Columns

Improving balance of payments imperative to meet debt repayments

View(s):The balance of payments must be strengthened to cope with the impending high debt repayments in 2019 and beyond. Building up foreign exchange reserves to meet the large debt repayments with earned foreign exchange is imperative. To the extent that reserves are built up with earned foreign exchange, the country would need to borrow less in international capital markets for debt repayment. Strengthening of the balance of payments is vital to ensure that the country does not increase foreign debt. Otherwise, further borrowing for debt repayment would increase the country’s debt burden.

Debt repayment

Debt repayment

Debt repayments are estimated to be as high as US$4.2 billion in 2019, almost twice the debt repayment for 2017 of US$2.2 billion. Debt repayments from 2020 to 2022 are estimated to be around US$3.6 billion annually. This huge rise in debt repayment in 2019 and beyond implies the need to build up earned reserves in 2018. This in turn implies the need to strengthen the balance of payments.

Important strategy

An important strategy the government has decided to adopt as part of its debt repayment strategy is that income from the lease of properties, such as the Hambantota Port and divestiture of state assets would be placed in a special fund for debt repayment. This is indeed a prudent move in debt management.

However the amount of capital that could be raised depends on the progress of reforms and implementation of programs to bring in foreign investors. So far the progress has been tardy owing to a lack of consensus in the coalition government and violent opposition from opposition parties. Hopefully there would be progress in disposing unprofitable assets and building up reserves.

Strategies

Strategies

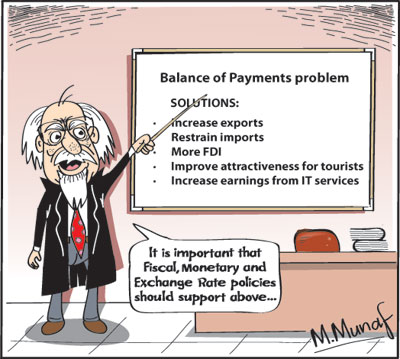

A multiplicity of strategies is needed to ensure a higher earned foreign exchange reserve for debt repayment. The strengthening of the trade balance and current account of the balance of payments is vital. This in turn requires supportive fiscal, monetary and exchange rate policies, improved competitiveness of exports, broadening and increasing of exportable commodities, increasing exportable surpluses and diversifying markets and products. The selective liberalisation of imports is also an essential element of an export expanding strategy. Once the country has a capacity to compete, free trade agreements could boost exports.

Macroeconomic policies

In the context of recent developments, where export growth was nullified by higher import growth, there has to be a concerted set of policies that would restrain non-essential imports. Fiscal, monetary and exchange rate policies should be geared to restrain imports. There does not seem to be an adequate policy thrust to restrain aggregate demand. As the IMF too has indicated, there is a need to change the policy stance on interest rates.

Trade balance

The reduction of the trade deficit is of fundamental importance in improving the balance of payments and strengthening foreign reserves. Unfortunately there has been a deterioration in the trade performance this year. The trade deficit for the first nine months of this year increased from US$6.4 billion to US$6.8 billion, and if current trends continue, it is likely to reach US$9 billion or more in 2017. This increase in the trade deficit has been owing to higher imports.

In the second quarter of this year exports amounted to over US$1 billion in each of the three months and continued into October and November when exports exceeded one billion US$. This growth is expected to continue and gain momentum and this year’s exports are expected to reach US$15 billion.

It is therefore vital that imports are contained. Fiscal and monetary policies should be designed to reduce imports. However some of the budgetary proposals are likely to increase imports, while fuel costs may rise owing to international prices increasing and rice imports will increase at least in the first half of next year. Coconut imports are also likely. Therefore vigilance on other imports is needed to achieve a lesser trade deficit in 2018.

Earnings from services

Three sources of earnings from services are significant: workers’ remittances, earnings from tourism and Information Technology (IT). These have more than offset the trade deficit to yield a current account balance of payments surplus. The latter two have a potential for significant increased earnings, while remittances are beyond our control.

Workers’ remittances

Workers’ remittances have been the most important source of earnings for the balance of payments. They have offset as much as 70 percent of the trade deficit or more. Regrettably, workers’ remittances have been decreasing in recent months owing to both political conditions and depressed incomes in many Middle Eastern countries. This trend continued in the nine months of this year when they declined by 7 percent from US$5382 million to US$4985 and offset nearly 73 percent of the trade deficit of US$6840 million.

The implication of this for the balance of payments is that lesser reliance has to be placed on the contribution of remittances to the balance of payments in the near future as the factors reducing these remittances are beyond the control of the government. It can only be hoped that the political situation in the Middle East would be stable and with the rise in their incomes with fuel prices increasing, workers’ remittances would improve.

Tourist earnings

Earnings from tourism increased by only 2.9 percent in the first nine months of this year compared to the same period last year, from U$2.59 billion to US$2.66 billion. The unexpected fall in tourist earnings in September by 2.3 percent is of serious concern. This reversal of the trend of increasing growth in earnings from tourism is a matter of serious concern as tourist growth was expected to be a significant source of economic growth by 2020 and 2025.

The reasons for this decline must be examined and appropriate measures taken to ensure a robust growth in tourism. Hotel rates, dengue, environmental concerns, traffic congestion, difficulties in obtaining rail tickets, threats to tourists and exorbitant charges for entry into cultural sites could be among the reasons.

Foreign Direct Investment (FDI)

Foreign direct investment that has been low must be increased substantially as such inflows not only provide support for the current balance of payments, but enhances exports in subsequent years. A significant increase in FDI this year augurs well for the balance of payments. According to the Board of Investment, there has been a substantial increase in foreign direct investment this year. FDI inflows in the first nine months of the year increased by 80 percent to US$795.5 million. The BOI expects FDI for 2017 to reach US$ 1.36 billion dollars.

Hopefully it would continue into next year too. Apart from its immediate benefit to the balance of payments, if the FDI inflows are for export manufacture, they could increase exports in the coming years.

Concluding reflections

In view of the very large foreign debt repayments in 2019 and beyond, it is vital for the country’s balance of payments to generate a significant surplus. The key to increased earnings is an improvement in the trade balance and enhanced earnings from services. The setback in tourism must be corrected and much higher earnings must be from IT services. Fiscal, monetary and exchange rate policies must be geared to increasing exports and restraining imports.

Leave a Reply

Post Comment