5.7, 5.5 and 5.3 percent of GDP in the subsequent years (2016-18) by a programme of revenue enhancing fiscal consolidation that was derailed once again in 2019 due to political motivated expenditure prior to the Presidential election. The corona pandemic and the parliamentary elections have compounded the problem further.

Serious problem

Large fiscal deficits have been one of the country’s most serious economic problems over the years. Large fiscal deficits have distorted priorities in public expenditure and retarded economic and social development. However the importance of fiscal consolidation is not commonly understood.

Adverse impacts

Large fiscal deficits result in inflationary pressures which in turn increase the costs of production and erodes the country’s competitiveness in international markets. This necessitates the depreciation of the Rupee in order to remain competitive with other countries that have lower rates of inflation.

Reduced export earnings imply loss of employment and lower incomes to workers in industries affected by lower exports. Otherwise, lesser export earnings would increase the trade deficit that would be a strain on the balance of payments. The solution to the problem is the depreciation of the currency that would ease the competitiveness of exporters, but would lead to further inflation and increased hardships to people.

Inflation

Inflation

Large fiscal deficits result in increases in cost of living that cause severe hardships especially to the lower end of wage earners and pensioners. This in turn could lead to strikes with demands for higher wages and social unrest.

Increase in public debt

Large fiscal deficits lead to borrowing and in turn to huge debt servicing costs. The large accumulated debt is a result of persistent fiscal deficits over the years.

Public debt

In 2008 the public debt was over 80 percent of GDP. In 2009 it had risen to 86.2 percent of GDP owing to the large foreign and domestic borrowing. The public debt rose to 85 percent of GDP at the end of last year and has risen further in the first half of this year.

Public expenditure priorities

The massive public debt and crippling debt servicing costs distort public expenditure priorities and hamper economic development. With debt servicing costs absorbing almost the entirety of revenue, there is little financial scope for needed investments for economic development and expenditure for the improvement of the country’s education and health.

Reasons

The reasons for large fiscal deficits has been the significant shortfalls in revenue and due to government expenditure increasing without commensurate increases in revenue. Expenditure increases in the past have been due to high security related spending during the war and even after, increased salaries and wages, interest payments and expenditure on public investment projects. In brief, large fiscal deficits were as a result of both a shortfall in revenue and of increases in expenditure.

Elections

No doubt elections are an underlying cause for the various measures that increased government expenditure. The slow growth in the economy accounted for revenue to fall far short of expectations.

Debt servicing

One of the main reason for the high deficit was the huge expenditure in the budget to service the high public debt. There can be no controversy on this. In 2008 the amount spent on servicing the debt absorbed 90.5 percent of revenue and therefore was a reason for the high borrowing that in turn increased the annual costs of servicing the debt.

Last year this figure would have risen as the debt had risen and there were higher costs of servicing the debt owing to commercial borrowing. Besides this there was a shortfall in revenue collection that would have increased the proportion of revenue that had to be spent on servicing the debt.

The high debt servicing cost has been due to the accumulation of debt over a long period owing to recurring high fiscal deficits. No doubt one of the important reasons for the accumulation of debt has been the high costs of defence from especially the mid-eighties. Yet it would be misleading to think that the high public debt was entirely due to defence costs. When there are high defence costs in a country, prudent fiscal policy measures are adopted. These include the tightening of the tax system and new and higher taxes.

These measures would increase the tax: GDP ratio. In spite of many new taxes and a very untidy system of taxation in the country, tax revenues hardly increased over time. On the side of expenditure, there was no commensurate curtailment of expenditure to cope with the additional high expenditure on defence.

In fact public expenditure on several items that have been dubbed as “wasteful expenditure” as these do not increase production, increased significantly. Notable items are the huge increases in the costs of public administration, large recruitment to the public services and salary increases, the burden of indefensible large cabinets and perquisites. Among other noteworthy items of high expenditure are the losses of public enterprises.

Imperatives

Fiscal discipline is an essential prerequisite for economic stabilisation and growth. Containing the fiscal deficit is vital for the country’s economy to achieve the desired high rates of growth to resolve the problems of unemployment and poverty. However, containing the fiscal deficit has eluded successive governments.

Reducing the size of the cabinet is a useful step in reduction in costs. Losses in public enterprises should be brought down by both reforms in their management and pricing policies. A better system of taxation and tax administration could increase revenue.

Until now defence expenditure was blamed for much of the fiscal deficit. The end of the war and curtailment of defence expenditure offers an opportunity to reduce the deficit. Yet this alone would be inadequate. Wasteful and unproductive expenditure, losses in public enterprises and other prudent financial measures are needed.

Government revenue too has to be increased with a better taxation system and administration. There is an opportunity to begin a process of fiscal consolidation this year that would provide a foundation for rapid economic growth and development.

Until now defence expenditure was blamed for much of the fiscal deficit. The end of the war and curtailment of defence expenditure offers an opportunity to reduce the deficit. Yet this alone would be inadequate. Wasteful and unproductive expenditure, losses in public enterprises and other prudent financial measures are needed.

Government revenue too has to be increased with a better taxation system and administration. There is an opportunity to begin a process of fiscal consolidation this year that would provide a foundation for rapid economic growth and development.

In conclusion

There must be a strong resolve to reduce the deficit this year and reduce it progressively in the next five years. If public expenditure is not reduced in line with government revenue to achieve a lower deficit, the cycle of a large deficit leading to borrowing that in turn leads to deficits will continue to cripple economic growth and development.

Leave a Reply

Post Comment