Columns

Declining trade deficit could improve external finances

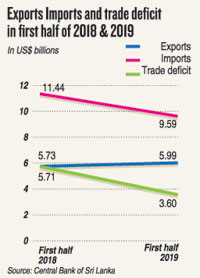

View(s): There is a prospect of a larger balance of payments surplus this year owing to the reduction of the trade deficit. The decrease in the trade deficit by US$ 2.1 billion in the first half of this year compared to the same period last year could result in a higher balance of payments surplus and a strengthening of the external finances this year.

There is a prospect of a larger balance of payments surplus this year owing to the reduction of the trade deficit. The decrease in the trade deficit by US$ 2.1 billion in the first half of this year compared to the same period last year could result in a higher balance of payments surplus and a strengthening of the external finances this year.

A higher balance of payments surplus this year could strengthen the external reserves and ease the country’s debt burden.

Trade deficit

The much improved trade performance in the first half of the year, when the trade deficit was only US$ 3.6 billion, leads to an expectation of a lower trade deficit of around US $8 billion or less this year. This could in turn enable a balance of payments surplus of around US$ 3 billion, provided tourist earnings, workers’ remittances and capital inflows do not dip much from those of last year.

The much improved trade performance in the first half of the year, when the trade deficit was only US$ 3.6 billion, leads to an expectation of a lower trade deficit of around US $8 billion or less this year. This could in turn enable a balance of payments surplus of around US$ 3 billion, provided tourist earnings, workers’ remittances and capital inflows do not dip much from those of last year.

The decrease in the trade deficit by US$ 2.1 billion in the first half of this year, compared to the same period last year, was achieved by an export growth of 4.7 percent and a decrease in imports by as much as 15.4 percent. A balance of payments surplus of about US$ 3 billion or more would enhance the country’s external reserves significantly.

Export performance

The increase in exports by 4.7 percent was driven mainly by manufactured exports increasing by 6.7 percent. Exports of garments and rubber goods contributed to this growth. The recent performance of agricultural exports has however been unsatisfactory. In the first half of this year, agricultural exports declined by 2.1 percent. Tea exports declined by as much as 6 percent in the first half of this year compared to the same period last year.

The export growth of nearly 5 percent in the first six months of this year is a continuation of the increasing trend in exports since 2016. Exports grew by 10.2 percent in 2017 and by a further 4.7 percent in 2018. Exports increased from US$ 10.3 billion in 2016 to US$ 11.9 billion in 2018. Therefore it is realistic to expect exports to exceed US$ 12 billion this year. This coupled with a significant decrease in imports would reduce the trade deficit.

Import decline

Import decline

Imports have been increasing at a much higher amount than the export growth. Imports increased by 10.2 percent in 2017 from that of 2016 and increased by a further 4.7 percent in 2018. Therefore the decrease in imports in the first half of 2019 by 16.1 percent is a noteworthy reversal of the increasing trend in imports. Hopefully this year’s total imports could be contained at US$ 19 billion or less.

Trade deficit

The substantial increases in the trade deficit from 2016 to 2018 has been arrested this year. The trade deficit increased from US$ 8.7 billion in 2016 to US$ 9.6 billion in 2018 and to US$ 10.3 billion last year. In contrast to the recent experience of import growth exceeding export growth, there has been an import decline that has reduced the trade deficit to only US$ 3.7 billion in the first half of this year compared to US$ 5.71 in the first half of last year.

This decrease in the trade deficit in the first half of this year has been achieved by an increase in exports and a significant decrease in imports. The continuation of this trend of growth in exports and decline in imports could reduce this year’s trade deficit to less than US$ 8 billion from the massive trade deficit of US$ 10.3 billion last year.

Balance of payments

Balance of payments

The lower trade deficit could result in a balance of payments surplus of over US$ 3 billion, especially if there is an improvement in tourist earnings and there isn’t a drop in workers’ remittances, both of which have declined in the first half of this year.

The trade performance in the first half of the year leads to an expectation of a much reduced trade deficit of around US $7 billion or less this year. This would in turn enable a balance of payments surplus of around US$ 3 billion provided tourist earnings, workers’ remittances and capital inflows do not dip much from those of last year. Since June there has been an increase in tourists that would improve earnings from tourism in the second half of the year.

Summary

The trade deficit that has widened in recent years owing to the growth in imports being higher than the growth in exports has been reversed in the first half of this year. Owing to the continued growth in exports and a decrease in imports, the trade deficit has been reduced significantly. It is very significant that imports declined by as much as 16.1 percent in the first half of this year compared to that of the same period last year.

The reduction in the trade deficit this year is likely to result in a higher surplus in the balance of payments. This would strengthen the external finances. The external reserves that were US$ 8.2 at the end of June could be enhanced to nearly US$ 10 billion. This may enable meeting next year’s debt repayment obligations without resort to further borrowing and thereby reduce the foreign debt.

Conclusion

It is of utmost importance that the momentum of export growth is accelerated especially by increased exports of agricultural exports that have declined in the first half of this year. The containment of imports too is vital to keep the trade deficit at the projected level.

Monetary and fiscal policies should ensure that there isn’t a surge in imports as happened last year. Furthermore, increased foreign direct investment, higher earnings from services, increased tourist earnings and workers’ remittances would increase the balance of payments surplus.

Leave a Reply

Post Comment