Columns

Economic perspectives on taxation: Increased revenue vital for economic stability and growth

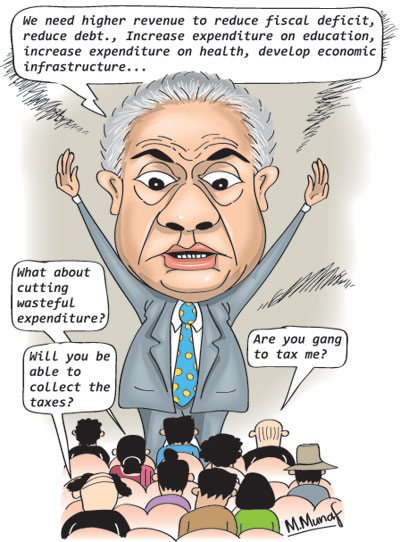

View(s): Last Sunday’s column pointed out that the underlying rationale for the new Inland Revenue Bill was the critical need to gather adequate revenue for the country’s development. A significant increase in government revenue is vital for fiscal consolidation, macroeconomic stability and economic development. The resolution of many fundamental macro-economic problems requires an increase in revenue collection as well as increased expenditure on education, health and economic development.

Last Sunday’s column pointed out that the underlying rationale for the new Inland Revenue Bill was the critical need to gather adequate revenue for the country’s development. A significant increase in government revenue is vital for fiscal consolidation, macroeconomic stability and economic development. The resolution of many fundamental macro-economic problems requires an increase in revenue collection as well as increased expenditure on education, health and economic development.

Reducing the fiscal deficit to 3.5 percent of GDP by 2020 as targeted by the government should be achieved by a significant increase in government revenue.

Inadequate revenue

Inadequate government revenue has been a fundamental economic weakness and concern for quite some time. Government revenue has been inadequate to meet its committed current expenditures. And in some years government revenue has been even inadequate to meet debt servicing costs. Since government revenue has been inadequate in recent years to meet its current expenditure it had to borrow.

Fiscal deficits have been as high as 7 percent of GDP in certain years. The fiscal deficit was brought down to 5.4 percent of GDP in 2013, but soared to 7.4 percent of GDP in 2015. These fiscal deficits have been an underlying reason for the increasing public debt as there has been a continuous need for the government to borrow to finance even its current expenditure.

One of the current government’s achievements was the reduction of the fiscal deficit to 5.4 percent of GDP last year. Reducing the fiscal deficit to 3.5 percent of GDP by 2020, as targeted by the government, is imperative. This should be achieved mostly by increasing revenue as there are needs to increase expenditure on economic and social development. Proposals of the new Inland Revenue Bill are expected to enhance revenue collection.

The inadequacy of our revenue collection is clear when our revenue collection is compared with other counties.

Out tax revenue has been well below what it should be at this stage of development. Sri Lanka’s tax revenue should be about 20 percent of GDP at this stage of development.

Revenue decline

Revenue decline

Interestingly, Sri Lanka’s tax revenue has decreased with increasing per capita income. In 1990, government revenue was 21 percent of GDP. At the turn of the century the tax to GDP ratio had fallen to 16.8 percent of GDP and by 2015 it had fallen further to 13 percent of GDP. In 2016 there was an increase in revenue to 14.3 percent of GDP that is still much below other middle income countries with Sri Lanka’s per capita income that collect around 20 percent of GDP as revenue.

High indirect taxes

A significant feature of the country’s taxation system is that as much as 80 percent of tax revenue is obtained through indirect taxes. Most indirect taxes fall on low income households that are taxed when they purchase basic items of food such as wheat flour, bread, sugar, milk and imported items of food such as dhal. These taxes are a high proportion of their incomes. Therefore indirect taxation is considered to be regressive.

Indirect taxes

However all indirect taxes are not regressive, especially those taxes that fall on luxury items of consumption such as on foreign alcohol, motor cars and high income consumer goods. Sri Lanka does have high taxes on such items whose incidence fall on high income consumers. Therefore it could be contended that the regressive nature of the taxation is not as much as he ratio of 80:20 suggests. On the other hand, one way of increasing revenue would be to increase some of these indirect taxes that are low compared to those of the other countries.

The rationale for indirect taxation is that these taxes are easy and more certain to collect. This is especially so as tax evasion and tax avoidance is very high and the administrative capacity to collect taxes from high income earners is weak. Therefore there is scope for higher indirect taxes on conspicuous expenditure such as high value vehicles and items of luxury consumption. The new Inland Revenue Bill does move in this direction as well, but some could contend that it does not go far enough.

Concluding observations

The underlying economic rationale of the new Inland Revenue Bill is in the right direction of garnering a much larger revenue by increasing direct taxes, introducing new taxes and reducing tax exemptions. There may be some taxes that require to be reconsidered if they have serious disincentives for investment. On the other hand, there may be scope for higher taxes on consumption that fall on the affluent and are not disincentives for effort and investment. These should be explored to achieve the higher revenue target.

The objective of reducing the fiscal deficit requires a thrust not only on the revenue side, but also the expenditure side. There is still a dire need to curtail wasteful and ineffective expenditure. While there have been some curtailment of wasteful expenditure, there are no signs of prudence on government expenditure on such blatant examples of expenditure such as on one hundred ministers, unheard of in other countries. A hundred minsters overlooking bifurcated responsibilities is also one of the reasons for inefficiency. The purchase of vehicles and there misuse is another instance for pruning government expenditure.

The country’s fiscal situation cannot be improved without reforming the large number of loss making enterprises and privatising some. As much as increasing revenue is vital, the reduction of losses in state owned enterprises is a must. Will the political context permit the reform of state enterprises?

Finally, most important is the need to strengthen the administrative capacity of the revenue administration. This is a herculean task that the passage of the Bill will not accomplish. If the tax administration remains inefficient and corrupt, the inherent problem of tax evasion and tax avoidance would vitiate the objectives of the tax reform, though certain tax provisions in the Bill would no doubt enhance revenue to some extent.

Last word

As a former Commissioner of Inland Revenue, D.D.M. Waidyasekera has said in his Taxation in Sri Lanka: Current Trends and Perspectives: In the final analysis, it is the level of efficiency of the revenue administration which determines the level of effectiveness of any tax system.

Leave a Reply

Post Comment