Columns

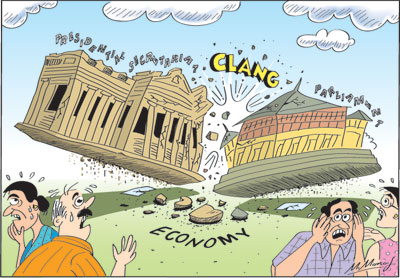

Continuing squabbles are a severe constraint to economic stability

View(s):Political consensus policy certainty and effective implementation are vital for economic development. The disagreement between the President and the Prime Minister is a severe constraint to the country’s economic stability and progress. This is especially so after 52 days of political hiatus that made the government dysfunctional and setback the economy. The uncertainly is hampering the economy seriously.

A consensus and agreement among the President and the Prime Minister are vital for the machinery of government to function effectively and efficiently. The need of the hour is a consensus on economic policy, policy certainty and effective implementation. These prerequisites for economic recovery, economic stability and economic growth are precisely what are woefully lacking.

No agreement

No agreement

Although Ranil Wickremesinghe was sworn in as the Prime Minister on December 16, there were no signs of a political rapprochement between the President and the Prime Minister. The unprecedented scathing attack by President Sirisena on Prime Minister Wickremesinghe sent signals that theirs was not a working relationship. The disagreements between them had delayed the appointment of the cabinet though it was essential for the government’s functioning. The country can ill afford another crisis that disrupts economic activities and continues to erode confidence in the country’s political stability.

Unworkable and dysfunctional

The country is now saddled with an unworkable and dysfunctional leadership. In fact, it is much worse than that. The effective opposition to the government now is not in parliament: it is in the executive arm of the government. It is a government with the enemy within. Could there be a worse political arrangement for economic development?

Economic imperatives

Steps have been taken to address immediate economic imperatives — a credible cabinet that will inspire national and international confidence and a vote on account to tide over the urgent financial needs, followed by a budget that gets national priorities correct and ensures that there is no fiscal slippage.

A clear concise and unambiguous economic policy statement that spells out the government’s policies for the next one and a half years would be expedient. A favourable assessment of these would be vital for the government’s political future.

Effective implementation of political promises will be the key to the government’s success and the economy’s progress. In the last three and a half years, the Achilles heel was the weak implementation of economic policies and consequently the lack of visible benefits.

International confidence

International confidence

Restoring the eroded international confidence is vital for the sustainability of the external finances of the country. However, restoring international confidence and stabilising the economy cannot be achieved as fast as it was destroyed.

A precondition is strong evidence that there would be political stability. This is a difficult task owing to the manner in which the political crisis was brought about and its prolongation by unruly behaviour. These make it difficult to inspire international confidence in the commitment to democracy and constitutional governance and will no doubt be considered a fragile democracy from now on.

In spite of the difficulty, restoring international confidence and trust is crucial for our economically dependent economy as it affects our trade, aid and tourism, among others. International confidence will play an important role in enabling the flow of foreign assistance and loans that were agreed on before the political crisis.

Especially important for restoring international confidence and enhancing our external finances is the IMF’s first tranche of about US$ 500 million of a loan facility of US$ 1.5 billion that is pending release. This is vital to restore international confidence and provide balance of payments support. It will assist in improving the ratings of international agencies that would in turn improve the investment climate and reduce international borrowing rates.

Fulfilling conditions

However, as the release of the loan requires compliance with agreed conditions that have been flouted, there has to be compliance once again. Furthermore, the current political instability means that the IMF will withhold the loan till political stability is restored and there is certainty that the country will follow sound macroeconomic policies that would stabilize the economy.

Macroeconomic policies

There must be certainty and predictability in economic policies. The initial objective should be short-term substantial and inclusive economic gains rather than visions and dreams of making the country a rich and prosperous one in the distant future. The need of the hour is a 2020 vision for economic stability and growth.

It is vital for the postponed budget for 2019 to have a clear one-year programme of economic recovery. It should focus on increasing near-term production and exports. It must ensure that there is no fiscal slippage.

Fiscal consolidation

No doubt, the budget that was prepared for presentation on November 5th would have to be modified. Combining the political compulsion of a populist budget with one that keeps to fiscal consolidation targets is an enormously challenging task. This is especially so as much damage has been done in the interim by reducing taxes and increasing expenditure.

It is politically impossible to reverse these. Consequently the fiscal deficit target of 4 percent of GDP in 2019 is unlikely to be achieved. A large fiscal deficit would destabilise the economy and retard economic growth. Apart from these adverse economic consequences of a larger fiscal deficit on the stability of the economy, the deviation from fiscal target would not be in conformity with the agreed conditions for the IMF facility of US$ 1.5 billion.

The postponement or cancellation of this IMF loan would not only have direct adverse impact on the external reserves and debt repayment capacity, but also affect the country’s credibility in international financial markets and among investors. Therefore, measures to cut expenditure are vital to achieve fiscal consolidation.

The revenue enhanced fiscal consolidation programme must be adhered to as the economic consequences of high fiscal deficits are serious. Fiscal slippage must be avoided at all costs.

External finances

The vulnerability in the country’s external finances brought about by the political crisis has to be resolved. Political stability and return to constitutional propriety is vital in enabling the flow of foreign assistance and loans that were agreed on before the political crisis. An improvement in international ratings is also of utmost importance. Political stability and restoration of parliamentary democracy will play an important role in easing the external vulnerability.

Concluding reflections

The current disagreement between the President and the Prime Minister has created a fresh stalemate that has once again created political instability that would hamper the restoration of the economy. A stable government with a consensus and certainty in economic policies is vital for the stabilisation of the economy and economic recovery.

The economic programmer must be pragmatic, decisive and credible; its implementation must be swift and effective. Political rhetoric must be translated into institutional reality. Time is running out.

Leave a Reply

Post Comment