Columns

Central Bank’s monetary and exchange rate management policies and its independence

View(s):The Road Map: Monetary and Financial Sector Policies for 2017 and Beyond presented by Governor Dr. Indrajit Coomaraswamy on January 3rd was of special significance as it was an honest and realistic assessment of the economy, as it spelled out forward looking monetary and exchange rate policies and underscored the need for strengthening the Central Bank’s independence.

Admittedly the issues with respect to monetary and financial policies envisaged, though simply stated, were technical in nature and the importance of Central Bank independence not easily understood. Certainly Central Bank independence vital for financial and economic stability is especially important in our highly politicised country.

Admittedly the issues with respect to monetary and financial policies envisaged, though simply stated, were technical in nature and the importance of Central Bank independence not easily understood. Certainly Central Bank independence vital for financial and economic stability is especially important in our highly politicised country.

Economy

The Central Bank assessment of the economy was forthright and realistic. It made it clear that the country’s economy was in a critical state owing to its large trade and fiscal deficits that were threatening the stability of the economy. However recent corrective measures to enhance revenue and reduce the fiscal deficit to 4.6 percent of GDP were stabilising the economy. Last year’s fiscal deficit target of 5.4 percent is expected to be achieved.

Economic growth

Economic growth

Although economic growth in the first nine months was only 4 percent, the Central Bank expects a higher growth in the fourth quarter to push up the annual growth rate in 2016 to reach 4.5 to 5 percent. The economy is expected to grow by 5.5 to 6.0 percent in 2017.

Perhaps both estimates are slightly optimistic. Other estimates expect last year’s economic growth to be at most 4.5 percent. This year’s growth expectation of 5.5 to 6 percent is more optimistic owing to the challenges and downside risks that the Governor himself underscored. Global uncertainty, higher US interest rates, slow global economic growth, higher oil prices, drought and energy shortages are likely to slow economic growth to about 4 percent. The Road Map recognises these but perhaps assumes they would be less unfavourable.

Highlights of the 2017 Road Map

The most significant statement in the road map was that the Central Bank wanted its monetary policy stance and its exchange rate management framework to be transparent and predictive. In line with international practices, the Central Bank is looking at moving towards a flexible inflation targeting (FIT) framework and to develop a properly designed and widely accepted framework for exchange rate management that would be driven by market forces. Both these are realistic and pragmatic policy perspectives. Their implementation would ensure more effective responses to emerging economic conditions.

Monetary policy

The current monetary targeting framework would be gradually replaced by a flexible inflation targeting framework, where the Central Bank would focus on stabilising inflation in mid-single digits over the medium-term, while supporting growth objectives and flexibility in exchange rate management.

The essence of this monetary policy stance is to not be reactive to current conditions, but be proactive to emerging and expected conditions. In accordance with this policy the monetary targeting framework would be gradually replaced by a flexible inflation targeting framework under which, “the Central Bank would focus on stabilising inflation in mid-single digits over the medium term while supporting growth objectives and flexibility in exchange rate management.”

Inflation targeting

As the Governor explained “an inflation targeting framework is characterised by an announced numerical inflation target, a medium term inflation forecast, which facilitates forward looking monetary policy decision making and a higher degree of transparency and accountability.”

The rationale for this approach lies in the experience of many countries that Central Banks respond too late to inflationary or recessionary conditions such that their policy interventions are irrelevant as conditions in the economy have changed. Often monetary policy interventions aggravate the real situation. Milton Friedman, the Nobel Prize laureate in economics demonstrated this in a seminal article in the American Economic Review. He substantiated his argument with evidence from the US Federal Reserve Bank’s interventions that were too late and aggravated economic conditions more often than they resolved them.

Forward looking

Therefore the new thrust in monetary policy is a forward looking one. However it requires accurate data and forecasting skills. As the Governor pointed out “Inflation targeting is known to be operationally complex. It requires greater awareness of the whole monetary transmission mechanism (MTM) and is based on a working link from policy interest rates to interbank interest rates and to long term interest rates.”

Exchange rate

The Governor expressed the Bank’s commitment to a flexible exchange rate policy that would ensure export competitiveness and safeguard the external reserves. He said, “Volatile global market conditions and Sri Lanka’s vulnerability as a twin deficit country underscore the vital importance of having a flexible exchange rate policy to adjust to external pressures. Recent experience has clearly demonstrated that it is unsustainable to maintain an overvalued exchange rate at the expense of external reserves.”

He said “Wasting large amounts of the country’s external reserves, much of it borrowed, in a vain effort to defend the currency, which has to be ultimately depreciated anyway, is clearly unsustainable. It is time to stop this pattern and commence building up of external reserves through sustainable foreign exchange inflows.”

Independence

Dr. Indrajit Coomaraswamy made a very significant point as he concluded the presentation of the Road map. He emphasised the need for strengthening the technical capacity of the Central Bank and ensuring its independence. “I should also mention that the government has announced its intention to restructure the Central Bank. We would very much welcome a constructive restructuring process, which would upgrade processes and result in the reform of the Monetary Law and Banking Acts, particularly to give greater powers to the Central Bank to regulate the financial system. We are confident that such moves would be instrumental in enhancing the credibility of the Central Bank, while preserving the independence it needs to perform its roles effectively.

Importance

The independence of a Central Bank is vital for a country’s economic stability. Economies that have performed well are those who not only preserved the independence of the Central Bank but have strengthened its independence. An independent Central Bank is able to make a correct assessment of the economy, give sound economic advice and take the correct monetary policy decisions to curb inflation or stimulate the economy.

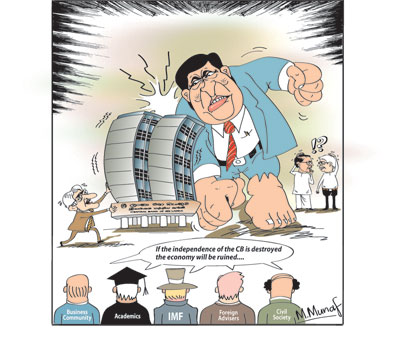

It is of vital importance that all sections of the community protest against any moves to undermine the independence of the Central Bank that is so vital for financial and economic stability but detested by politicians in our highly politicised country.

Leave a Reply

Post Comment