Columns

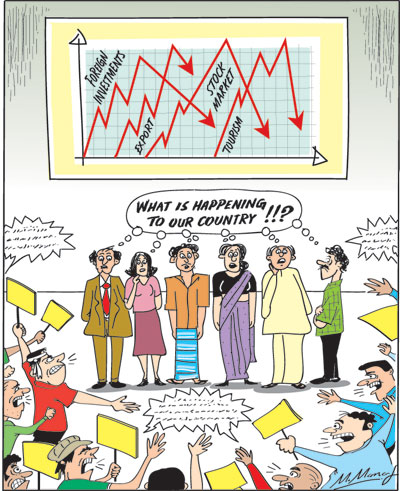

Harmful economic consequences of a prolonged political crisis

View(s): The adverse economic consequences of the prolonged political crisis are many. A protracted political stalemate would set back the development of the economy immeasurably. Deterioration in law and order would be the worst scenario for the economy.

The adverse economic consequences of the prolonged political crisis are many. A protracted political stalemate would set back the development of the economy immeasurably. Deterioration in law and order would be the worst scenario for the economy.

There is no clear indication as to how or when the current political impasse would be resolved. Hopefully there would be an early resolution of the constitutional crisis and a legitimate and stable government established soon before the economy faces a severe crisis.

The speedy resolution of the political crisis and restoration of political stability is crucial for the economy.

Overview

The adverse economic consequences of the prolonged political crisis are proximate, pervasive and permanent. The longer the political confusion, uncertainty and chaos, the deeper would be the adverse economic consequences. The crisis would affect the balance of payments adversely and weaken the external finances considerably.

As Fitch ratings has pointed out a protracted political crisis could undermine foreign investor confidence and make it more challenging for the country to pay foreign debts.

Economic impacts

Economic impacts

The proximate economic impacts discussed in this column last Sunday have already happened or are unfolding. The political stalemate has already inflicted several serious setbacks. There has been an outflow of capital from the stock market, drop in tourist bookings, adverse international risk ratings, further depreciation of the rupee and higher sovereign borrowing rates.

New international threats and economic repercussions too have surfaced.

Long run

The long-run economic impediments will soon set in, if the political uncertainty continues. The long-term economic impacts could affect the economic development of the country adversely for many years.

The persistence of the political struggles, both within parliament and outside, could drive the economy to the brink of economic depression.

Foreign investment

Most significant of these setbacks to the economy is the disincentive to foreign investment. The country has been struggling to attract adequate foreign investment that could propel it to a higher trajectory of growth by increasing exportable manufactures. Increased foreign investment could also contribute to enhancing the country’s technical capacity by technology transfer.

The current political instability along with uncertainty is likely to dissuade foreign investors who have the choice of more stable countries with well-defined economic policies, disciplined labour, flexible labour regulations and peaceful conditions. This disadvantage effectively means that the country’s development would be on a lower trajectory of the historical average of about 4.5 percent per year and lower than the regional growth of around 7 percent per year.

Tourism

The expectation of a further surge in tourism during this year’s peak tourist season has been stifled. The expectation of tourist earnings of US$ 3.5 billion this year that would have improved the balance of payments is unlikely to be realised. Hotel bookings have been cancelled and the image of the country spoiled. This is a serious setback to the country’s external finances as tourist earnings made an important contribution to the balance of payments.

Capital outflows

In less than two weeks of the political stalemate, capital outflows from the Colombo Stock market have been around US$ 30 million. These outflows not only depress the stock market, but are a drain on the country’s foreign reserves. Foreign reserves have fallen as there have also been significant outflows from government securities.

International repercussions

Serious international repercussions are on the horizon. These include the withdrawal of trade concessions, foreign assistance and withholding of loan facilities. If these were to materialise, the external finances could be in jeopardy.

Exports

The European Union (EU) has threatened to withdraw the GSP plus concession the removal of which plunged the country’s exports of manufactured goods and sea food. The restoration of this GSP plus concession with much effort last year had an important impact on the country’s export earnings. There was a significant revival of these exports since March 2017.

In 2017, exports grew by 10.2 percent due to increased exports of manufactured goods by 7.6 percent and sea food exports by 42 percent. This upsurge in exports accelerated and, in the first eight months of this year, exports increased by 5.8 percent to US$ 7.2 billion. Monthly export earnings have exceeded US$ 1 billion in the last several months.

In the first eight months of the year, exports were 5.8 percent more than in the same period of last year and amounted to US$ 7.8 billion. This expansion of exports was in large measure due to the GSP plus concession of the EU.

The EU has warned that Sri Lanka could lose the GSP Plus facility if certain commitments are not met. Sri Lanka lost the concession in 2010 because the Government had failed to adhere to conditions inherently attached to the GSP Plus: the International Covenant on Civil and Political Rights (ICCPR), the Convention against Torture (CAT) and the Convention on the Rights of the Child (CRC).

The withdrawal of the EU concession would be a serious setback to the country’s export earnings and balance of payments. It would reduce employment and incomes too.

IMF

One of the most serious setbacks to the economy would be the International Monetary Fund’s withholding of facilities that would signal a lack of confidence in Sri Lanka’s economy that would in turn erode international confidence on the solvency of Sri Lanka.

The IMF was about to announce an agreement on releasing a new tranche of a US$ 1.5 billion loan when the political crisis emerged. The release of the funds would depend very much on the restoration of a stable government. This underscores the vital importance to return to constitutional propriety and a stable government.

Foreign assistance

Several countries have threatened to withhold foreign assistance. A multimillion dollar US grant aid programme which was to be signed in December is hanging in the balance due to the current political turmoil.

The United States’ Millennium Challenge Corporation (MCC) that had approved a five-year grant of about US$ 460 million for Sri Lanka’s land and transport sectors for upgrading road networks and the bus system in the Colombo metropolitan area is being delayed.

Japanese assistance

Political stability would be a condition for Japanese assistance. Japan is arguably the biggest donor of assistance. The current situation has raised doubts over a $1.5 billion Japanese-funded light rail project and another US$ 480 million for transport and health is being withheld.

In conclusion

The current political crisis and uncertainty is detrimental to the economy in many ways. These are particularly serious as they come at a time when the economy is facing several challenges from global financial developments and escalating fuel prices while debt repayment next year will be massive.

Hopefully the reconvening of parliament next week will provide an opportunity for a democratic settlement that would ensure political stability and peaceful conditions in the country. Political stability must be restored speedily to ensure economic stability and economic growth.

Leave a Reply

Post Comment