Columns

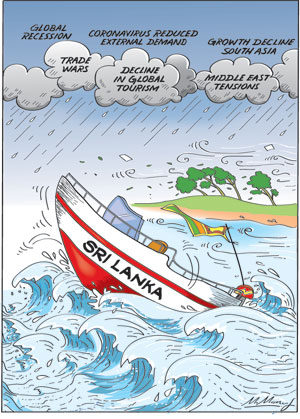

External shocks could destabilise economy

View(s):External shocks have been serious setbacks to the Sri Lankan Economy since independence.

Once again the Sri Lankan economy is facing severe external Shocks. Slow growth of the international economy will reduce the country’s exports. The dip in world tourism will cripple the country’s attempt to revive tourism. There is a likely hood of a spike in fuel prices (although prices have fallen at present) and economic dislocation due to the impact of Corona virus.

72 Years

72 Years

In the 72 years of Sri Lanka post independence economic history, external Shocks have been determining factor in the country’s economic performance. After a short period of favorable external trading conditions, the country faced a severe deterioration in the terms of trade. In the late 50′s and 60′s the country faced a fall in export prices for tea and rubber while the country’s imports cost more.

This caused a severe balance of payments problem and erosion in the country’s foreign reserves. This resulted in imposition of import controls and exchange controls. The government followed inward looking economic policies that also failed to resolve the problem. The external Shocks of the 1970′s were exasperated by world food prices rising at the same time as when there was severe droughts that led to a sharp fall in domestic food production.

One of the fundamental reasons why external Shocks have severe impact on the country is due to the character of the country’s exports and imports. Exports are very elastic in demand, in other words the world demand for our exports could fall. This is particularly so in respect of the country’s primary agricultural exports. The diversification of our exports after 1978 has reduced this instability somewhat but in contrast the country’s imports are highly inelastic. The intermediate imports of fuel, fertiliser, raw material for manufacture, machinery and other capital goods are vital. Fuel imports constitute around 15 % to 20% of imports. When fuel prices rise it is a massive burden on the balance of payment.

One of the fundamental reasons why external Shocks have severe impact on the country is due to the character of the country’s exports and imports. Exports are very elastic in demand, in other words the world demand for our exports could fall. This is particularly so in respect of the country’s primary agricultural exports. The diversification of our exports after 1978 has reduced this instability somewhat but in contrast the country’s imports are highly inelastic. The intermediate imports of fuel, fertiliser, raw material for manufacture, machinery and other capital goods are vital. Fuel imports constitute around 15 % to 20% of imports. When fuel prices rise it is a massive burden on the balance of payment.

International fuel prices tend to fluctuate and the country has faced fuel price hikes during the post-independence years. Even today there is today a threat of oil price increases due to the tensions in the middle east.

Although the country has achieved self-sufficiency in rice and increased production in other food crops as well, the country continues to be dependent on imports of essential food items. These include wheat, grain, sugar, milk and dhal. These imports also basically inelastic.

Global economic downturn

Even before the current situation developed by the middle of last year there was an expectation that the world economy would slow down. Around the middle of last year the global economy was estimated to dip in 2020. South Asia which was the fastest growing region in the world was expected to grow at less than the 6% in 2020. The current world situation implies that growth will fall in the South Asian region. These global developments of low growth will impact on the Sri Lankan economy. Export growth is likely to be adversely affected.

Export growth

Sri Lanka’s export growth has been far less than other countries in the region. This is specially so compared to the high export growth of Bangladesh and Vietnam. One of the underlying reasons for this inadequate export growth of manufactures is that while countries like Bangladesh and Vietnam have liberalised their economy, Sri Lanka’s protection has increased. Export growth requires low import tariffs. What has happened over time is that the effective rate of protection has increased. Although there have been efforts in 2019 to reduce or eliminate Para tariffs, this has been inadequate. In the light of the challenges facing the country’s exports it is vital that there is further trade liberalization.

Brexit

Britain’s exit from the European Union provides both opportunities and challenges. The country must be prepared to exploit the opportunities such as the location of British investments in Sri Lanka and export possibilities to Britain. This once again requires a forward looking pragmatic trade and investment policies.

Tourism

The current situation in world tourism is a massive blow to Sri Lanka’s tourism. The country was trying to revive its adversely affected tourism when the new wave of tourism decreased. It is not only that we are adversely affected by the global dip in tourism but also affected by the cutoff of Chinese tourists into the country. The Chinese are the second largest single destination of tourists. Therefore this year the tourist sector will continue to be adversely affected. Furthermore local tourism too may decrease owing to fears of the Novel Corona virus outbreak.

This dip in tourism will affect a number of other sectors in the economy that are linked to tourism. These include transport, gem trade, arts and crafts, food and beverages. Therefore the Sri Lankan economy is likely to grow at a slow pace.

Other challenges

Quite apart from the current global impact on the Sri Lankan economy there are impending challenges. The country’s entitlement to the European Union’s GST + Concession expires in 2023 owing to Sri Lanka having achieved the high middle income status in 2019.The continuity of the GSP plus status till 2023 is not automatic but subject to the country observing certain conditions. This implies that the country’s competitiveness in world trade has to improve as other countries will continue to enjoy the GST+ status.

Conclusion

The external Shocks the country may face in 2020 could destabilize the economy, increase the country’s external vulnerability. The weak external finances and the high debt repayment obligations this year makes the country’s economic predicament serious. It is imperative that the government is conscious of these threats to the economy and adopts policies and measures to litigate their impact. The prudent management of fiscal and monetary policy will be an important determinant of the country’s capacity to face the external shocks.

Leave a Reply

Post Comment