It’s a ‘flight’ situation in the broking industry

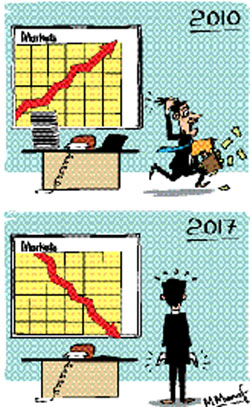

View(s): In the early years, being a stockbroker was refined and rewarding. It seems that the coolest job in the world has in recent times taken a nosedive with many young stockbrokers, recruited during the market’s heydays, unable to ‘make it’ in this high pressure job and are taking flight to other less stressful, high paying jobs.

In the early years, being a stockbroker was refined and rewarding. It seems that the coolest job in the world has in recent times taken a nosedive with many young stockbrokers, recruited during the market’s heydays, unable to ‘make it’ in this high pressure job and are taking flight to other less stressful, high paying jobs.

A heap of daunting issues that slugged the stock market has also crept into the morale of the young traders in the industry. Many young stockbrokers who joined the market at its recent peak times (2010 onwards) are deserting the industry as they feel the only way the Sri Lankan stock market will go is south.

This generation of youngsters that are leaving this industry is the ones who can change it for the better, laments the Chairman of the Colombo Stock Exchange (CSE), Vajira Kulatilleke. Ever the hopeful one, he says that the capital market is in dire need for an attitude change.

New jobs

“These are the ones who can do this,” he told the Business Times. However, they seem to not recognise this potential, because the ‘nothing is happening’ scenario at the CSE has forced them to take better positions elsewhere.

Many firms at the CSE’s peak were looking for brokers who have at least a bachelor’s degree, preferably focused on business or finance or engineering.

Mr. Kulatilaka along with his colleague at his day job as Director/Chief Executive Officer, NDB Capital Holdings PLC, Senaka Kakiriwaragodage who is also working in a company under the NDB Group, as  Managing Director at NDB Zephyr  are  both engineers.

Youngsters with similar education, Mr. Kulatilaka agrees now have many new avenues to move out and do something less risky in a ‘stable’ industry as opposed to the volatility that they’re encountering now in the capital market. Most are taking flight abroad and others opt to go to different industries.

A young trader who worked for five years in the industry during both boom and bust times said that “boom and bust cycles are fine as long as one can see the light at the tunnel’s end, but we can’t in the current situation”, he said.

Despite the stock market improving in more ways than one since its pioneering days, the industry is down. But unfortunately there will always be cycles where there’ll be tough times, says Mr. Kulatilaka in hope.

The capital market industry, which was a growth industry in the 1980s with hiccups in the ’90s to regain its vibrancy at the start of this decade has become, since of late an exceedingly unstable business with no clear growth trend. Industry revenue figures aren’t pretty and that also has scared the young blood in the industry.

Broking firms have cut back on many costs since the crisis in the CSE nearly three years ago, but to no avail. It’s hard to rally in profits, they say adding that some new firms are mulling cold storaging their licences which is when a stock broker can hold on to their licenses, but not trade. This has come on the back of the Securities and Exchange Commission’s (SEC) new rules in capital adequacy. The SEC on the recommendation of the CSE directed the implementation of a risk based Capital Adequacy Requirement (CAR) of 1.2 times the risk requirement of stockbrokers subject to a minimum liquid¬†¬†¬† capital requirement of Rs 35 million.

There will always be an attraction for this once lucrative high flying job, industry analysts believe while adding that the capital market is cyclic and when the boom cycles come, so will the young aspirers – and with a bang.