Sunday Times 2

Expressways: Real costs here growing faster than in the rest of the world

View(s):By Prof Amal Kumarage

A road for the village has been a fail-safe election promise in Sri Lanka since Independence. Sixty thousand kilometres of rural roads were constructed between 1960 and 1990. Since 2000, around Rs. 160 billion has been spent on carpeting or concreting thousands of kilometres of rural roads. But investment on rural roads has not translated into economic prosperity for these areas. Instead, they have become a burden to maintain. The economic damage inflicted on the country by political and welfare-oriented road construction is yet to be studied and documented.

Today, highways are being planned as if there is no alternative. Possible alternatives or economic viability is not studied. The award of contracts without competitive bids is nothing less than a calculated theft of public funds, a mortgaging of the country’s future. This article shows how most expressways now being proposed have not been studied properly and how, at the prices being negotiated, will be economically unfeasible. Maintenance is estimated to cost even more than toll collection, creating still more financial woes.

Today, highways are being planned as if there is no alternative. Possible alternatives or economic viability is not studied. The award of contracts without competitive bids is nothing less than a calculated theft of public funds, a mortgaging of the country’s future. This article shows how most expressways now being proposed have not been studied properly and how, at the prices being negotiated, will be economically unfeasible. Maintenance is estimated to cost even more than toll collection, creating still more financial woes.

It was found that many road projects undertaken before January 2015 were blatantly inappropriate financial transactions. But nobody has been held responsible, let alone charged. Clearly, all those who aided and abetted such activities are free to continue even today.The taxpayers, whose money is spent on these projects, must insist on proper feasibility studies being completed and made public before ministers lay foundation stones or issue media statements. The Cabinet, the Committee on Public Enterprise (COPE) and the Department of National Planning should demand that such reports are presented and publicly discussed before huge sums of money are approved.

The public must also insist that no major project is financed on negotiated loans and nominated contractors because the resultant lack of competitive pricing has been the single reason for why expressway construction costs have skyrocketed in Sri Lanka.This malady is not restricted to expressways. Today, funds for other road construction projects are distributed across different levels of government quite liberally. Politicians of all strata are happy to nominate their contractors for the work. It is left to the public to imagine the rest.

Impact on mounting debt

Of Sri Lanka’s foreign debt of Rs 3,544 billion rupees, at least 20% is on account of highways and expressways. The current projects will add up to over Rs. 850 billion, doubling the highway component in the foreign debt. This with interest is a debt of Rs 350,000 per household in Sri Lanka that has to be paid through taxes such as VAT by the current generation and the next. Furthermore, it can be rationally proven that these projects will not return an adequate investment and Sri Lanka will plunge further behind in its endeavour for economic progress.

There is also a myth propagated that expressways cover their cost with toll revenues. In 2015, the RDA earned revenue of Rs 5.3 billion from expressways. Policing, lighting, toll collection and administration together with maintaining expressway standards will likely exceed this as the surface wears out. The pay-back of the loan and interest is additional.

There is also a myth propagated that expressways cover their cost with toll revenues. In 2015, the RDA earned revenue of Rs 5.3 billion from expressways. Policing, lighting, toll collection and administration together with maintaining expressway standards will likely exceed this as the surface wears out. The pay-back of the loan and interest is additional.

If there are indeed conspiracies against Sri Lanka, this extravagance will be the most obvious threat to our prosperity if we stand aside, watch and allow daylight robbery.

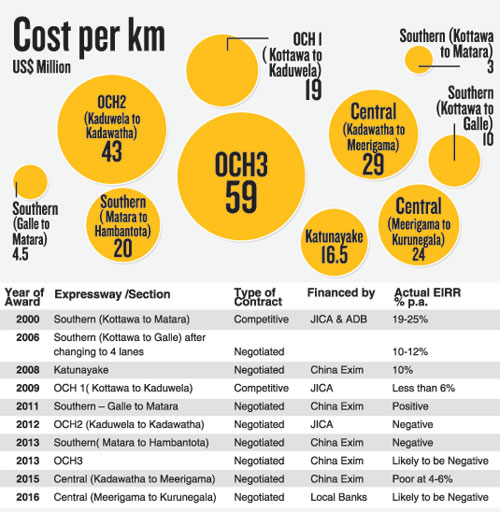

Highways are essential for Sri Lanka to become economically competitive while providing modern amenities to its people. Highway Construction Cost Indices used globally from 2002-2014 indicate an increase of just around 50% of cost per km in US$ during this period. Therefore, even after allowing for inflation, the real cost per km of four-lane expressways given in the table below is seen to have increased at a rate much higher than global trends. (see table)

In many countries, as local engineers gather experience, they are able to reduce cost. In Sri Lanka, the opposite has happened. It appears that, with time, unscrupulous elements have succeeded in finding more ways and means of increasing costs. This trend can only have a sinister motive.

The Exim Bank of China, which is funding most of these projects, is not asking for comprehensive studies as required by multilateral agencies such as the Asian Development Bank (ADB) and the World Bank. This allows ample opportunity for unchecked project costs benefiting the lenders, contractors and brokers. For example, let us say the actual cost of a properly-designed highway is US$5 million per km. If it has been poorly designed (with unnecessary viaducts, interchanges, crossings, higher embankment heights etc) there could be an increase by 50-100%; a further 30-40% if the material quantities have not been calculated properly; and a further 20% in the rates allowed. The overall ‘cost’ on paper would quickly escalate to US$ 15 million.

To keep a highway in motorable condition, a provision of around 1% of construction cost should be provided annually over its life. At current costs of Rs 4 billion per km, the 450km network of expressways planned by 2020 will cost, in today’s prices, Rs 18 billion per year just for maintenance alone. This is more than four times the entire maintenance budget of the RDA for 2017!

Does it matter?

The public applaud road building without realising the economic cost and damage of unplanned and uneconomical construction. The President and the Prime Minister, as well as many senior Ministers in this Government, campaigned to end corruption citing the previous regime’s highway projects. Claiming “We are not as bad as those before us” is not good enough to develop the country.

Parliament and, in particular, COPE, has largely neglected its duty to examine the RDA’s investments. The Committee on Public Accounts should be more vigilant about institutions such as the National Planning Department (NPD), set up to study such investments and advice Cabinet before it approves large financial commitments. It is not known if the NPD approved all these projects and, if so, what documents they studied to justify such investment.

No minister should be allowed to inaugurate projects unless full feasibility studies are completed and accepted by relevant agencies. It is hoped that at least the current COPE, which has shown intent and capacity in recent times, will take up highway expenditure as an important agenda for early investigation.

The RDA, along with the Government, should also be held accountable for waste in resources. In most cases, projects were simply formulated and implemented by a few selected officers in consultation with ministry officials. Highways were not properly planned or designed and construction bids were not called in an advantageous manner–at least to the country. The RDA has spent over Rs 1 trillion on road works over the last 10 years. It is clear that a sizable proportion of this has been wasted or stolen.

(Amal S. Kumarage PhD is a Chartered Civil Engineer and Senior Professor in the Department of Transport and Logistics Management at the University of Moratuwa. He former Chairman, National Transport Commission, and former Vice President of the global body of the Chartered Institute of Logistics and Transport)

Expressways: The journey so farNorthern Expressway-Central Expressway

The initiative was intended to be a mammoth construction project of four sections costing Rs 600 billion. However, the SMEC feasibility study dated October 2013 makes some imaginative assumptions to justify this highway at 12.1% IERR. The RDA has played a Jekyll-and-Hyde role: It accepted the study by making nearly the full payment while also rejecting it on grounds of technical inadequacy. Notwithstanding this contradiction, the RDA went ahead and inaugurated construction in 2014. Thus, SMEC had severely compromised its position. A subsequent review by a local university is also yet to be accepted. In any case, it has assumed the same RDA-estimated cost for the project without any verification or comparison and, thus, cannot be considered as a full and independent study. While the entire country expected the new government to reexamine these highway projects, the opposite is true. There were superficial changes–such as shifting the starting point from Enderamulla back to Kadawatha, changing the name of the project from Northern Expressway to Central Expressway, and altering the starting point of the extension to Kandy. But the same project is proceeding as before. In December 2015, Cabinet decided to obtain technological and financial proposals from the Metallurgical Corporation of China for the section from Kadawatha to Kossinna–a stretch that was to have been built with savings from OCH3. It was revealed a few weeks ago, however, that the entire Section 1 of 36.5 km is to be awarded to this same company for Rs 158 billion. This works out to US$ 30 million a km, 10% more than the cost per km before the elections! The China Exim Bank with whom the Government has entered into an MOU has recently asked for a feasibility study for Section 1. The RDA has supplied a cut-and-paste job using material from different studies, including reports it had previously rejected. This is the sad plight of a country about to embark on its biggest investment in history, much larger than the Mahaweli project. Based on previous feasibility studies, which were done in an acceptable and transparent manner, the negotiated cost appears inflated several times. At this price, the traffic-heavy Section 1 will not yield a return rate of more than 4-5% p.a., indicating that it will be an extremely poor investment. Last week, the Government announced that Section 2 has also been awarded–this time to consortia of local contractors for Rs 137 billion at US$ 24 million per km. As before, there is still no accepted feasibility study for this section at this expenditure. With traffic levels, that would only be a fraction of Section 1 and time savings that are even less, it is likely that at this higher negotiated cost, it would end up with negative economic returns. It is widely known that expressions of interest were called from local construction companies for Section 2. But instead of calling competitive bids, the RDA formed consortia to negotiate costs for design-and-build so that there was only a single bid for each subsection. For Section 3, limited bids are being called from Japanese companies. The media reported that the same Japanese company which provided the opportunity for the first large-scale cost escalation for the OCH2 during the previous regime is now in the picture again. Speculation is rife that Section 4 has also been awarded by negotiation to Chinese contractors. Hence it appears to be open-season yet again for highway robbery. Southern Expressway In 2000, the Japan International Cooperation Agency (JICA) and the Asian Development Bank (ADB) financed this project after International Competitive Bidding (ICB). In 2006 some of the contracts were re-negotiated due to political initiatives that led to converting two lane sections to four lanes. With this the final cost at completion was an increase of over 200% to US$ 10 million per km. An economic analysis using the higher cost and lower benefits represented by lower-than-estimated traffic volumes reduces the actual rate of return to 10-12%, making this barely justifiable. The next phase of the Expressway, the 30km section between Galle and Matara, was awarded on a negotiated basis to a Chinese contractor in 2011 with financing from Exim Bank of China for a contract value of Rs 18.7 billion (US$ 165). This was not on competitive bidding. But since proper estimates and designs were available, the final cost was a modest US$ 4.5 million per km– the only such contract to be favourable. The final section of the Extension of the Southern Expressway from Matara to Hambantota, a 74 km section also studied by this author in 2007, was found to be feasible provided that proposed development in Hambantota preceded the construction of the highway. The cost was estimated at Rs 33.2 billion (US$ 300 million) or US$ 4 million per km. The EIRR was estimated to be only 6.2% p.a. with a recommendation was for delayed construction. However, in 2013/14 the Road Development Authority (RDA) awarded this highway on negotiated design-and-build basis to Chinese companies for a total contract value of Rs 224 billion (US$ 1892 million) amounting to US$ 20 million per km. Given that the anticipated primary industries in Hambantota have not materialized and that the cost has escalated from US$ 4 to 20 million per km, the economic return from this 96km project will be negative and a significant loss. Colombo-Katunayake Expressway (CKE) The current traffic levels, however, are less than 50% of estimated. With the final cost of the highway at US$ 353 million, the actual EIRR translates to a marginal benefit of 10%p.a. Outer Circular Highway (OCH) In 2012, the Japanese restricted the second section (OCH2) between Kaduwela and Kadawatha to Japanese contractors resulting in one company submitting a proposal at a very high price. Even with a recommendation to re-bid, the Government in 2012 decided to award it to the same company following superficial negotiations. The cost for this 9km section was US$ 329 million (at US$ 43 million per km), a significant increase over OCH1. The initial feasibility study made by Oriental Consultants–a leading Japanese engineering consulting firm with extensive international experience–estimated the cost at just US$ 120 million for OCH1 and only US$ 80 million for OCH2. The actual cost of construction was 100% more for OCH1 and a phenomenal 300% more for OCH2. The third stage of the OCH from Kadawatha to Kerawelapitiya was also awarded in 2013 on a negotiated design-and-build basis with financing from China Exim Bank. The contract value for this 9km highway was negotiated for Rs 66.7 billion (US$ 535million), amounting to a record US$ 59 million per km. The actual cost estimated by Oriental Consultants of Japan for this entire 9km section was only US$ 50 million. The RDA has not carried out a feasibility study for the revised cost. Sadly, the Exim Bank which provided this loan does not seem to follow the practice of other international lending agencies in asking for a rigorous study. This was pointed out by the writer prior to the Presidential elections. The current Government, a few months afterwards, announced a negotiated reduction in the cost. This circus act however, enabled the OCH3 contractor to negotiate and secure the first stage of the Central Expressway without competition as the so-called saving (which has now transpired to be almost nil) was transferred to that construction to avoid calling for international bids. This means this section too will have negative returns. |

|---|

However, in 2011, the Government procured the services of the Australian-based SMEC International consulting firm without tender to undertake just the feasibility study of a 198km Northern Expressway. Astoundingly, this contract cost over Rs 1 billion!

However, in 2011, the Government procured the services of the Australian-based SMEC International consulting firm without tender to undertake just the feasibility study of a 198km Northern Expressway. Astoundingly, this contract cost over Rs 1 billion!