Columns

Economic consequences of terrorist attacks: Impact on external finances

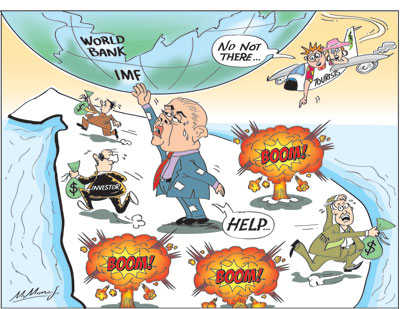

View(s):The economic consequences of the terrorist attacks on Easter Sunday and the events that followed would weaken the economy, especially the country’s external finances and capacity to meet foreign debt obligations.

International financial assistance is urgently needed to save the economy from this perilous predicament.

International financial assistance is urgently needed to save the economy from this perilous predicament.

Overview

The cumulative impact of the current terrorism would be to destabilise the economy and slow economic growth. The terrorist attacks would impact adversely, inter alia, on the balance of payments, external financial position and fiscal outcome. The nation’s increased external vulnerability would be the most serious consequence.

Setback to BOP

Prospects of an improvement in external finances this year discussed in last Sunday’s column have been dashed to the ground. Achieving a higher balance of payments surplus and reducing external financial vulnerability is impossible this year owing to the widespread threat of terrorism weakening the balance of payments.

Increased tourist earnings, net capital inflows, higher exports, reduced non-essential imports, lower food imports and increased earnings from ICT services were expected to contribute to a significant balance of payments surplus. Most of these favourable expectations are now unlikely. Instead of the expected balance of payments surplus, a deficit is most likely.

The country’s external financial vulnerability is increased as several items in the balance of payments are adversely affected. This is especially so with respect of tourist earnings, foreign investments and capital inflows. It is, therefore, unrealistic to expect an improvement in the balance of payments as these sources of foreign earnings would be reduced.

A balance of payments deficit would reduce the foreign reserves of the country and require additional borrowing at higher interest costs to meet debt repayment.

Tourism

Tourism

In spite of the setback to tourism due to the political anarchy last October, earnings from tourism reached a peak of US$ 4.1 billion. There were signs that the country had recovered from this political shock and was once again poised to resume its growth trend. Tourist arrivals were expected to exceed 2.5 million and earn US$ 5 billion this year. The current expectation is that tourist earnings will dip below US$ 3 billion. This US$ 2 billion fall is a massive loss. Consequently, the balance of payments is likely to be in deficit.

The horrendous terrorist attacks would have a far greater setback to tourism. It is akin to the period of LTTE terrorism coupled with the JVP insurgency in 1988-89. These were in the words of a leading hotelier, Hiran Cooray, “the darkest hour for tourism’.

The recent attacks would put back tourist arrivals for quite some time. This setback is a serious blow to the balance of payments, the hospitality industry and many services linked to tourism.

Investment

This turn of events would further weaken the investment climate. Both foreign and local investors are likely to withhold investments till there is a distinct improvement in security. This may not happen in view of the impending elections and political instability as well. The end result would be slow growth and balance of payments difficulties.

Fiscal slippage

Inevitably, expenditure on rebuilding the destroyed churches, compensation for the large number who have died and the thousands injured that the government has promised would result in increased expenditures that were not budgeted. The huge compensation and expenditure on the victims of the bomb blasts would be a strain on government expenditure. Part of this would be mitigated by insurance but a large part would have to be borne by the government.

Furthermore, the slowdown in economic activity owing to the insecure conditions would reduce output and decrease revenue. For these reasons fiscal slippage is likely unless appropriate measure are taken to reduce other expenditure and increase taxation.

Fiscal policy

Prudent fiscal policies could also assist in ensuring that the deterioration in the balance of payments is contained. The BOP is an outcome of domestic policies. It is the difference between foreign exchange inflows and outflows in the current and capital accounts and this outcome is closely linked to fiscal and monetary policy.

Affected activity

Several economic activities that have backward linkages with tourism and other affected industries would be affected adversely. Travel, hotels, guest houses and other tourist accommodation, restaurants, arts and crafts, gem and jewelry sales would have a setback owing to the lower number of tourists.

Silver lining

On the other hand, while several sectors of the economy would be adversely affected, there are some important activities that can continue without a setback. Agricultural activities can continue uninterrupted. This year’s bumper harvest, if followed by a good Yala harvest would ensure that the country is more than self-sufficient in rice and, therefore, not require to import rice, as well as reduce wheat imports that are a close substitute. Export manufactures that are not affected should attempt to increase their exports. The unaffected economic activities should redouble their efforts to support the economy.

Summary and conclusion

The internationally plotted and nationally executed terrorist attacks would have an adverse impact on the balance of payments, external financial position and fiscal outcome. The cumulative impact of the new wave of terrorism would slow economic growth. It is, therefore, crucial that economic activities, such as agriculture and manufactures for export produce at their maximum potential. The deterioration of the nation’s external vulnerability would be the most serious consequence.

International financial assistance is crucial to overcome the economic consequences of this internationally planned terrorist attacks. Only a meaningful and substantial international assistance effort could strengthen the country’s external reserves to meet her debt repayment obligations in the coming months and meet the essential import needs of the country.

Leave a Reply

Post Comment