Columns

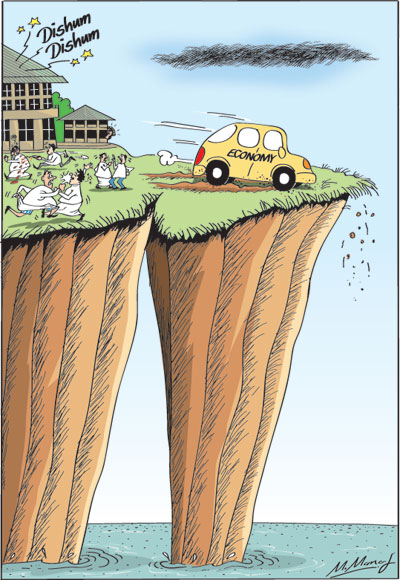

Political crisis retards economic recovery and development

View(s):The political stalemate of over one month is a severe blow to the economy. This year’s economic recovery would be retarded and next year’s economic performance would be adversely affected. Long-run economic development is being undermined by weakening macroeconomic conditions.

There are serious apprehensions on what may befall the economy. The political impasse will retard this year’s economic recovery as several facets of growth, such as tourism and foreign investments, are adversely affected. The continuing depreciation of the rupee would increase production costs and make investment too costly.

There are serious apprehensions on what may befall the economy. The political impasse will retard this year’s economic recovery as several facets of growth, such as tourism and foreign investments, are adversely affected. The continuing depreciation of the rupee would increase production costs and make investment too costly.

The political crisis is affecting the balance of payments adversely, weakening the external finances and making repayment of debt next year onerous. Foreign reserves could be reduced due to an adverse balance of payments, capital outflows, and the withholding of foreign assistance and loans.

Debt repayment

A protracted political crisis could undermine foreign confidence and make it more challenging for the country to repay foreign debts. Capital outflows from the stock market, drop in tourism, adverse international risk ratings, higher sovereign borrowing rates and the withholding of foreign aid and IMF facility would make debt repayment arduous. Foreign borrowing costs could increase. These factors would undermine macroeconomic stability and long run economic growth.

Economic recovery

Economic recovery

The economy was on a path of recovery when the Government was dissolved and the country was plunged into a state of constitutional crisis and political confusion in a move that was detrimental to economic stability and growth. The economy was expected to revive from its low growth of 3.1 percent last year to around a 4 percent growth.

In the first quarter of this year the economy grew by 3.4 percent and in the second by 3.7 percent. There were signs of higher growth in the second half owing to a significant expansion in exports, a boom in tourism, increased production of food crops and an improvement in the business climate.

Agriculture and industry

There was a growth in food crop agriculture, though plantation agriculture did not perform too well. There were expectations of increased production of tea and rubber in the second half. Growth in construction had retarded, though manufacturing grew. Construction is likely to be affected by the current situation.

Tourism

A robust growth in tourism and exports were growth factors. The setback to tourism will affect only the last two months. Therefore, the growth in tourism by 11 percent in the first ten months would contribute to growth. However, the expectation of a further surge in tourism during this year’s peak tourist season has been stifled. Although it will affect only the last two months of this year that is the peak tourist season, it is a severe blow to the industry and the economy next year. This is a serious setback to the country’s external finances as tourist earnings made an important contribution to the balance of payments.

Long-run

The long-term adverse economic impacts of the political instability on economic development are serious. Most significant of these setbacks is the disincentive to foreign investment. The country has been struggling to attract adequate foreign investment that could propel it to a higher level of growth by increasing exportable manufactures. Increased foreign investment could have also contributed to enhancing the country’s technical capacity by technology transfer.

Foreign investment

The political crisis occurred just as there were signs of increased foreign investment. The current political instability and uncertainty is likely to dissuade foreign investors that have the choice of more stable countries with well-defined economic policies, disciplined labour, flexible labour regulations and peaceful conditions.

This disadvantage effectively means that the growth of the country’s development would be on a lower trajectory of about 4 to 4.5 percent per year as in the past and this is inadequate to move to a higher income level or resolve the country’s economic and social problems.

International repercussions

International repercussions could impact on the economy seriously if the political gridlock is not resolved. The withdrawal of trade concessions, foreign assistance and withholding of loan facilities could jeopardise the external finances.

Exports

The European Union (EU) has threatened to withdraw the GSP plus concession, the removal of which would plunge the country’s exports of manufactured goods and sea food. In 2017, exports grew by 10.2 percent due to increased exports of manufactured goods by 7.6 percent and sea food exports by 42 percent. Export growth accelerated and in the first 10 months of this year by 5.8 percent to US$ 10.2 billion. This expansion of exports was in large measure due to the GSP plus concession of the EU.

The EU has warned that Sri Lanka could lose the GSP Plus facility if certain commitments are not met. These would include a commitment to a constitutional democracy. The withdrawal of the EU concession would be a serious setback to the country’s export earnings and balance of payments. It would reduce employment and incomes too.

IMF

The withholding of the International Monetary Fund’s tranche of US$ 1.5 billion would signal a lack of confidence in Sri Lanka’s economy. It would erode international confidence on the solvency of Sri Lanka. The release the funds would depend very much on the restoration of a stable government and constitutional propriety.

Foreign assistance

Several countries have threatened to withhold foreign assistance. A multimillion dollar US grant aid programme is hanging in the balance due to the current political turmoil. A US$ 1.5 billion Japanese-funded light rail project and a US$ 480 million aid offer from the United States to improve the transport and health sectors are being withheld.

Macroeconomic fundamentals

Macroeconomic fundamentals that are being weakened pose a severe setback to the country’s long-term economic development. One of the severest blows to economic development could arise from the reversal of the progress in fiscal consolidation. The recent political convulsions have set back the progress in fiscal consolidation achieved in the last two years and undermined economic growth and development.

The fiscal deficit was expected to be brought down to 5.3 percent this year and to 4.8 percent of GDP in 2019. This is unlikely to be achieved. The target of achieving a fiscal deficit of 3.5 percent in 2020 is now a dream as no government is likely to take firm steps to enhance revenue and contain expenditure.

The fiscal deficit was on course to be reduced to 4.8 percent of GDP this year with the mid-year fiscal deficit reduced to 2.4 percent compared to last year’s 2.5 percent of GDP. However this year’s deficit would have expanded even without the political crisis owing to increased expenditure on several programmes that could increase expenditure in the second half of the year.

The political instability has resulted in the government increasing expenditure, on the one hand, and decreasing revenue on the other hand, to placate the voters to ensure its popularity.

In conclusion

The current political crisis and uncertainty are detrimental to the economy in many ways. The tourist industry that is one of the country’s important sources of foreign exchange earnings is threatened. Foreign investments, foreign assistance, capital outflows and exports are likely to be adversely affected. These are particularly serious as they come at a time when the economy is facing several economic challenges from global financial developments and escalating fuel prices while debt repayment next year is massive. One of the significant gains towards economic stabilisation has been the fiscal consolidation that is likely to be undermined by imprudent measures.

The economy would be severely affected unless there is an early return to a functioning democracy and orderly government.

Leave a Reply

Post Comment