Columns

The balance of payments heading for a deficit in 2018

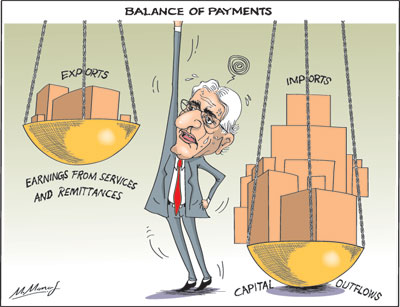

View(s):The balance of payments that was in surplus last year is likely to be in deficit this year. This reversal of the balance of payments surplus of US$ 2.01 billion last year is mainly due to the unfavourable developments in global financial markets that led to outflows of foreign investments from Sri Lanka.

Expectation

Expectation

The expectation at the beginning of the year was that this year’s balance of payments (BOP) surplus would exceed last year’s surplus and contribute to ease the massive debt repayment of more than US$ 4 billion next year. This reversal is owing to recent developments in global financial markets, particularly the strengthening of the US economy and increase in policy rates of the US Federal Reserve Bank that resulted in outflows of foreign investments from Sri Lanka and capital markets in emerging economies.

Consequently, there were continuous foreign investment outflows from the government securities market, particularly from the third quarter of 2018.

The current global financial market developments are having a serious setback on the balance of payments and foreign reserves of the country. The diminishing balance of payments surplus in the first seven months of this year is likely to continue in the remaining months and result in a balance of payments deficit this year. The emerging adverse balance of payments is a serious concern, but one that is mostly out of the control of the government.

Experience

Sri Lanka’s balance of payments experience has been one where in spite of the large trade deficits, the balance of payments has been in surplus owing to workers’ remittances, earnings from tourism and receipts from other services being larger than the trade deficit. Net capital inflows further strengthened the balance of payments.

The main strengths of the balance of payments have been workers’ remittances over some time and earnings from tourism. These have increased in recent years and often offset the entire trade deficit to yield a balance of payments surplus.

First 7 months

This year, too, workers’ remittances and tourist earnings have offset the large trade deficit. Although the trade deficit expanded to a massive US$ 6.4 billion in the first seven months, workers’ remittances of US$ 4.24 billion and tourist earnings of US$ 2.56 billion, together amounting to US$ 6.8 billion, exceeded the trade deficit of US$ 6.4 billion.

The increase in the trade deficit could have led to a serious deterioration in the balance of payments, if not for the inward remittances of Sri Lankans living abroad and the increased earnings from tourism. While the widening trade deficit weakens the balance of payments, remittances and tourist earnings offset it to improve the final balance of payments outturn. This has been the cardinal feature of the Sri Lankan balance of payments. It has been so this year too. Nevertheless capital inflows have made a serious dent to reduce the BOP surplus.

Capital outflows

Capital outflows

Capital outflows owing to the global financial movements led to net outflows of capital resulting in the BOP surplus of only US$ 0.55 billion in the first 7 months of the year compared to a surplus of US$ 1.45 billion for the same period last year. This small surplus is also likely to be eroded in the next five months to result in a balance of payments deficit this year.

According to the Central Bank of Sri Lanka, foreign investments in the government securities market recorded a net outflow of US dollars 53 million in July 2018, resulting in a cumulative net outflow of US dollars 229 million during the first seven months of 2018. Foreign investments in the Colombo Stock Exchange (CSE), including both primary and secondary market foreign exchange flows, recorded a net outflow of US$ 3 million during July 2018 and cumulative net inflows to the CSE in the first seven months of 2018 amounted to US$ 50 million, with a net outflow of US$ 16 million from the secondary market and an inflow of US$ 66 million to the primary market during the period.

External finances

The external finances of the country are a serious weakness. The external debt at US$ 51 billion is about 65 percent of GDP and foreign debt servicing is about 27 percent of export revenue. Furthermore, owing to accumulated foreign debt, foreign debt servicing next year is estimated to be US$ 4.2 billion and high then onwards. In this context, the lack of a balance of payments surplus is a huge disadvantage

Foreign reserves that peaked to nearly US$ 10 billion (US$ 9.6 billion) at the end of last year have come down to US$ 7.4 billion at the end of August 2018, owing to the expanding trade deficit and outflows of capital due to the current global financial developments.

The Central Bank considers the foreign reserves adequate to meet the debt obligations, though foreign borrowing may be needed as this year’s balance of payments surplus is likely to fall from last year’s US$ 2 billion to very little, if any.

Expanding trade deficit

The widening trade deficit despite the growth in exports is a matter for concern. The trade deficit expanded to US$ 7 billion in the first 7 months despite the growth in exports of by 6.2 percent owing to higher imports of fuel, motor vehicles and gold. This too had an adverse impact on the balance of payments.

Last word

Although this predicament in the balance of payments has been brought about mostly by the current global financial developments, the fundamental weaknesses of the economy have compounded the difficulties. Once again the need to have a better trade performance by increasing exports and containing non-essential imports has been made clear. Imprudent government spending is also a root cause for the difficulties.

Unquestionably, the political and ideological milieus are insurmountable obstacles to economic reforms that would enhance the efficiency and productivity of the country and strengthen the economy.

Leave a Reply

Post Comment