Columns

Global economic recession will affect Sri Lankan economy adversely

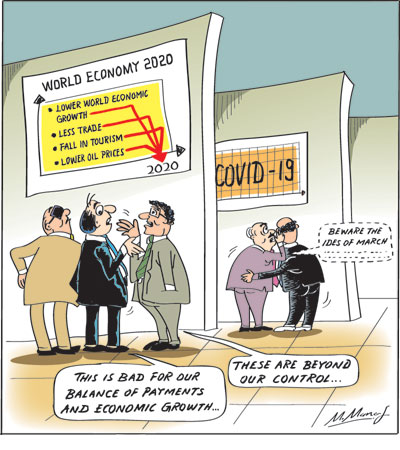

View(s):The COVID-19 epidemic, now described as a pandemic, that has affected over one hundred thousand persons in all continents, is having disastrous economic consequences the world over. International travel is vastly curtailed, unemployment is rising, hotels and restaurants are closing and the decreased demand for oil has resulted in lower prices for oil and lesser incomes for oil producing countries.

Serious threat

Serious threat

The International Monetary Fund (IMF) has said that the Coronavirus poses a serious threat to the world economy. The world economy that was expected to slowdown in 2020, before the outbreak of the Coronavirus (COVID-19) is now heading towards a recession.

Western economies, the Chinese economy and Asian economies were expected to slowdown. The South Asian region that was the fastest growing in 2020 was also slowing down and expected to grow at less than the 6 percent growth estimated for 2019. It may now dip to much less owing international demand for South Asian exports falling drastically and a precipitous decline in tourism to the region.

Recession

Although some prominent economists took the view at the beginning of COVID-19 that the epidemic would not lead to a world recession, there is little doubt that there would be a significant fall in world trade and international travel. The extensive spread of the virus and the economic impacts the pandemic is undoubtedly leading to a global economic recession. The worst affected would be trade and travel dependent economies like Sri Lanka.

Impact on Sri Lanka

Navigating the Sri Lankan economy this year in the current troubled international economic waters is no easy task. This is especially so as the country’s foreign indebtedness and debt obligations are high and external finances are weak. These weaknesses would make international borrowing difficult and costly.

Exports would face an inhospitable world market compounded by trade conflicts and restrictions. The demand for Sri Lanka’s industrial exports is likely to fall. The shrinkage in international tourism is likely to continue till an effective control of the Coronavirus (COVID-19) is achieved.

Exports would face an inhospitable world market compounded by trade conflicts and restrictions. The demand for Sri Lanka’s industrial exports is likely to fall. The shrinkage in international tourism is likely to continue till an effective control of the Coronavirus (COVID-19) is achieved.

The only silver lining among these dark clouds is the fall in fuel prices that would ease the trade deficit. However, even this would impact adversely on tea exports and workers’ remittances.

The benefit of lower fuel prices would be offset by a fall in demand for tea, as past experiences have shown. Workers’ remittances that fell last year by US$ 300 million may continue to shrink because of the lesser incomes in West Asia owing to the decreased prices for oil and fears of travel by

Sri Lankan workers.

Tourism

The most serious setback to the balance of payments and the economy would be to the country’s tourism that has been seeking a revival after the Easter Sunday bombing. Although the IMF forecast a revival of tourism, the continued threats to international travel owing to COVID-19 makes such a revival unlikely.

In fact tourist earnings that fell by 18 percent from US$ 4.38 billion in 2018 to US$ 3.59 billion last year will probably decrease further this year owing to the curtailment of travel from the main countries of origin, most notably China, the second largest travellers to Sri Lanka. Middle Eastern travellers would also fall owing to less travel due to fears of COVID-19 as well as depressed oil incomes. A further drop in tourist earnings by US$ 1 billion would have a serious adverse impact on the balance of payments.

Summing up

The reduction in exports, earnings from tourism and workers’ remittance could lead to a large balance of payments deficit. This would make the repayment of foreign debt obligations that are already difficult more onerous. This would be especially so if there is a high premium on interest rates for the country.

Conclusion

The economic difficulties the country faces this year are beyond the control of the country. Key sectors of the economy such as exports, tourism and workers’ remittances are likely to earn less. In such a difficult economic context prudent management of the public finances is vital to ensure that the difficulties are mitigated. Monetary and fiscal policies must not compound the balance of payments difficulties.

The much expected economic revival in 2020 is not likely till the global economic conditions are more conducive to exports and tourism. The end of the pandemic and return to normalcy remains uncertain.

Leave a Reply

Post Comment