Columns

IMF cautions on possible slippages in fiscal consolidation, public debt management and monetary policy

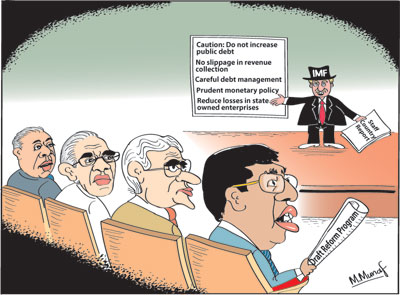

View(s):The International Monetary Fund (IMF) considers the expected economic growth of 4.7 per cent this year acceptable owing to the floods and drought that impacted adversely on the economy. However, in its latest Staff Country Report it cautions against any future increasing of public debt and revenue slippage and stresses the need for careful debt management, prudent monetary policy and the need to reign in losses in state owned enterprises.

Core weaknesses

Core weaknesses

The fundamental weaknesses of the economy include the large foreign and public debt, high fiscal deficit, large losses of state owned enterprises, trade imbalance, weak balance of payments and inadequate foreign investment. Many of these weaknesses are not new but an inheritance from the previous twelve years. The new Government also contributed to the fundamental weaknesses by its late 2015 fiscal policies.

There is a new resolve by the government to correct these weaknesses that impact on the future economic growth potential in the economy. However the inability of the government to pursue reforms owing to a lack of consensus within the coalition government, opportunist politics of the opposition and an ineffective administration weighs heavily on the resolution of these issues.

Public debt

According to the IMF, the public debt rose from 82 to 84 per cent of GDP between 2015 and 2016 largely due to exchange rate depreciation and an increase in guaranteed debt. In 2017, public debt is expected to rise slightly to 85 percent of GDP due to the still large fiscal deficit and exchange rate depreciation. Furthermore, the IMF points out that if contingent State Owned Enterprises (SOE) debt is included, total public debt would rise to 94 per cent of Gross Domestic Product (GDP) and decline below 90 per cent of GDP by 2020. The IMF says that the likelihood of such a scenario has increased due to delays in energy pricing reform and policy reforms aimed at economic efficiency and productivity.

Debt burden

Although some view the public debt as not excessive, its servicing cost absorbs almost the entirety of government revenues and the government requires to borrow to meet its current and capital expenditure. This distorts priorities in expenditure on economic and social development, while increasing the debt burden. This cyclic problem could only be mitigated by a reduction of the fiscal deficit by increased revenue collection and cutting uneconomical expenditure.

A fiscal deficit

A significant improvement in economic fundamentals has been the reduction of the fiscal deficit by an increase in revenue. Government revenue collection expanded to a record 14.2 percent of GDP in 2016. Fiscal policy is in the direction of a reduced fiscal deficit. The IMF considers the medium-term overall deficit target of 3.5 percent of GDP appropriate for reducing the risk of debt distress, and would lower the public debt to GDP ratio to 76 percent of GDP by 2020. The IMF however warns of possible fiscal slippage, especially if the proposed Inland Revenue Act is not implemented.

Foreign debt

Foreign debt

The IMF considers the external debt sustainable but high at 57 percent of GDP and vulnerable to currency risks. Furthermore the IMF points out that rollover needs will increase as external sovereign debt begins to mature in 2019. Therefore the IMF advocates advanced planning and medium-term debt management. Foreign debt increased this year too in order to service external debt obligations and enhance foreign reserves. It is important to strengthen the balance of payments by an improved trade performance as external debt servicing absorbs over one fourth of the country’s export earnings.

Trade imbalance

The large and persistent trade deficits are a foremost weakness in the country’s balance of payments that lead to foreign borrowing. For instance in the first five months of this year, the trade deficit expanded by 23.5 per cent to as much as US$4.2 billion. If this trend continues the trade deficit is likely to increase to more than the 2016 trade deficit of US$9.1 billion and reach as much as US$10 billion or more.

This widening of the trade deficit, despite an improvement in exports since March this year, has been brought about entirely due to an increase in imports that have nullified the gains in export earnings. During the first five months of 2017, exports grew by 4.3 per cent, while imports increased by twice as much – 8.6 per cent. Imports increased substantially due to higher imports of fuel and rice. Imports of fuel increased by 63 per cent, rice imports increased by more than twenty-fold. Drought conditions that destroyed as much as 40 to 50 percent of the rice crop necessitated the huge increase in rice imports. Both rice and wheat imports are likely to increase in the second half of the year as well.

This increase in imports has implications for monetary policy exchange rates and interest rates. The rate of growth of aggregate demand and aggregate supply have an important bearing on the trade performance. Therefore monetary, fiscal and exchange rate policies should be geared to ensuring a healthier trade balance.

Monetary policy

The IMF points out that further monetary tightening would head off second-round effects of currently high inflation, rein in credit expansion and protect against potential capital outflows from further US interest rate hikes. It suggests other measures to slow credit growth, including raising the reserve requirement and employing macro-prudential instruments, such as broader use of limits on loan-to-value ratios in vulnerable sectors and a credit limit or increasing risk weights in the housing sector.

The IMF said that monetary policy should be tightened to rein in inflation and credit growth and particularly to ensure that credit growth was directed towards productive economic activity. The Sri Lankan authorities agreed to closely monitor credit growth, and would tighten monetary policy further by the use of macro-prudential measures, if necessary.

Conclusion

The fundamental macroeconomic weaknesses have to be addressed to avoid a further weakening of the economy. The improvement in fiscal consolidation has been a significant achievement that must be sustained. The expansion of exports in the second half of the year and lesser imports of fuel may strengthen the economy. The additional revenue from the Hambantota port project would also strengthen the balance of payments and foreign reserves. Furthermore, the Government is preparing a reform package, which may be implemented later this year.

Leave a Reply

Post Comment