Columns

Political stability, policy certainty and agreed economic policy programme imperative

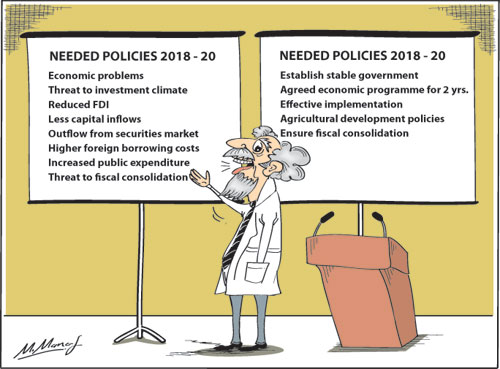

View(s):Political instability and confusion after the local government elections have been detrimental to economic growth. A stable government and an agreed economic programme effectively implemented are prerequisites for economic development.

Continuing political instability affects investment, international borrowing costs, capital outflows and economic efficiency. It is imperative that a stable government is established for the next two years and that economic stabilisation and growth is not compromised. Macroeconomic fundamentals must not be weakened for short term political gains. The economic deficiencies that affected the political fortunes of the unity government must be corrected without undermining the macroeconomic fundamental.

Continuing political instability affects investment, international borrowing costs, capital outflows and economic efficiency. It is imperative that a stable government is established for the next two years and that economic stabilisation and growth is not compromised. Macroeconomic fundamentals must not be weakened for short term political gains. The economic deficiencies that affected the political fortunes of the unity government must be corrected without undermining the macroeconomic fundamental.

Prerequisites

As Central Bank Governor, Dr. Indrajit Coomaraswamy is reported to have said, when announcing the Central Bank’s first Monetary Policy Review for 2018: “If you have prolonged political instability, you can’t have accelerated growth or development. Political stability, macro-economic stability, the rule of law are the basic ingredients for development. So, clearly the faster we can restore political stability, the better it would be for the country’s economy.”

Dr. Coomaraswamy emphasised that “There should be political stability in which the nation can move forward.” Furthermore, he pointed out that political instability will affect market sentiment. And if this causes a negative impact, it would lead to a reduction in investment and growth. He also cautioned that if the current political conditions lead to a loosening of fiscal policy, then the Central Bank would have to tighten its monetary policy.

Debt repayment

Debt repayment

The government’s strategy is to ensure the debt repayments from 2019 onwards must be rigorously implemented to ensure that the country does not default for the first time in its economic history. The 2018 balance of payments outcome and international borrowing costs are important for foreign debt servicing. An improvement in the external finances is imperative as there is a large foreign debt repayment of US$4.2 billion in 2019. Debt repayments from 2020 onwards too are high.

Interest rates

International interest rates play an important part as the magnitude of the debt repayment is such that there is a need to obtain fresh loans to supplement loan repayment. The country’s debt repayment capacity is affected by international perception of risk that influences the country’s international borrowing rates. These play an important part as the magnitude of the debt repayment is such that there is a need to obtain fresh loans to supplement the repayment.

The instability and political uncertainty subsequent to the local government election results will erode international confidence, raise the perception of risks and uncertainties and increase borrowing costs. Consequently the already onerous foreign debt repayment would be more burdensome. A quick establishment of a stable government is vital to restore international confidence.

External finances and balance of payments

There could be a reversal of the significant progress in exports that improved the trade balance and contained the trade deficit. There was a significant increase in exports to US$10.5 billion at the end of November 2017 and exports are likely to reach about US$11.5 billion for 2017.

The balance of payments recorded an overall surplus of around US$2 billion by end November 2017. Gross official reserves also increased to US dollars 7.3 billion by end November 2017 from US dollars 6 billion recorded at the end of 2016. A current account surplus of about US$2.5 billion is expected for last year.

Exports

It is to the credit of the government that exports expanded with the restoration of the GSP plus concession by the European Union (EU). Exports began an uptrend since March last year with significant expansion of sea food and garments exports. This momentum of export growth must not only be maintained but accelerated to achieve an improvement in the trade balance.

An improvement in the business climate and ensuring an increase in the exportable surpluses in agricultural exports and manufactured products is needed to keep up the momentum of export growth. Political uncertainty does not augur well for export expansion. The adverse impact could be a long run one affecting the balance of payments as well as economic growth and employment.

Macroeconomic fundamentals

The macroeconomic fundamentals that must be strengthened are primarily fiscal consolidation and an improvement on the external finances. It is to the credit of the coalition government that after an initial deterioration of the fiscal outcome in its first budget in 2015 and Budget 2016, there have been significant achievements in reducing the fiscal deficit. The implementation of new revenue proposals and a more effective tax administration are expected to achieve a fiscal deficit of 3.5 percent in 2020.

Fiscal consolidation

Will the political setback to the government at the local government elections alter its resolve to achieve this target? This is a real danger as imprudent spending to garner political support and popularity before the next elections could erode public finances. As fiscal consolidation is fundamental to achieving economic stability and growth any deterioration in the government’s resolve and ability to achieve the fiscal target would jeopardise the country’s economic future.

Fiscal slippage

Governor Coomaraswamy implied possible fiscal slippages that would hurt the economy. As to whether the government would loosen its fiscal policy to address concerns of the political economy remains to be seen. Going on past experience of governments it is likely that this would happen. Public spending is likely to expand in agriculture subsidies, rural welfare measures, salary increases and increased employment in the public services. If this were to happen and there were large increases in public expenditure, the fiscal deficit would expand and the stability of the economy will be undermined. If there are political compulsions to increase expenditure, there should be countervailing measures to increase revenue or cut other expenditure.

As Governor Coomaraswamy pointed out, “The current fiscal policy is built into the government’s medium term budgetary framework. So, basically if you deviate from that framework, it would be very challenging in terms of managing the country’s debt dynamics. This is particularly so, at a time the international dimension is becoming more difficult with rising interest rates”.

Final word

One lesson that the political leadership should have learnt from the jolt they had was that they must put nation before party and in such an approach the national economy is of foremost importance. It is important that a stable and more cohesive government is established speedily. Though the two main parties have now agreed to continue the national unity government, uncertainty still prevails. They need to be reminded that the economy has become the first victim of the prevarication and confusion that prevailed following the February 10 local government elections. The sooner a stable government is established and an agreed economic programme implemented, the faster the threat to the economy will recede.

Leave a Reply

Post Comment