Columns

Sound macroeconomic fundamentals essential for economic stability and growth

View(s): The economy cannot be revived without healthy macroeconomic fundamentals that include, a moderate fiscal deficit, low inflation, a small trade deficit, a balance of payments surplus and adequate foreign reserves. The country’s domestic and foreign debt and foreign debt servicing obligations too should be within acceptable levels.

The economy cannot be revived without healthy macroeconomic fundamentals that include, a moderate fiscal deficit, low inflation, a small trade deficit, a balance of payments surplus and adequate foreign reserves. The country’s domestic and foreign debt and foreign debt servicing obligations too should be within acceptable levels.

Macroeconomic stability

The inability to grow at a rapid pace has been owing to these key indicators of macroeconomic stability being unsatisfactory and non-economic conditions such as political uncertainty, terrorist attacks and ethnic tensions hindering economic growth. Rapid economic growth cannot be achieved without these economic and other conditions being fulfilled.

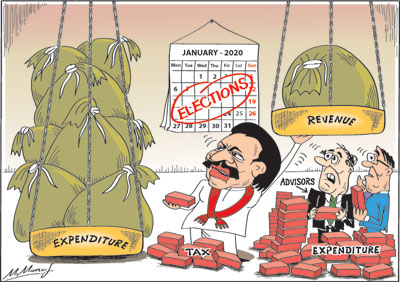

One of the most important preconditions for economic stability and growth is fiscal sustainability. The fiscal slippage this year under the previous government and a likely further widening of the fiscal deficit owing to a number of tax concessions granted by the new regime has raised concerns that the country’s macroeconomic fundamentals could be eroded. This is especially so as we are in the run-up to a parliamentary election and the government is likely to grant extravagant relief measures.

Fiscal stimulus

Fiscal stimulus

Economists recognise that one means of stimulating economic growth in a sluggish economy is a fiscal stimulus. Lower taxation is expected to stimulate the economy by making investment more profitable. The reductions in taxes are expected to give a fiscal stimulus to investment and enhance growth. This is however possible only if other conditions for investment too are propitious for the fiscal stimulus to enhance investment and propel economic growth.

The danger of a fiscal stimulus is that the large fall in revenue, together with the overruns in expenditure, could result in a large fiscal deficit that would undermine macroeconomic fundamentals and destabilise the economy. It is therefore of utmost urgency to recognise this and commence a fiscal consolidation programme. In the current political and economic context, fiscal consolidation has to be achieved mostly by increasing government revenue.

Financial strategy

Fortunately the government is aware of the danger of a fiscal slippage and is in the process of preparing a financial strategy to ensure fiscal stability. As mentioned in this space last Sunday, Dr Indrajit Coomaraswamy, in his last address as Governor of the Central Bank, stated that the government will be making a statement to show how the fiscal stimulus package will be accommodated without undermining economic stability, overheating of the economy and creating balance of payments and inflationary pressures in the economy.

Difficult

Formulating such an economic framework to ensure both fiscal and debt sustainability is not an easy task in a political context where the reduction of taxes and increased government expenditure are political imperatives. Nevertheless reducing the fiscal slippage in 2020 and achieving a measure of fiscal consolidation within the political constraints is vital to provide an economic environment for economic growth. Large fiscal deficits would undermine economic stability and growth.

Fiscal consolidation

The process of fiscal consolidation that was derailed from 2018 onwards must be resuscitated. Progressively lower fiscal deficits must be achieved to reach the fiscal deficit target of 3.5 percent of GDP that was set for 2020 that cannot be achieved. A new fiscal consolidation programme must progressively achieve a fiscal deficit of less than 4 percent of GDP by 2025. This has to be achieved mainly by enhanced revenue, as there are likely to be increased government expenditure. Furthermore, the country’s revenue to GDP ratio is low.

Path to fiscal consolidation

The path to fiscal consolidation has to be mostly by the enhancement of government revenue although it must also find ways and means of reducing as much as possible wasteful and unproductive expenditure. However, the possibility of reducing government expenditure is limited as there are political pressures for increasing government expenditure. Government expenditure is likely to increase rather than be contained.

Reducing the massive losses of state owned enterprises is one means of doing this, but once again there are political difficulties in adopting a pragmatic programme. Therefore the process of fiscal consolidation must be by the enhancement of government revenue.

Revenue enhancement

Sri Lanka had one of the lowest tax to GDP ratios of 13 percent of GDP until the previous government began a programme of fiscal consolidation that was based on revenue enhancement. This fiscal consolidation programme raised the tax to GDP ratio to about 16 percent of GDP in 2018. However in 2019 a fiscal slippage occurred owing to increased government relief measures and increased public expenditure and this year’s fiscal deficit is likely to be 6 percent of GDP or more.

The increase in government expenditure of the previous regime and the present government’s tax reliefs are likely to increase the fiscal deficit and undermine macroeconomic fundamentals. Next year too is not a propitious year for containment of expenditure owing to it being an election year.

Enhance revenue

The government’s tax reliefs are likely to reduce the tax revenue to GDP ratio. New taxation measures are needed to ensure that government revenue does not fall. It is in this context that the government must come up with a programme of fiscal consolidation based on its economic strategy and priorities in public spending. It must necessarily be one based on a revenue enhancement programme. The measures to enhance government revenues must necessarily come from mostly direct taxes and some progressive indirect taxes. There is some limited scope for higher indirect taxes on luxury imported items and higher property taxes, stamp duties and wealth taxes.

Tax evasion

One of the difficulties in increasing revenue is the large scale tax avoidance and tax evasion and inefficient and corrupt tax administration. Tax avoidance and tax evasion have to be drastically reduced to not only increase revenues, but make taxation more equitable, as very rich persons and high income earning professionals are avoiding taxes. This is a most difficult task due to the innovative methods used by professionals to avoid and evade taxes and the inefficiency and corruption in the tax administration.

In spite of these difficulties, innovative methods of direct and indirect taxation must be devised. The Report of the Tax Commission chaired by Professor W D Lakshman of a few years ago that has not been made public could have proposals for enhanced tax collection.

Conclusion

As an initial policy the government has adopted a fiscal stimulus. This is one means of stimulating economic growth in the current context of a sluggish economy as lower taxation is expected to stimulate the economy by making investment more profitable. Although the reductions in taxes are expected to give a stimulus to investment other conditions for investment too should be propitious for the fiscal stimulus to enhance investment and propel economic growth. The shortcoming of this approach of a fiscal stimulus is that the fall in revenue together with the overruns in expenditure, could result in a large fiscal deficit that would in turn undermine macroeconomic fundamentals and destabilise the economy. It is therefore of utmost urgency that the government recognises the adverse impacts of the fiscal slippage and commences a revenue enhancing fiscal consolidation programme.

Leave a Reply

Post Comment