Columns

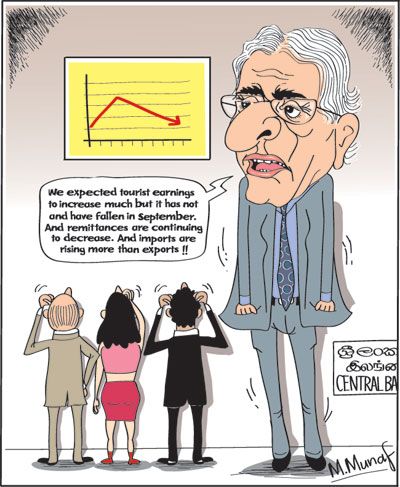

BOP concerns; increasing trade deficit, lower remittances and slow growth in tourist earnings

View(s):The increasing trade deficit this year, together with lower remittances and slow growth in earnings from tourism are serious concerns for the balance of payments. If these trends continue, the current account of the balance of payments would have only a small surplus or be even in deficit.

This unfavourable balance of payments outcome is especially unfortunate when the strengthening of the country’s foreign exchange reserves are important to meet the huge debt repayments in 2019. Furthermore, the anticipated reduction of the trade deficit with the growth of exports this year was not achieved owing to the more than commensurate growth in imports.

This unfavourable balance of payments outcome is especially unfortunate when the strengthening of the country’s foreign exchange reserves are important to meet the huge debt repayments in 2019. Furthermore, the anticipated reduction of the trade deficit with the growth of exports this year was not achieved owing to the more than commensurate growth in imports.

Trade balance

The trade deficit for the first nine months of this year increased from US$ 6.4 billion to US$ 6.8 billion and is likely to reach US$ 9 billion or more in 2017. As discussed in last week’s column, the trade deficit expanded to US$ 6.8 billion in the first nine months despite a growth in exports owing to higher imports.

Trade deficit offset

In spite of this large trade deficit of US$6.8 billion in the first nine months of this year, it was offset by workers’ remittances and tourist earnings that together amounted to US$7.6 billion. (See table). While workers’ remittances off set 73 percent of the trade deficit, tourist earnings offset 38 percent. However, remittances and tourist earnings declined in September and there is a concern that these may offset much less of the trade deficit in the near future. Despite this setback, the overall current account surplus of US$2 billion in the first nine months of this year was much higher owing to increased capital inflows.

Earnings from services

In past years workers remittances offset as much as 70 percent of the trade deficit or more. Tourist earnings more than offset the rest of the deficit and with the help of capital inflows, there was a current account balance of payment surplus. For instance in 2016 when the trade balance reached US$10.3 billion owing to a poor performance of exports and continued increases in imports, the entire trade deficit was more than offset by workers’ remittances of US$7 billion and earnings from tourism of US$2.8 billion that together amounted to US$10.7 billion.

These strengths in the balance of payments are weakening with workers’ remittances declining and a setback to tourism.

Hopefully the setback to tourism will be reversed quickly by remedial actions that would make the country an attractive holiday destination.

Workers’ remittances

Remittances that are the most important source of funds to offset the trade deficit have been decreasing in recent months owing to both political conditions and depressed incomes in many Middle Eastern countries. This trend continued in the nine months of this year. In the first nine months workers’ remittances declined by 7 percent from US$5,382 million to US$ 4,985.

However these remittances were able to offset nearly 73 percent of the trade deficit of US$6,840 million. The implication of this for the balance of payments is that lesser reliance has to be placed in the contribution of remittances to the balance of payments in the near future.

However these remittances were able to offset nearly 73 percent of the trade deficit of US$6,840 million. The implication of this for the balance of payments is that lesser reliance has to be placed in the contribution of remittances to the balance of payments in the near future.

Tourist earnings

Adding to the anxieties in the balance of payments was the unexpected fall in tourist earnings in September by 2.3 percent. Earnings from tourism increased by only 2.9 percent in the first nine months of this year compared to the same period last year; from US$2.59 billion to US$2.66 billion. This was a reversal of the trend of increasing growth in earnings from tourism in recent years. The arrested growth in tourist earnings is a matter of anxiety as tourist growth was expected to be a significant source of economic growth by 2020 and 2025.

Summing up

This year’s profile of the current account of the balance of payments is significantly different. There was a trend of increasing exports since March this year that resulted in an export growth of 8.2 percent. Hopefully this trend would accelerate during the next three months as well as into 2018. However the benefits of this export growth was negated by a more than commensurate growth in imports. While exports grew to US$8.4 billion or by 8.2 percent, imports grew by 9.7 percent to 15.3 billion, resulting in the trade deficit expanding to US$6.8 billion.

With the slowing down in worker’s remittances this year, remittances of US$4.98 billion offset 73 percent of the trade deficit. The slow growth in tourist earnings to US$2.7 billion in the first nine months meant that the recent experience of these two items offsetting the trade deficit may not be as much as in past years.

This year’s balance of payments is disappointing. The current account of the balance of payments that consists mainly of the trade balance and net receipts from services is likely to be a small surplus, at best. And this would be due to increased capital inflows to the stock market and government securities. The increase in the trade deficit, despite the growth in exports, the decrease in workers’ remittances and slowing down of tourist earnings are serious concerns. Hopefully there would be a rebound in tourism and a restraint in imports.

This year’s balance of payments is disappointing. The current account of the balance of payments that consists mainly of the trade balance and net receipts from services is likely to be a small surplus, at best. And this would be due to increased capital inflows to the stock market and government securities. The increase in the trade deficit, despite the growth in exports, the decrease in workers’ remittances and slowing down of tourist earnings are serious concerns. Hopefully there would be a rebound in tourism and a restraint in imports.

Future

What would hopefully happen is a change in this balance of payments performance next year. The export growth is likely to continue and hopefully gain momentum while there would be some restraint in imports. This however may not be a realistic expectation as fuel prices are high and rising, the end year imports are generally high and the reduced tariffs of some import items in the budget too would encourage imports.

On the other hand, an increase in tourist earnings is quite realistic to expect. These we hope will give a better balance of payments outcome. Nevertheless the balance of payments performance is such that affirmative economic policies are needed to achieve a better balance of payments outcome so essential to strengthen the foreign reserves.

Leave a Reply

Post Comment