Columns

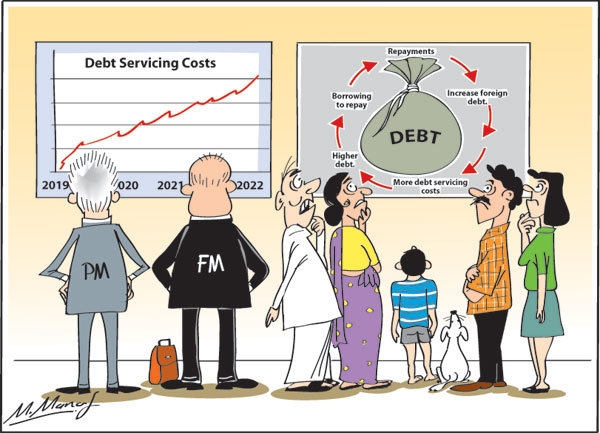

The vicious cycle of borrowing to repay foreign debt: Critical issues in debt management

View(s):Debt servicing costs are onerous next year and beyond. Next year’s debt servicing cost (interest payments and debt repayment) is expected to be as much as US$ 4.2 billion. Debt servicing costs are estimated to be US$ 12 billion in the next three years.

Severe strain

Severe strain

Last Sunday’s column pointed out that indebtedness caused by the massive borrowing during the previous regime and the further increase of foreign debt in the last three and a half years have created a huge debt servicing burden. Debt servicing costs are a serious challenge to the government as they are onerous next year and beyond.

While debt servicing is a serious strain on the country’s external finances, there is no prospect of the country defaulting on its obligations. The Central Bank of Sri Lanka has been accumulating foreign reserves to be in a comfortable position to service the debt. Currently foreign reserves are in the region of US$ 10 billion.

However these borrowings from the international capital market at fairly high interest rates to repay debt commitments have increased the foreign debt. The debt servicing costs in recent years have been in the region of about one fourth of the country’ export earnings.

Growth of foreign debt

Foreign debt increased significantly during 2000-2009. It doubled from US$ 9 billion in 2000 to US$ 18.6 billion in 2009. In the next five years it more than doubled. At the end of 2014 foreign debt had risen to US$ 42.9 billion or 53.6 percent of GDP.

The foreign debt continued to grow in the last three and a half years under the new government. At the end of 2015 the foreign debt reached US$ 44.8 billion or 54.4 percent of GDP and dipped slightly to US$ 46.6 billion at the end of January 2017. The current foreign debt is estimated at US$ 51 billion that is about 55 percent of GDP.

The foreign debt continued to grow in the last three and a half years under the new government. At the end of 2015 the foreign debt reached US$ 44.8 billion or 54.4 percent of GDP and dipped slightly to US$ 46.6 billion at the end of January 2017. The current foreign debt is estimated at US$ 51 billion that is about 55 percent of GDP.

Economic policies

Although debt repayments was one reason for increasing foreign borrowing in the last three and a half years, the economic policies pursued by the unity government too contributed to the need to borrow. Monetary and fiscal policies aggravated the problem by increasing the trade deficit.

The foreign debt has reached proportions when its servicing is a serious problem. It has to borrow to service the massive foreign debt of around US$ 51 billion that has accumulated mostly over the last decade. Undoubtedly the country is in a foreign debt trap as the government must borrow to meet annual debt repayments and interest obligations.

Current debt servicing situation

What is the current situation of foreign indebtedness of the country? How deeply are we in debt and what are the debt servicing costs and burden?

The foreign debt servicing cost is certainly a huge problem for the government next year and in the two subsequent years. The international borrowing from the Chinese for infrastructure development is one reason for this. However there has been considerable other borrowing for war expenditure, other development projects and for resolving the balance of payments problem. In fact the Chinese debt is only a fraction of the country\s total foreign debt.

The foreign debt servicing costs from next year onwards is a huge concern as debt servicing has to be met by further borrowing as the balance of payments surpluses are small. It is estimated that in the next three years the country’s debt repayments would be around US$ 12 billion with a debt servicing cost of US$ 4.2 billion next year.

It is for this reason that the Central Bank has been accumulating reserves by borrowing in the international financial market by issuing sovereign bonds. The problem is that as most repayments of foreign debt is with further borrowing the foreign debt keeps increasing.

This feature of foreign debt servicing for many years, and especially since 2015, has been inevitable as there were no significant surpluses in the balance of payments. And this was mostly due to the large trade deficits in recent years. Undoubtedly the country is in a foreign debt trap as the government must borrow to meet annual debt repayments and interest obligations. Consequently, the foreign debt keeps growing.

Debt servicing

The debt servicing cost that was US$1.8 billion in 2015 increased to US$2.4 billion last year. What is particularly worrisome is that although debt repayments are modest this year, they are expected to be heavy in the foreseeable future. They are estimated to rise to a mammoth US$ 4.2 billion in 2019. An underlying reason for the difficulty in servicing the debt is due to the large borrowed funds being utilized in high cost unproductive infrastructure projects that have not increased tradable goods.

Critical issues in foreign debt

In Sri Lanka’s situation of high foreign indebtedness, prudent foreign borrowing is essential to ensure that the foreign debt does not expand much further. Commercial high cost borrowing for projects with low returns must be avoided. It is vital to pursue policies that are not foreign debt dependent and improve the balance of payments to generate surpluses that ensure resources for reducing the debt.

The current debt servicing scenario and the country’s external finances do not provide the possibility of not borrowing to repay debt. This implies that the government must be prudent in its other foreign borrowing. As much as possible development projects should not be debt-dependent. And whenever possible borrowing, high cost borrowing must be avoided.

Development projects should be chosen on the basis of priorities for projects that enhance exports or reduces imports. Alternate forms of foreign investment such as foreign direct investments and public private partnerships with foreign investors must be sought as these do not increase indebtedness.

Measures must be taken to strengthen the balance of payments by reducing the trade deficit as well as increase earnings from services. The current trend in export growth has to be accelerated to reach the export development goals of the Export Strategy 2025. The Export Development Strategy launched last week has to be implemented effectively to increase exports substantially as envisaged in the export plan. Since the gains in exports have been negated, there has to be serious policy measures to curtail unwarranted imports such as gold and motor car imports and expand import substitution by increasing domestic production of imported items and import substitutes.

Synthesis

Sri Lanka’s foreign debt has reached proportions when its servicing is a serious problem. It has to borrow to service the massive foreign debt of around US$ 51 billion that has accumulated mostly over the last decade. The government must be prudent in its foreign borrowing and pursue policies that do not increase debt much above its current level. Most of the needed policies to reduce foreign debt are medium and long term. The necessary foundation must be laid now.

Leave a Reply

Post Comment