The Economic Analysis

Coping with economic consequences of corona pandemic

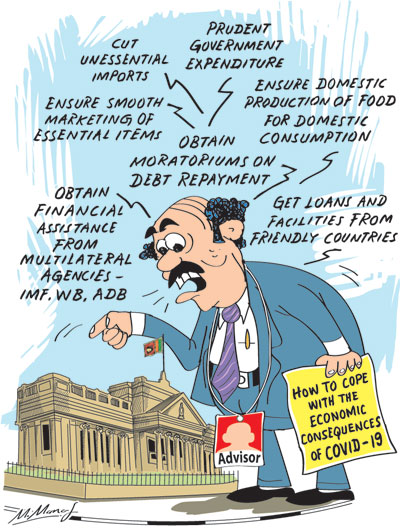

View(s): The containment of the humanitarian tragedy that is unfolding must get precedence before the world economy is restored to normalcy.The economic consequences of the corona pandemic (Covid19) could be effectively resolved in Sri Lanka only after the virus is contained the world over. Until then the government must adopt policies that would mitigate the economic consequences and plan how it will revive the economy once it is over.

The containment of the humanitarian tragedy that is unfolding must get precedence before the world economy is restored to normalcy.The economic consequences of the corona pandemic (Covid19) could be effectively resolved in Sri Lanka only after the virus is contained the world over. Until then the government must adopt policies that would mitigate the economic consequences and plan how it will revive the economy once it is over.

Global impact

At present there are neither signs of its containment nor any idea of how long it would take to bring the pandemic to manageable proportions. The only glimmer of hope is signs of containment of the virus in China. However it is spreading in the rest of the world.

The globalisation of the world economy has impacted on most economies. Small trade dependent economies and countries with weak external finances like Sri Lanka are worst affected. The revival of the Chinese economy and developed economies is essential for other economies to regain and develop their economies.

Sri Lanka

The March 15 and 22 columns discussed the severe impact the world economic consequences would have on the country’s economy and external finances. Key sectors of the economy such as exports, tourism and workers’ remittances are likely to be adversely affected. The external financial vulnerability has to be mitigated by a multipronged strategy in cooperation with friendly countries and multilateral agencies.

Trade

Sri Lanka’s merchandise exports are likely to fall precipitously owing to the diminished demand for industrial exports, as well as tea, the main agricultural export, owing to depressed demand and disruption of marketing. The country’s exportable supplies would be also reduced owing to unavailability of raw materials, disruption of international supply chains and depressed demand.

Tourism

Tourism

The sharp contraction in international travel is affecting tourist earnings severely. Official estimates are that this year’s tourist earnings would fall by US$ 1.5 billion. Indications are that they would fall by much more, about US$ 2 to 2.5 billion,

This severe decrease in earnings will depress the 2020 balance of payments and affect the country’s external finances adversely. Compounding the balance of payments difficulties is the fall in workers’ remittances.

Remittances

Workers’ remittances make a substantial contribution to the country’s balance of payments. So much so that in many years, workers’ remittances have offset large trade deficits. Apart from their significant contribution to the balance of payments, they are a significant income support to low income households. The livelihoods of low income households would be severely eroded by the decrease in remittances.

Workers’ remittances that fell last year by US$ 300 million are likely to shrink further because of fears of travel by Sri Lankan workers and travel restrictions for employment to several countries like South Korea, Italy and Iran. In addition, the lesser incomes in West Asia owing to the decreased prices for oil could also reduce remittances.

Remittances are likely to fall from US$ 6.7 billion last year to about US $ 5 billion this year. This fall of US$ 1 to 2 billion will aggravate the balance of payments problem.

Balance of payments

The reduction in exports, earnings from tourism and workers’ remittance could lead to a large balance of payments deficit. This would weaken the country’s foreign reserves and make the repayment of foreign debt obligations more onerous. Commercial borrowing can come only at high interest rates owing to the country’s risk rating.

Oil prices

The only silver lining among these dark economic clouds is the fall in fuel prices that would ease the trade deficit. However, even this would impact adversely on tea exports and workers’ remittances. Also a reversal in oil prices is not unlikely as petroleum exporting countries could curtail oil supplies. At the time of writing oil prices that fell to US$ 30 per barrel have risen to US$ 45. This would wipe away this benefit.

Food security

Ensuring the availability of, and accessabilty to, at least minimum food requirements of people is crucial during this period. Already a proportion of the population would not have had adequate minimum food owing to the curfew, rush of people to shops, demand for food exceeding the available food stocks and inadequate income to obtain their food.

Domestic food

There are two dimensions in ensuring adequate food. The government must ensure that the country’s domestic food production is at a maximum. This is particularly relevant at this time of the Maha crop harvesting. The curfew should not obstruct the availability of labour and machines for harvesting. This is, however, not easy during a period of a country-wide curfew.

Availability

Although there is a potential large rice crop adequate for the country’s requirements till the end of 2020 and beyond, there could be a shortfall in harvesting it. It is also important that large stocks of paddy are not hoarded to create a scarcity to increase prices.

At the best of times, it has been difficult to achieve an equitable marketing of paddy. Effective measures are needed to ensure the availability of rice to people at a reasonable price, while at the same time givivg farmers a remunerative price.

Food imports

The other dimension in food security is the need to import essential food items that are inadequately produced in the country. These include wheal, sugar, dhal and milk. There could be difficulties in importing these food items as countries producing these are themselves affected by the virus.

External assistance

The country would no doubt face severe balance of payments difficulties and problems in repayment of debt obligations. The reduction in exports, earnings from tourism and workers’ remittance could lead to a large balance of payments deficit, weaken the country’s foreign reserves and make the repayment of foreign debt obligations onerous. This would be especially so if there is a high premium on interest rates for the country’s international borrowing.

The economic impact of the global corona pandemic and the disruption and dislocation of the Sri Lankan economy by it, has made the external finances of the country very vulnerable. It is a time when international financial assistance is mandatory. The international assistance that must be sought are a moratoriums on debt repayment, loans and facilities from friendly countries

The required international assistance may come in the form of moratoriums on debt repayment and financial assistance from multilateral agencies, especially, the International Monetary Fund(IMF), the World Bank and the Asian Develompent Bank. We must also seek loans and facilities from friendly countries. It is by these means that the country could withstand the severe international vulnerability it is facing.

Summing up

In these difficult economic conditions, it is crucial to find ways and means by which the economic difficulties facing the country could be ameliorated. It is vitally important that those sectors of the economy that are least affected by the adverse international factors produce their maximum output, This is especially so with respect of food crops that have an important role in ensuring food security.

The full harvesting of the Maha crop is essential to ensure an adequate availability of the country’s staple food at reasonable prices. It is also important to ensure adequate imports of wheat, sugar, dhal and milk imports.

The economic difficulties the country is facing are serious. In such a difficult economic context, prudent management of the public finances is vital to ensure that the difficulties are mitigated. Monetary and fiscal policies must not compound the economic difficulties.

Leave a Reply

Post Comment