Columns

Rapid growth an illusion in an inhospitable climate

View(s):There was no surprise in the Central Bank’s expectation that this year’s economic growth would be modest. Although international agencies expect a growth of around 4.5 percent this year, this may be difficult to achieve due to some proximate adverse conditions, obstructionist political actions and policy uncertainty that is not conducive to investment. Owing to these reasons only a modest growth of 3.5 to 4 percent is a realistic expectation for this year.

What is disconcerting is not only this modest growth rate. It is also the sources and nature of growth and the factors inhibiting growth. The factors stifling growth are mainly political and are likely to continue for the duration of this government. More significantly, a rapid economic trajectory is inconceivable in the current political context and milieu.

What is disconcerting is not only this modest growth rate. It is also the sources and nature of growth and the factors inhibiting growth. The factors stifling growth are mainly political and are likely to continue for the duration of this government. More significantly, a rapid economic trajectory is inconceivable in the current political context and milieu.

Sources of growth

Economic growth has been achieved in recent years by construction and services. Agricultural production has declined due to adverse weather conditions. Manufacturing has hardly grown and investment is tardy. Development projects are being objected to and foreign investment is drying up with less than US$200 million in the first half of the year.

Modest growth

The Central Bank predicts a modest recovery in GDP growth in the fourth quarter of this year following the lower growth recorded in the first quarter of this year. Agriculture is expected to perform the least, as was the case last year. Services are expected to grow fastest and contribute most to this year’s growth. The industrial sector too is expected to grow somewhat better as manufacturing is expected to improve. All things considered, the economic performance is expected to be lacklustre, as was the case in 2016.

Drought and floods

Much of the blame for slow growth last year and this year has been placed on the setback to agriculture owing to drought and floods. There is no denying the fact that these adverse climatic conditions were a setback to agricultural production. In fact the adverse impact of the drought would continue to affect agricultural production this year and in the next. This is especially so with respect to coconut production, where this year’s drought would impact next year’s crop too.

The impact of the floods and drought was not confined to decreased agricultural production. It increased food and fuel imports and strained the balance of payments. The large imports of fuel, rice and wheat were a direct result of the floods and drought. In fact the costs to livelihoods and living were immeasurable and continues.

The impact of the floods and drought was not confined to decreased agricultural production. It increased food and fuel imports and strained the balance of payments. The large imports of fuel, rice and wheat were a direct result of the floods and drought. In fact the costs to livelihoods and living were immeasurable and continues.

Diversified economy

Notwithstanding these setbacks, it is incorrect to attribute the economy’s slow growth to agriculture’s performance. Sri Lanka’s economy is a diversified one in which agriculture contributes less than 10 percent to GDP. In 2016 owing to the fall in agricultural output agriculture’s contribution to GDP was only 7.1 percent. The industrial sector contributed 30.8 percent and services contributed 52.3 percent to the GDP. It was the inadequate growth in these sectors that slowed down growth.

Construction

Another aspect to the growth story is that in the industrial sector most of the growth was generated by construction rather than industrial manufactures. Construction is import dependent and its growth strains the trade balance. Had the growth been in export manufactures, the country’s economic fortunes would have been more robust.

One of the important means of enhancing industrial manufactures is by attracting appropriate foreign direct investment. Foreign direct investment has been disappointing and declining. Unlike countries like Vietnam, Malaysia and Indonesia, our policies and political conditions are not attractive to investors.

Reasons

What are the reasons for the country’s low economic growth? The political context has been a major reason for the economic impasse. This has been manifest in numerous ways. First there has been no consensus between the two parties that constitute the unity government on economic policies. Even when there has been an apparent agreement, it is changed subsequently. This policy uncertainty has been a disincentive for investment.

The most recent and glaring instance was the agreement with a Chinese firm to develop the Hambantota harbour. The agreement was approved by the cabinet and signed. After the signing we are told the President is amending it. Quite apart from the inability to change an agreed and signed international agreement, this is a clear case of prevaricating on policy and lack of consensus on economic policy.

This lack of a policy consensus has hampered economic development. There are no clear-cut economic policies and the consequent uncertainty is a severe constraint on investment. The government has failed to announce an economic policy framework and adhere to it. In fact in several instances the government has retracted from its policies owing to opposition from within and opposition parties.

Opposition strategy

It is blatantly clear that the opposition has a strategy to obstruct the government’s policies. These have taken the form of trade union actions to cripple the government’s economic programme. Trade union actions have been well outside the labour unions interests. So trade unions have become an obstructionist force in the economy. Even veteran trade unionists have pointed out that these actions were not legitimate trade union activities.

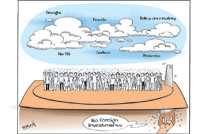

These obstructionist acts of the opposition have not been confined to trade unions. The opposition has succeeded in mobilising large numbers of people to demonstrate and object to government programs. For instance, objections to the government’s investment zone in Hambantota has made the government shelve a foreign investment that would have contributed much to the economy.

These obstructionist actions not only deter the particular project but foreign investment in general. While other countries are inviting foreign investors to set up industries in their countries, we are frightening them away. This inhospitable environment has retarded the country’s development irreparably.

Positives

This distressing tale would be imbalanced if the positive achievements of the unity government is not mentioned. The positives are the establishment of law and order; good relations with foreign countries, especially countries that matter for the economy; the restoration of GSP plus by the European Union; and greater fiscal and economic stability. What is unfortunate is that the advantages of these favourable development have been dissipated by the political factors discussed earlier. The enemy is within.

Ultimate question

The question uppermost in the minds of those concerned is whether there would be a change in these inhibiting political conditions to usher in a climate favourable to economic growth. What is certain is that unless the government adopts a clear-cut set of economic policies, undertakes the required reforms and implements an agreed economic policy effectively, rapid economic growth would remain an illusion.

Leave a Reply

Post Comment