Twin deficits impact Sri Lanka’s growth momentum

Sri Lanka’s twin deficit condition – high budget and external current account deficits – has been fuelled by a host of domestic and international factors driving the economy towards a crossroads with many tough challenges.

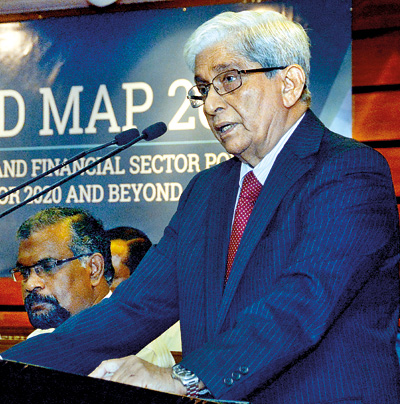

Prof. W.D. Lakshman presenting the Road Map. Pic by Priyantha Wickremarachchi

The country has an inherent economic potential to face these challenges, new Central Bank Governor Prof. W.D. Lakshman said.

He quoted Sir Winston Churchill’s famous saying, “The pessimist sees difficulty in every opportunity. The optimist sees the opportunity in every difficulty,” to emphasise the country’s resilience to meet emerging challenges.

Addressing a representative audience of bankers, diplomats and officials at the launching ceremony of Central Bank’s Road Map 2020 in Colombo on Monday, Prof. Lakshman noted that external borrowing contributes to widen the deficit in the external current account further.

In addition, the increased foreign debt service payments drain the country’s international reserves, which serve as a buffer for external shocks.

Therefore, while fiscal consolidation efforts continue, it is important to maintain the current account deficit in the balance of payments at sustainable levels by strengthening the tradable sector.

Foreign reserve management activities will continue to be based on a model-based Strategic Asset Allocation (SAA) framework. Further initiatives are planned in this subject area, he disclosed.

The Central Bank is also in the process of introducing a mid-day benchmark reference rate in line with International Organisation of Securities Commission (IOSCO)’s principles for the benefit of stakeholders, including the general public and foreign investors.

It will continue to ensure that the government’s financing requirements are met at the lowest possible cost with a prudent degree of risk, while assuring debt sustainability over the medium term.

The Medium Term Debt Management Strategy (MTDS) remains focused on containing the foreign currency debt as a share of total debt, improving the Average Time to Maturity (ATM) of the foreign currency debt portfolio, and limiting the debt maturing within one year, he pointed out.

Referring to improvements of the Treasury bond issuance system, he said that the Central Bank has already initiated raising funds in the domestic market and building buffers within the Active Liability Management Act (ALMA) framework by issuing Treasury bonds in the domestic market.

These operations will continue in 2020 and beyond in line with the forthcoming debt service obligations, Prof. Lakshman said adding that the Central Bank commenced capturing price, yield and settlement value of each securities movement carried out in the LankaSecure system from January 1, 2020 onwards.

Measures are being taken to establish a distinct Electronic 33 Trading Platform (ETP) and a Central Counter Party (CCP) arrangement for government securities along with required legal reforms to deepen and broaden the secondary market for government securities.

Steps will be taken to introduce a new primary issuance system for Treasury bills and a web based auction system for Sri Lanka Development Bonds (SLDBs) to enhance their secondary market tradability, he disclosed.

The Central Bank has initiated a drafting a new Banking Act and expects to complete its enactment in 2021.

The proposed Act will provide provisions to introduce a single type of banking licence for licenced commercial banks and licenced specialised banks.

The new Act will contain provisions to extend regulations for banks which are to be established in the Colombo International Financial Centre, he revealed.

Going forward, the Central Bank expects to further reinforce the stabilisation of the finance sector with proposed changes to the Finance Business Act (FBA).

Directions will be issued on ownership limits for Licenced Finance Companies (LFCs), giving a reasonable time horizon for the implementation, with flexibility on ownership limits for investors who invest in distressed companies expecting to restructure such companies.

Importance of strong corporate governance processes and 26 practices in the conduct of finance business and the stability of the sector is recognised, he opined.