Columns

Political compulsions are destabilising the economy

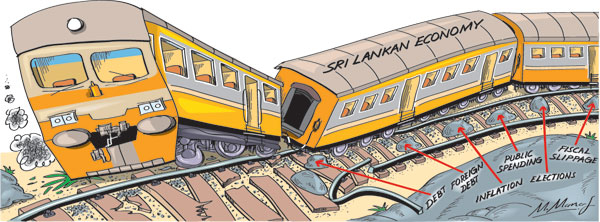

View(s): The political compulsions of electoral politics are destabilising the economy. The overriding current public interest is the presidential election. Economic issues are of little public concern as matters of electoral politics have taken centre stage. Meanwhile, economic fundamentals are being eroded and the country is heading towards an economic crisis.

The political compulsions of electoral politics are destabilising the economy. The overriding current public interest is the presidential election. Economic issues are of little public concern as matters of electoral politics have taken centre stage. Meanwhile, economic fundamentals are being eroded and the country is heading towards an economic crisis.

Political compulsions

The political compulsions of the elections are driving the government to adopt policies that would enhance the government’s votes. These policies are moving the economy into the brink of an economic crisis.

The macroeconomic fundamentals are being seriously eroded by politically motivated economic policies. This is especially so with respect to heavy public expenditure that would expand the fiscal deficit, increase the public debt and release inflationary pressures that would affect the external finances adversely. Resolving the resultant deterioration in macroeconomic fundamentals would be a herculean task for whoever forms the next government.

Economic consequences

Economic concerns are not uppermost in the government’s thinking in the run up to the elections. Consequently, the management of the economy is being compromised and the already weak macroeconomic fundamentals are being weakened further.

The most serious economic consequence of the current thrust in policies is the fiscal slippage. As discussed in the previous two columns, the consequences of the high fiscal deficit would be an increase in the public debt, inflationary pressures, weakening of the country’s export competitiveness and low economic growth. These consequences of the expansion in the fiscal deficit are serious. They will erode price stability, increase public debt, exert pressures on the exchange rate, affect external trade adversely and people’s livelihoods would be affected on top of the adversity caused by the tourist crash.

Public debt

Both the debt-to-GDP ratio and the fiscal deficit are far too high and burdensome. The debt-to-GDP ratio at the end of 2018 was as much as about 80 percent. This is an unacceptable level. Its further increase this year and its servicing costs are a severe burden.

Implications

The high debt servicing cost as a proportion of revenue indicates the crippling effect of the large public debt. In most years the debt servicing costs exceeded government revenue or absorbed nearly all government revenue. The inadequacy of revenue to meet debt servicing costs means that funds are not available for other essential expenditure. This has been an important reason for low growth.

When government revenue is inadequate to meet debt servicing costs, all current and capital expenditure have to be met by further borrowing from domestic and foreign sources. This lack of funds from revenue results in a distortion in priorities in public spending. The inadequacy of public expenditure means inadequate funds for education, health and development projects.

The inability of revenue to even meet the debt servicing expenditure is alarming. Debt servicing costs absorbing the entirety of government revenue implies that the government’s current and capital expenditure have to be from further borrowing. This is an unhealthy situation. It is like the plight of a household whose total income has to be spent on debt repayments and has to borrow for even its consumption needs.

Increasing debt

The increasing debt — both domestic and foreign – is a serious economic concern. The acknowledged threshold for the fiscal deficit is about 3 to 4 percent of GDP and the debt-to-GDP ratio is expected to be kept at no higher than 60 percent of GDP. The current position exceeds both these thresholds. It is also not merely the amount of the public debt per se but its use, impact and the capacity to repay that matters.

Debt is not necessarily bad for an economy. In fact, the incurring of foreign debt provides the means by which the savings-investment gap could be reduced. However, when a country’s foreign borrowing exceeds an amount where its servicing costs (interest and capital repayments) through export earnings are too high, then it is on the road to a debt trap. This is particularly so if the borrowed funds are utilised in a manner that does not increase the country’s export earnings.

Politics and economics

Constitutional experts have said that the new President’s powers are severely limited by the 19th Amendment. Yet the vast majority of the electorate consider the presidential election as of foremost importance. This is perhaps due to the view that whoever wins the presidential election would swing the electorate to the winning candidate’s party or alliance.

The focus is gradually shifting from who would be the Presidential candidates to who will be the President of the Republic. Although economic issues would figure in the coming two elections they would be peripheral. Most references to the economy will be distorted and not based on actual economic facts and on sound economic thinking. Political issues would no doubt dominate the election campaign.

Formidable challenges

Whatever be the political outcomes, whoever forms the government, it cannot escape the serious economic problems of the country. The next government would have to face the serious economic issues of a high foreign debt of over US$ 50 billion and difficulties of meeting the high foreign debt repayment obligations. The weak external finances and vulnerability of the country’s external finances would be a mammoth problem.

Conclusion

The massive public debt, whose servicing costs absorb more than the entirety of government revenue, would pose a serious difficulty with inadequate finances for development needs. Restoring the eroded business confidence in such macroeconomic background would indeed be difficult. Inadequate economic growth would impact on the employment, incomes and livelihoods of the rural community and growing deterioration in livelihoods.

The adoption of sound economic policies would have to await the outcome of the presidential election and then another period of uncertainty till the parliament is elected and a new government is formed. Meanwhile, the state of the economy is likely to get worse and the remedial measure more difficult to adopt. The fiscal slippage that is occurring is a fundamental weakening of the economy that would create serious economic difficulties.

Restoring economic stability and enhancing economic growth are massive challenges for the next government.

Leave a Reply

Post Comment