Columns

Taming non-essential imports vital to improve trade balance

View(s):Restraining non-essential imports are imperative to reduce the massive trade deficit that is heading to over US$ 10 billion this year. Taming the growth of non-essential imports, such as gold and vehicles, is crucial to reduce the trade deficit to a manageable level.

Increased imports have more than counterbalanced the gains in export growth and expanded the trade deficit to huge proportions in 2017 and in the first half of this year. Despite an impressive growth in exports this year, the increase in imports is likely to result in a massive trade deficit of over US$ 10 billion this year. The recent deterioration in the trade balance has been due to large increases in imports more than offsetting the gains in export growth.

Increased imports have more than counterbalanced the gains in export growth and expanded the trade deficit to huge proportions in 2017 and in the first half of this year. Despite an impressive growth in exports this year, the increase in imports is likely to result in a massive trade deficit of over US$ 10 billion this year. The recent deterioration in the trade balance has been due to large increases in imports more than offsetting the gains in export growth.

Restraining imports

The large trade deficit cannot be contained at a manageable level unless there is a taming of imports. While most imports are essential, the growth of exports that are not essential is posing a serious problem. It is mostly these that must be curtailed. The recent increase in gold and cars are among the imports that must be tamed.

Expansion of the trade deficit

Expansion of the trade deficit

The recent expansion in the trade deficit has been owing to a significant growth in non-essential imports, particularly imports of gold and cars. These imports have widened the trade deficit to an unacceptable level. A further expansion in the trade deficit would weaken the balance of payments and external finances.

Restraining of imports has become crucial owing to the growth in exports being offset by higher import growth. The export growth must go hand in hand with a containment of imports to achieve an improvement in the trade balance…

Reducing the trade deficit vital

In view of the very large foreign debt repayments in 2019 and beyond, it is vital for the country’s balance of payments to generate a significant surplus. Reducing the large trade deficit is vital to improve the balance of payments and strengthen the external finances to reduce the country’s external vulnerability.

The key to an improvement in the balance of payments is a lower trade deficit. Much higher export earnings and lesser imports are needed to reduce the trade deficit. The mounting trade deficit is reducing the balance of payments surplus and weakening the country’s external finances. The containment of imports is vital to reduce the country’s external vulnerability.

Recurrent feature

Recurrent feature

A recurrent feature of the country’s trade balance has been the much higher imports than exports. While a trade deficit is inevitable owing to the import dependent structure of the economy, it is essential that this deficit is contained to an extent that enables workers’ remittances, earnings from services and capital inflows to generate a balance of payments surplus.

Import dependency

Sri Lanka’s high import dependency is inevitable for a country with limited resources and dependent on exports with high import contents. Most manufactured exports have high import content and infrastructure development too is highly dependent for capital goods and construction materials.

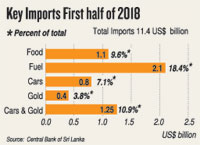

The country is dependent on oil imports that constituted 16 percent of the import bill in 2017 and 18 percent of imports in the first half of this year. The Island is also dependent on basic food imports like wheat, sugar, dhal and milk.

Food imports cost U$$ 2.2 billion or 10.5 percent of total imports in 2017 and US$ 1.1 billion in the first half of this year that was 9.6 percent of total imports.

Gold and Cars

In addition, motor car imports and gold imports cost US$ 1.4 billion or 6.7 percent of total imports in 2017. These imports have increased in the first half of this year to US$ 1.25 billion and exceeded food imports of US$ 1.1 billion. Is the import of cars necessary when there is a huge stock of cars in the country?

In the first half of this year, gold and car imports together constituted as much as 10.9 percent of total imports, compared to food imports that were 10.5 percent of total imports. Gold imports cost US$ 437 million and car imports cost US$ 812 million in the first half of this year.

In comparison with the imports of cars and gold that cost US$ 1.25 billion in the first half of this year, total food imports cost US$1.1 billion. Such a large expenditure on the imports of cars and gold that is more than the cost of food imports is a severe strain on the country’s external finances and one of the reasons for the large trade deficit.

Import substitution

A popular prescription for reducing imports is import substitution. Import substitution is, no doubt, important to develop a healthy trade balance. As the saying goes, ‘a dollar saved is a dollar earned’.

Increasing domestic production is vital for a healthy trade balance. Increased domestic production of import substitutes is a sure means of reducing the country’s import dependency. Increased production of food crops, coconut and fruits could improve the trade balance. However the limitations of such a strategy must also be realised.

Constraints

There are scarce resources of land, water and labour that limit production of import substitutes. It is also a longer term strategy, especially with respect to agricultural production. Notwithstanding these limitations the country must strive for increased domestic production and encourage consumption of locally produced commodities.

Concluding reflections

The state of external finances of a country reflects the management of the domestic economy. The weak external finances reflect bad economic policies. The long-term improvement in external finances is dependent on correct economic policies.

Economic policies must be formulated and implemented to increase investment, reduce the fiscal deficit, encourage exports, restrain imports and attract foreign investors. Monetary and fiscal policies must contain aggregate demand.

While the growth in exports should gain momentum, there has to be a strategy to curtail imports. Both monetary and fiscal policies must ensure that non-essential imports are contained and do not expand beyond the country’s capacity.

Increased export proceeds, workers’ remittances, other earnings from services and earnings from tourism should not be dissipated in non-essential imports. The taming of imports is imperative to strengthen the country’s external finances.

Leave a Reply

Post Comment