Columns

Economic expectations and prospects in the year ahead

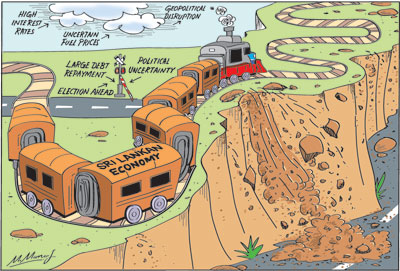

View(s):Recovering from the economic disruption of six weeks of political chaos, restoring international confidence and reviving the economy in 2019 are challenging tasks.

A stable and credible administration is vital to resolve the economic crisis facing the country this year. However, the current political developments do not demonstrate a serious concern about the daunting economic issues facing the country.

A stable and credible administration is vital to resolve the economic crisis facing the country this year. However, the current political developments do not demonstrate a serious concern about the daunting economic issues facing the country.

Overcoming setback

Global developments and political conditions in the country make it difficult to predict the country’s economic outcome in 2019. Much of the year’s economic performance would hinge on overcoming last year’s jolt to the economy. It is essential to restore political stability, certainty and consensus on economic policies and effective implementation.

A much stronger resolve to pursue policies to stabilise the macroeconomic fundamentals is essential. Consistent and consensual economic policies are vital to face the economic difficulties and achieve economic growth. Neither the current economic conditions in the country, nor the global economic environment are conducive to economic growth. Furthermore, as much of the policies pursued would have an eye on the forthcoming elections, economic policies are unlikely to be in the interests of economic stability and long-term development.

Global economy

Being an export-import economy with large debt servicing obligations, global economic conditions have an important bearing on the Island’s economic performance. As the New Year dawns, there is much uncertainty about the world economic outlook. The trade war between the two largest economies, Brexit, uncertainty in world supply of oil, high interest rates in the US and geopolitical instability make it difficult to predict the global economic outturn.

Nevertheless, global economic growth is expected to slow down only slightly this year. Favourable outcomes in the US and the EU that are the major industrial economies are expected to achieve growth of 2.3 percent for 2018 and 2.1 percent for 2019. The Japanese economy is, however, showing an unexpected contraction that may reduce this growth projection. World economic growth is expected to be only slightly lower than that of last year.

Nevertheless, global economic growth is expected to slow down only slightly this year. Favourable outcomes in the US and the EU that are the major industrial economies are expected to achieve growth of 2.3 percent for 2018 and 2.1 percent for 2019. The Japanese economy is, however, showing an unexpected contraction that may reduce this growth projection. World economic growth is expected to be only slightly lower than that of last year.

The high growth of China and India is expected to also decelerate somewhat. Asian economies are expected to grow fastest at 6 percent. South Asia is forecast as the fastest growing region in the world at 7 percent.

The slightly lesser growth of the US and the EU bloc would not have an important bearing on the country’s manufactured exports. Consequently, last year’s export growth of nearly 10 percent should be sustained. Manufactured exports, such as garments, rubber goods and ceramics should not be adversely affected. The slight dip in growth of advanced countries is not likely to dent the demand for our exports by much. Increased efficiency could overcome this disadvantage.

Agricultural exports that have not fared too well in the first ten months of 2018 have showed signs of revival and may fair better this year to maintain export earnings. A significant increase in tea production is vital to achieve this. An early settlement of trade union demands would be necessary to achieve this. Weather would, of course, be an unpredictable factor.

Trade deficit

The large trade deficit last year was a serious burden on the external finances. It is vitally important to reduce the trade deficit that has been expanding despite an export growth of nearly 10 percent owing to import growth being at a faster pace and by a larger amount. The Central Bank expects a moderation of imports owing to recent fiscal and monetary measures and the depreciation of the rupee. However, more stringent measures may be needed to contain unessential imports that are causing a large trade deficit in spite of the growth in exports.

International confidence

Restoring international confidence on the country’s political stability is vital for economic recovery. The political anarchy since October 26th aggravated the country’s external financial vulnerability by an outflow of capital, withholding of foreign assistance, a blow to the booming tourist industry and the downgrading of the country’s international risk ratings that increased the costs of foreign borrowing.

It is, therefore, imperative to restore political stability and convince the rest of the world that the country is on a path of good governance. A precondition for restoring international confidence is strong evidence that there would be political stability. This is a difficult task owing to the petti party politics that is dominating the legislature. These make it difficult to inspire international confidence in the commitment to democracy and constitutional governance and will no doubt be considered a fragile democracy unless there is more responsible conduct from now on.

In spite of the difficulty, restoring international confidence and trust is crucial for our economically dependent economy as it affects our trade, aid and tourism, among others. International confidence will play an important role in enabling the flow of foreign assistance and loans that were agreed on before the political crisis.

IMF

Especially important for restoring international confidence and enhancing our external finances is the IMF’s first tranche of about US$ 500 million of a loan facility of US$ 1.5 billion that is pending release. This is vital to restore international confidence and provide balance of payments support. It will assist in improving the ratings of international agencies that would in turn improve the investment climate and reduce international borrowing rates.

Recognising this importance, the government and the Central Bank are attempting to negotiate the IMF’s Extended Credit Facility of US$ 1.5 that was negotiated but withheld. The negotiation would be extremely tough as the country has breached the policy conditions and there is little prospect of achieving the fiscal targets.

It is only if the IMF looks at the Sri Lankan situation with a great deal of compassion and understanding that this facility is likely to be given. It is most likely that the IMF would insist on complying with the agreed conditions. International politics too may play a role in the decision making though the IMF would deny such intervention.

Other aid

The resumption of other aid that was withheld is more likely. Now that a government with which it had agreed to provide assistance has been established, it is likely that the assistance from the Millennium Corporation and the Japanese aid would be forthcoming. Hopefully other governments, too, would provide aid in the New Year.

Conclusion

The New Year is certainly a difficult one for the economy. Yet there is a lack of seriousness among the legislators to ensure a credible government. Continuous squabbling for ministerial positions and a lack of firm economic policies are continuing to undermine confidence in the government.

Final word

As former COPE Chairman D.E.W. Gunasekera has stressed, the economy is the responsibility of all members and parties in parliament and not of the government alone.

Leave a Reply

Post Comment