Columns

Foreign debt and external financial vulnerability

View(s):

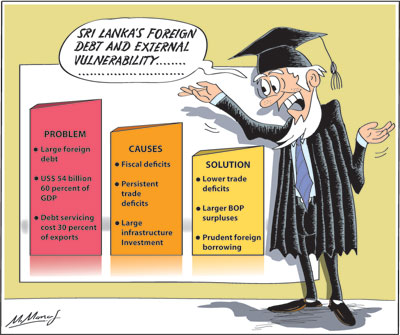

Sri Lanka’s foreign debt increased to US$ 54.2 billion in the first quarter of this year from US$ 52.3 billion in the fourth quarter of 2018. This is over 60 percent of the country’s GDP.

If the foreign debt is not brought down to a manageable level in the next few years, the country’s external financial vulnerability would be unsustainable. The country could be extricated from this debt trap only by a reduction of the trade deficit, improvement in the balance of payments and prudent foreign borrowing.

Foreign debt

The country’s massive foreign debt and its high servicing costs are serious external vulnerabilities. The debt servicing costs have been met by further borrowing. Consequently the foreign debt and its servicing costs have been increasing. Persistent large trade deficits and small balance of payments surpluses have hardly contributed to the repayment of foreign debt.

Growth of debt

The foreign debt has increased over the years to reach US$ 54 billion, which is over 60 percent of GDP. The debt servicing cost (repayment of capital and interest) is as much is about 45 percent of export earnings.

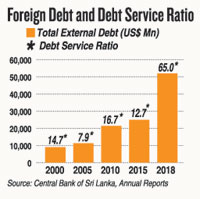

The rapid growth in foreign debt is captured in the table and chart. The foreign debt was only US$ 9 billion in 2000. It increased to US$ 11.3 billion in 2005, to US$ 21.4 billion in 2010 and to US$ 52 billion in 2018. It increased further this year to US$ 54 billion in the first quarter of this year. This increasing foreign debt implied increasing debt servicing costs. One reason for the escalation of debt is the foreign borrowing for repaying earlier incurred debt.

Causes

Causes

There are several other reasons for this growth in foreign debt. They include the persistent fiscal and trade deficits and inadequate revenue for public expenditure. Persistent fiscal and trade deficits have been responsible for foreign borrowing. Part of large fiscal deficits has been financed by foreign borrowing. Persistent trade deficits, too, have been an important factor contributing to the external indebtedness, as well as the difficulty in resolving it.

The country has had trade deficits in 63 of the last 68 years (1950-2018). There were trade surpluses only in five of those years. The last time there was a trade surplus was in 1977 when there was a small trade surplus with stringent import controls and exchange restrictions. Trade deficits have increased progressively and in fact ballooned in recent years. In the last three years it has ballooned from US$ 8.9 billion in 2016, to US$ 9.6 billion in 2017 and to US$ 10.3 billion in 2018. These large trade deficits have weakened the balance of payments and reduced balance of payments surpluses. Consequently, debt repayment has been with further foreign borrowing that has increased the foreign debt.

Foreign borrowing

Foreign borrowing

In this context of a lack of domestic savings, development expenditure has to be financed by foreign debt. Foreign borrowing is not intrinsically wrong. On the contrary, foreign borrowing is an important means by which countries lacking in resources are able to develop. It is the means by which the savings-investment gap of a developing country is met.

However, much of the growth in our foreign debt was due to borrowing for unproductive or low productive projects and consumption expenditure. The foreign expenditure did not result in an increase in tradable goods that would assist in the repayment of debt. These expenditures included large defence expenditure, development of infrastructure, such as expressways and roads, bridges, airport, harbours and sports stadiums.

Some of these expenditures are economically justifiable or essential, as in the case of defence expenditure and improvement of highways. However the expenditure incurred were much higher than they would have been had transparent international bids were called. Consequently the foreign debt incurred on these investments was higher than warranted. Some of the large foreign funded projects were even white elephants, far from resulting in earnings, they required further expenditure. This mismanagement of foreign borrowing is a root cause for the country’s difficulty in debt repayment.

Infrastructure

In any event, large infrastructure investments have a long gestation period and yield returns over a long period of time. When large infrastructure investments do not result in an increase in foreign earnings they become a huge burden on the economy.

Even when infrastructure investment is fully justified, excessive expenditure on such projects could be a strain on the external finances as infrastructure has a long gestation period and would be inflationary.

Glimmer of hope

There is a glimmer of hope in the balance of payments this year as there has been a significant improvement in the trade performance in the first half of this year. The trade deficit declined to US$ 3.6 billion in the first half of this year and there is an expectation that the trade deficit would be around US$ 8 billion for 2019. This could enable a balance of surplus of about US$ 3 billion or more.

The decrease in the trade deficit by US$ 2.1 billion in the first half of this year, compared to the same period last year, was achieved by an export growth of 4.7 percent and a decrease in imports by as much as 15.4 percent. A balance of payments surplus of about US$ 3 billion or more would enhance the country’s external reserves significantly.

Balance of payments

However, the lower trade deficit could result in a balance of payments surplus of over US$ 3 billion, especially if there is an improvement in tourist earnings and there isn’t a drop in workers’ remittances, both of which have declined in the first half of this year. It is important that tourist earnings, workers’ remittances and capital inflows do not dip much from those of last year. Since June, there has been an increase in tourist flow that would improve earnings from tourism in the second half of the year. A threat to the balance of payments comes from increased oil prices owing to the tensions in West Asia.

Way forward

Reducing the weaknesses in the trade and balance of payments and enhancing the strengths in the trade and balance of payments are the way forward to reducing the country’s external vulnerability. The reduction of the large foreign debt is possible only with higher balance of payments surpluses that reduce the need for foreign debt repayment obligations.

The trade deficit must be contained by reducing unessential imports. Monetary and fiscal policy must ensure this. Exports must be enhanced by higher exports of tea and other agricultural exports and by an acceleration of the growth momentum in manufactured exports. Hopefully tourist earnings will increase later this year and worker’s remittances will not drop. There could be external shocks that would weaken the country’s balance of payments such as the possibility of a hike in petroleum prices and trade tensions that could reduce exports.

Getting out of the foreign debt trap and external vulnerability is no easy task but a crucial one. Only a multipronged strategy could make an impact on reducing the country’s external financial vulnerability. Prudent management of foreign debt is imperative.

Leave a Reply

Post Comment