Columns

Increasing balance of payments deficit eroding external reserves

View(s): The increasing balance of payments deficit will weaken the external reserves and increase the country’s external financial vulnerability. External reserves that were US$ 7.5 billion at the end of 2019 are falling likely to dip to below US$ 6 billion at the end of this year. A huge balance of payments deficit is likely this year owing to a large trade deficit, decrease in workers’ remittances and a sharp decrease in tourist earnings.

The increasing balance of payments deficit will weaken the external reserves and increase the country’s external financial vulnerability. External reserves that were US$ 7.5 billion at the end of 2019 are falling likely to dip to below US$ 6 billion at the end of this year. A huge balance of payments deficit is likely this year owing to a large trade deficit, decrease in workers’ remittances and a sharp decrease in tourist earnings.

A balance of payments deficit of US$ 3 to 4 billion by the end of the year would erode foreign reserves to an unsustainable level. Foreign assistance is imperative to overcome the country’s impending external financial vulnerability.

Balance of Payments 2020

The trade and payments outcome of the first four months of this year is not necessarily indicative of the country’s external finances this year, as the impact of the global economic dislocation occurred only from March. Nevertheless, its initial impact is evident and the outcomes in the April balance of payments is indicative of the deteriorating trend in the trade and external finances of the country.

First four months

In the first four months of this year, the trade deficit decreased marginally to US$ 2.4 billion from that of US$ 2.5 billion during the same period last year. This was owing to both exports and imports declining. The balance of payments widened slightly from US$ 2.84 billion in the first four months of 2019 to US$ 2.90 billion in the first four months of this year. Significantly, this marginal decrease was due to the decrease in tourist earnings, workers’ remittances and lower capital inflows.

This trend is likely to gain momentum to result in a large balance of payments deficit at the end of the year. This is clearly evident in the trade and balance of payments outcome in April 2020.

April 2020

April 2020

In April, exports decreased by as much as 64 percent compared to April 2019. Imports too decreased but by less than exports: 30 percent. Manufactured exports decreased by as much as 74 percent, while agricultural exports decreased by 32 percent. It is noteworthy that even tea exports decreased by 20 percent this April compared to April last year.

These trends are likely to continue during the rest of the year and expand the trade deficit to a larger one than the US$ 8.3 billion in 2019. The trade deficit will however be contained owing to a commensurate decrease in exports. However the large trade deficit will lead to a severe deterioration in the balance of payments.

Large trade deficits have been offset in most years entirely or to a large extent by workers’ remittances and earnings from tourism. As there is no prospect of this happening this year, the large trade deficit is likely to increase the balance of payments deficit significantly.

Balance of payments

Unlike in 2019 when the entire trade deficit of US$ 8.3 billion was offset by workers’ remittances and earnings from tourism, these two sources are expected to decline drastically. Consequently the trade deficit is likely to lead to a large balance of payments deficit of US$ 3 to 4 billion. This will be a severe setback to the country’s external reserves.

In the first four months of this year, the balance of payments deficit increased to US$ 2.8 billion in comparison to a deficit of US$ 2.4 billion during the first four months of 2019. A balance of payments deficit of around US$ 4 billion is unsustainable with foreign reserves declining. The sharp decrease in exports, the precipitous decline in tourist earnings and drop in workers’ remittances will be responsible for this.

Conclusion

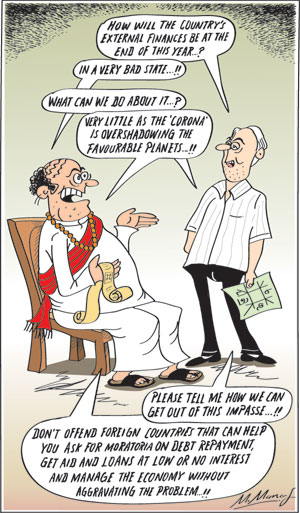

Sri Lanka’s economic recovery and increased exports are possible only after a global economic revival. This is particularly so with respect to the country’s manufactured exports to western economies that purchase about 70 percent of these exports. With the global pandemic still spreading, there is little likelihood of a global economic recovery. Tourism is unlikely to revive till at least the end of the year. Workers’ remittances will be much less than in 2019.

In this deteriorating balance of payments scenario, it is of utmost importance to seek moratoria on loan repayments, international financial assistance and foreign investments. Such foreign assistance is critical to overcome the country’s impending external financial vulnerability. The current opposition to foreign participation in development projects are a serious setback to such assistance.

Leave a Reply

Post Comment