News

Pricey urea imported despite cheaper alternatives

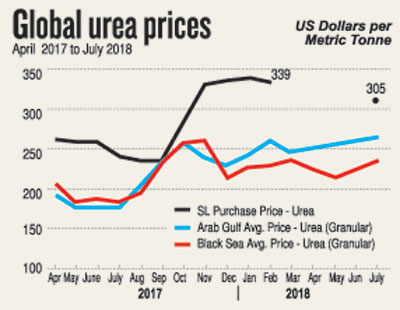

The National Fertilizer Secretariat (NFS) has yet again posted a gazette notification (No. 7/1/1/2018 dated 12 July 2018) fixing the purchase price of fertilizer at USD338 per metric tonne.

This is the benchmark for the purchase of straight fertilizer triple super sulphate, urea and potassium chloride (uriate of potash) by private sector importers.

The government placed its last order in July 2018 at at USD305 for 56 metric tonnes of urea to be distributed to farmers and is awaiting delivery.

But the cost of urea from the Arab Gulf last month stood at USD275 to USD285 per metric tonne, and from the Black Sea region at USD275 to USD285 per metric tonne.

This great disparity in the prices and why Sri Lanka imports urea at such high prices when the same could be purchased for less were the questions the Sunday Times posed to authorities.

The NFS, which is responsible for fixing prices, said that the prices are decided by a committee appointed by the Ministry of Agriculture, which reviews the prices of the last three months and decides the average price for the next three months.

The Ministry of Agriculture and the NFS jointly forecast the demand, quarterly. The fluctuating world market prices are not taken into consideration. The pricing committee includes officials from the Ministry of Agriculture, the Treasury, the Customs and other stakeholders.

Based on the forecast demand volumes and the availability of funds, the Ministry of Agriculture invites tenders. The tender procedure is governed by the Standing Cabinet Appointed Procurement Committee.

Director, NFS, G A Pushpakumara revealed that a colossal Rs 33 billion is spent annually on the fertilizer subsidy. The fertilizer is supplied to paddy farmers at Rs 500 for a 50 kilo bag.

The private sector is also invited to import fertilizer and allowed to sell it to farmers cultivating crops other than paddy. They are given a quota to import and the quantities vary each quarter.

In May 2018 the NFS made fertilizer an essential commodity and fixed the price of a 50 kg bag at Rs 1,500.

In the past, the NFS had been purchasing urea on a monthly basis. However, in January 2018, a bulk order for 60 tonnes was placed under a special cabinet paper by minister Duminda Dissanayake, when the monthly requirement for fertilizer stood at 20-30 metric tonnes.

The stock however was distributed over a five month period. Again, last month, a 56 metric tonne order had been placed. The NFS is awaiting the shipment.

A Ministry of Agriculture official, who wanted to remain anonymous, said the NFS is bypassing tender procedures and awarding orders to cronies through special cabinet papers.

The NFS pre-qualified tender participants are based in the UAE and Singapore and mainly dominated by companies managed by Indian businessmen representing Chinese fertilizer manufacturers. The price of Chinese fertilizer in the world market is high due to high production costs. Fertilizer in China is a manufactured product and the country uses gas and coal as fuel for its production. Recently the Chinese government imposed a tax on fertilizer due to environmental concerns and, as a result, prices skyrocketed to USD300 to USD350 per metric tonne.

Mr Pushpakumara argues that although urea from Gulf Arab and The Black Sea regions are priced low, the freight cost adds up, making the product expensive.

But it is counter argued that even by adding the freight cost to the FOB prices, the product is cheaper and will not reach USD311, the price the NFS has settled for in its July 2018 order.

Chinese prices for a metric tonne of urea is USD300 to USD350, whereas manufacturers in the Arab Gulf are trading at USD250 to USD270 per metric tonne. The lowest prices in the Black Sea region ranges between USD230-US250 per metric tonne. The countries include Russia, Serbia, Belarus, Turkey and Ukraine.

The official said that the NFS does not want to explore the possibility of procuring direct supplies with fixed manufacturers in the Arab Gulf or the Dead Sea regions where it could be purchased at a competitive price, while maintaining quality and standards.

Mr Pushpakumara dismissed the idea and said that although it can be obtained at lower cost from other countries there were problems. “There are United States sanctions against Iran and Russia has the mafia. We cannot deal with them,’’ he said.

The ministry official said that in the past many suppliers and traders failed to comply with tender guidelines and some even retracted their prices when the world prices of urea shot up.

This creates a shortage and the NFS has to submit special cabinet papers and award the contract at high prices to known suppliers. Sometimes they even intentionally delay shipments and create shortages. Even laboratory reports on quality tests are tampered with to clear substandard shipments.

Mr Pushpakumara said that nobody has been blacklisted yet, but suppliers have been warned about substandard products or for non-compliance with agreements.