Columns

Formidable economic challenges in 2020

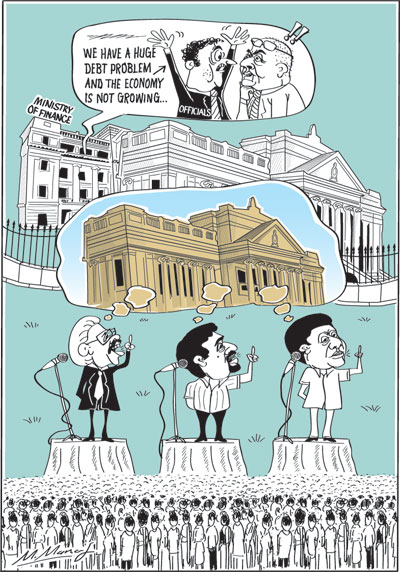

View(s): The economic challenges facing the country are formidable. The country is pre-occupied with the forthcoming Presidential election on November 16th, while the economy is in dire straits. A root cause of this economic predicament is the country’s electoral politics.

The economic challenges facing the country are formidable. The country is pre-occupied with the forthcoming Presidential election on November 16th, while the economy is in dire straits. A root cause of this economic predicament is the country’s electoral politics.

This year’s economic growth is dipping below 3 percent and the fiscal imbalance is growing. The public debt that consists of domestic and foreign debt is over 80 percent of the GDP. Meeting the debt servicing obligations and reviving the economy are massive economic challenges next year.

Next President

The presidential candidates may not be fully aware of the massive economic problems facing the country in the next five years. In any event, the responsibility of running the economy will not be with the next President. Since the President will not hold a single portfolio under the amended constitution, resolving the massive economic problems will be the responsibility of the present UNP government and the government that will be formed after the 2020 parliamentary elections.

The Prime Minister and the government will have to resolve the formidable economic problems and get the economy moving much faster.

Pre-occupation

The pre-occupation of presidential candidates is the election. They could make any promises to gain popular support irrespective of their capacity to fulfil them. As Lee Kwan Yu said Sri Lanka’s elections are an auction of non-existent resources. For most part, the extravagant public expenditure in the runup to the two forthcoming elections and promises would aggravate the economic problems rather than alleviate them. This would continue into next year owing to the parliamentary elections. Consequently the economic problems would worsen rather than lessen.

Economic woes

Economic woes

The three most critical economic problems are the servicing of the large public debt that distorts fiscal priorities and destabilises the economy; the growing foreign debt and meeting its debt servicing costs; and the tardy growth of the economy. The resolution of these problems requires a strong commitment to good economic policies that the political situation does not allow as good economics is bad politics in the short run.

Public debt

The most difficult problem faced by the country is its domestic and foreign debt. The total public debt — domestic and foreign — is around 80 percent of GDP and is evenly divided between the two. A debt to GDP ratio of 60 percent is acceptable, but when it exceeds this threshold, it is a sign of grave financial instability.

There are serious implications and consequences of the high indebtedness. One significant impact of this is that the government does not have the financial capacity to invest in the country’s economic and social development. This situation is likely to be further aggravated by further irresponsible public spending in the run up to the parliamentary election next year.

The inadequacy of revenue to meet even current expenditure, debt servicing costs of the public debt that exceeds revenue and the burden of servicing a foreign debt of US$ 54 billion are almost insurmountable problems. The continuous high fiscal deficits lead to inflation, lesser export competiveness and slower economic growth.

Foreign debt

The foreign debt has increased over the years to reach about US$ 54 billion, which is over 60 percent of GDP. The debt servicing cost (repayment of capital and interest) is as much as about 45 percent of export earnings.

The country’s massive foreign debt and its high servicing costs are serious external vulnerabilities. The debt servicing costs have been met by further borrowing. Consequently the foreign debt and its servicing costs have been increasing. Persistent large trade deficits and small balance of payments surpluses have hardly contributed to the repayment of foreign debt.

The country’s massive foreign debt and its high servicing costs are serious problems that cannot be resolved without rapid economic growth and higher export growth. Recent governments have repaid debt obligations by further borrowing and enhanced the foreign debt burden and external vulnerabilities. Consequently the foreign debt and its servicing costs have been increasing. Persistent large trade deficits and small balance of payments surpluses have hardly contributed to the repayment of foreign debt.

Reduce debt

If the foreign debt is not brought down to a manageable level in the next few years, the country’s external financial vulnerability would be unsustainable. The country could be extricated from this debt trap only by a reduction of the trade deficit, improvement in the balance of payments and prudent foreign borrowing. Getting out of the foreign debt trap and external vulnerability is no easy task but a crucial one. Only a multipronged strategy could make an impact on reducing the country’s external financial vulnerability.

Slow growth

The slow economic growth since 2015 is a serious concern. In the five year period (2015-2019), the economy grew by less than 4 percent compared to an annual average of about 4.5 percent in the post-independence period. Economic growth is estimated at only 3.7 percent this year.

The failure of the regime to inspire investor confidence, political instability created by the conflict within the government leading to the constitutional crisis in October 2018, the obstructionist activities of the political opposition and trade unions, the incapacity to implement policies and the setback to the economy by the Easter Sunday terrorist attack and ethnic violence are reasons for this tardy economic growth.

Concluding reflection

Politics is inextricably connected with economics. It is an axiom that good economics is bad politics in the short run. On the other hand, good economics is good politics in the long run.

Unless and until the country elects a government that adopts pragmatic economic policies, the economy is likely to stutter and falter and remain the slowest growing economy in South Asia. Political compulsions are preventing the nation from achieving its economic potential.

Leave a Reply

Post Comment