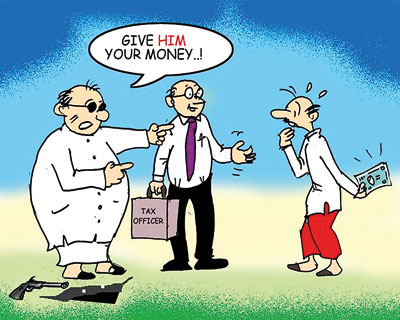

Taxing or Robbing: What’s the difference?

View(s):Once I came across a case study that had been circulated among the economics students in a foreign university. The students were supposed to read the case and review it for their tutorial. I thought of repeating this tutorial for your benefit, reporting the case study as follows:

“A robber stopped a man walking on the road at night and pointed a gun at his head, demanding his money. The frightened man gave his money to save his life, but after that went to the police to report the incident. The criminal was caught and the case was brought to the court for justice. In another incidence, politicians got a new tax bill passed in the parliament and deployed the tax officials to get money from people; some people paid, but some others evaded the tax. In both cases, apparently the innocent people had to give away their hard-earned money. Nevertheless, there is a difference in the judgement: In the first case, the one who lost money could go to the courts against the one who got his money. In the second case, it was the opposite; those who asked for money could go to the courts against those who did not give money.”

At a time that the new Inland Revenue Act (No. 24 of 2017) is being the subject of public discussions and debates in Sri Lanka, I thought of undertaking the above as a timely issue. It is not my intention, however, to review the Act and the pros and cons of its proposals. Rather my focus is on the difference between taxing and robbing, because the line between the two is absolutely very thin.

Spending others’ money

Governments are spending others’ money and so are the thieves who rob others’ money. This is why Milton Friedman – a great American economist from a Jewish lineage, distinguished four modes of spending. I am going to elaborate on these four modes in my own style as follows:

1. If I spend my own money on myself, my spending is absolutely very efficient and effective; I don’t spend on useless things and unproductive things. I keep watching on how my spending gives me a worthwhile return. I am so careful in spending so that I will not borrow and fall into debt.

2. If I spend my own money on someone else, I will be still cautious on how I spend. Unless my decisions are from my heart, my rational thinking does not allow me to cross the boundaries. I can buy a gift for someone, but I really consider its cost and, perhaps the value for money.

3. If I spend someone else’s money on myself, I can have a really good time – especially when that “someone else” is not anyone I know personally. Government money that comes from tax collection is absolutely like that; I don’t know who pays taxes but I know money comes from the Treasury for which I don’t have to worry about. I can get the best for me without thinking of how much it costs and even borrow on the account of the Treasury.

4. If I spend someone else’s money on someone else, I will have no sense of the quality and the cost; I don’t have to care about its return either. If there is any return for myself at least indirectly, I will choose to spend without boundaries and even decide to borrow.

The point that I want to get across is very clear: Government spending is closer to the 3rd and 4th scenarios where the government authorities spend others’ money for themselves than to the 1st and 2nd scenarios. This is where the line between taxing and robbing becomes blurred. That is why there should be institutions and mechanisms to improve the responsibility and accountability of public spending.

Taxes: Price of civilisation

According to a famous dictum, people who want to live in a civilised society pay taxes as the “price for civilization”. Given this fact, if you long to live in a “civilised Sri Lankan society”, you better pay taxes.

What do we mean by a civilised society? It is the kind of society that we like to live and work comfortably and safely with security and certainty about our future. In such a society, our tax money is spent to keep us free from crimes, rapes, robberies, harassments and other social disorders.

Our neighbourhood and our streets are clean and orderly because they are kept free from scattered garbage, stray dogs, mosquitos and, unbroken payments and open manholes.

Our children get education at their choice without being denied using various attributes and receive the best health care without delay and harassment.

Our taxes are being used to keep us from fires, floods, cyclones, earth slips, and wars and insurgencies. Law and order is maintained and, road discipline is established so that people can sleep at home without fear and commute on roads confidently and safely.

In a civilised society, we also have a social responsibility to look after the needy; the poor who cannot work, disabled and permanently sick, helpless widows and orphans, and the beggars on the streets. Finally, politicians and public sector employees – they all work efficiently, effectively, and tirelessly in order to ensure all above requirements of a civilised society. Therefore taxes should also be used to pay their salaries and wages, and other allowances and perks to compensate for what they do for civilisation.

You might be thinking if it is a joke: It is easy to say that taxes are the price we pay for civilisation, but is that the reality we see? The closer the authorities get to the 3rd and 4th types of spending modes, the thinner the dividing line between taxing and robbing.

Sri Lanka’s tax profile

Sri Lanka’s tax revenue of about 12 per cent of GDP can be comfortably increased further. One of the major problems is its overwhelming bias towards indirect taxes leaving out potential revenue from direct taxes on incomes, profits and capital gains. The Government here generates only about 15 per cent of its revenue from direct taxes. Japan, Malaysia and the US generate about half of the revenue from direct taxes while in Singapore, Thailand and UK it’s about one-third of the revenue from direct taxes.

Why is Sri Lanka generating such low direct tax revenue? This is primarily because many Sri Lankans who generate income, profits and capital gains do not pay taxes, while the government does not have a record of such income sources of the people. In addition, there are tax exemptions and tax evasions.

The flip side is that the Sri Lankan government depends largely on indirect taxes, which contribute about 85 per cent of the tax revenue. Indirect taxes are those taxes on sales of goods and services so that they are added to the price. As a result, our VAT and other indirect taxes on sales are exceptionally high so that as consumers we pay higher prices.

Among the indirect taxes, another area of distortion is the taxes on international trade, and particularly on imports. Tax revenue from international trade is about 17 per cent of revenue which is greater than the direct tax revenue. Compared to the Sri Lankan case, share of tax revenue from international trade is zero in some countries such as Singapore and the UK, and only 2 – 3 per cent in many other countries such as Malaysia, Thailand, Japan and US.

Reforms on both sides

Apparently, there is a strong case for tax reforms in Sri Lanka. Direct tax revenue has to be raised to about 40 per cent of the government revenue. At the same time, Sri Lanka’s indirect tax rates should be lowered and simplified to a great extent.

Secondly, it is difficult to ignore the reforms needed in spending the tax revenue. It is primarily about spending the tax money which makes a difference between taxing people and robbing people. The overwhelming public discontent about taxation actually echoes the years of public distrust about spending tax money.

(The writer is Professor of Economics at Colombo University)