Columns

Fiscal reforms imperative for sustained growth— Lankan economists’ consensus

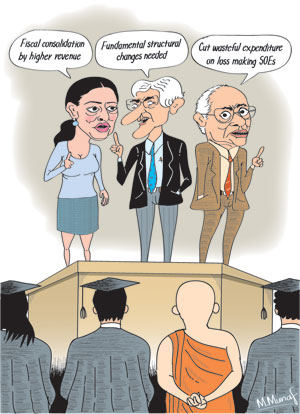

View(s):Economists who addressed the 30th Annual Sessions of the Sri Lanka Economic Association on October 21st and 22nd on the theme “Fiscal Reforms: An Imperative for Sustained Economic Growth” agreed that the country could not go forward without fiscal reforms and fiscal consolidation. Fiscal reforms were imperative to enhance government revenue, reduce the fiscal deficit and provide the fiscal space for developmental expenditure for sustained high economic growth.

Strategy

Economists pointed out that bringing down the fiscal deficit progressively to 3.5 per cent of GDP by 2020 by increased government revenue rather than a reduction of expenditure was imperative. Increased revenue was essential to reduce the fiscal deficit and contain the increasing public debt as well as for investment in development, especially in education and health and care of the ageing population.

Fiscal consolidation would enable a gradual reduction of the public debt to sustainable levels and arrest a possible debt crisis to which the economy is heading. Fiscal reforms that achieve these objectives were vital for sustained high economic growth. It would not be possible to attract foreign direct investment or to make adequate public investment in developing the economy’s competitiveness without fiscal consolidation.

Presidential address

In his address, the President of the Sri Lanka Economic Association (SLEA), Prof. A.D.V. de S. Indraratna said that “a series of policy and structural reforms, on trade and other real sectors, would be necessary, in order to reduce the budget deficit, fill the serious resource gap and reverse the economy to a growth trajectory to have sustained inclusive development, which should be the ultimate aim.” Professor Indraratna was of the view that of these, “fiscal reforms are an imminent imperative.” However he cautioned that “one should not think that fiscal reforms are sufficient or overlook the fact that they must be accompanied by incentive and structural reforms especially with respect to trade and other real sectors, the regulatory environment and access to credit by small and medium entrepreneurs.”

Governor Coomaraswamy

The chief guest at the annual sessions, Dr. Indrajit Coomaraswamy, the Governor of the Central Bank said that the priorities for achieving high sustained growth included strengthening macroeconomic fundamentals, structural reforms that improve the competitiveness of the economy and improving the doing business environment. He analysed the extent and character of the fiscal problem and emphasised that the reduction of the fiscal deficit was imperative.

This “most urgent challenge”, he argued, was not possible by the reduction of total expenditure, though some wasteful expenditure such as losses in state owned enterprises were needed. On the other hand, development expenditure had to be increased to enhance growth and the competitive capacity of the country through investments in high quality education and improvements in health. He also emphasised the need to have the fiscal space to take care of the rapidly ageing population.

Revenue

The increased revenue he said must come from increased tax revenue. The taxation reforms that are beige undertaken he hoped would increase the current low government revenue of only 13 per cent of GDP to about 15 per cent next year and increase it to about 20 per cent in 2020. This would enable the reduction of the public debt and debt servicing costs that are a severe fiscal constraint.

Balance of Payments

Dr. Coomaraswamy was hopeful of an improvement in the balance of payments and the foreign debt situation as there were no maturity of foreign loans in 2017 and 2018 and a surplus in the current account is expected this year. He described the next two years as ‘bonus years’ that would enable an easing of the external debt burden.

Role of IMF

Governor Coomaraswamy said there was much misunderstanding on the role of the IMF. He pointed out that had the IMF not been there, we would still have had the problem and we would have had to undertake fiscal and other reforms. The involvement of the IMF, he said, reduced the pain of the measures that were taken. The assistance of the IMF had been useful in building international confidence, easing the external finances and providing a breathing space to revive the economy.

IMF view

IMF view

The Resident Representative of the IMF, Dr. (Mrs) Eteri Kvintradze who was the guest of honour at the annual sessions gave a succinct analysis of the fundamentals of the fiscal problem and stressed that “fiscal consolidation efforts need to be focussed on revenue generation instead of expenditure compression”. She made a most powerful point that it was not whether fiscal targets can be met that matters but whether they are achieved “in a growth friendly manner where social and infrastructure spending is fully implemented”.

Dr. Kvintradze advocated increased revenue collection though tax reforms and effective taxation, reduction of losses in public enterprises through state enterprise reforms and privatisation and increased expenditure on developmental needs. She said there were far too many tax exemptions that eroded tax revenues.

She observed that at this critical juncture in the country’s development when the private sector has to play an important role, it was essential to have “a predictable, fair and automated tax system” that reduces uncertainties for investment.

Summing up

Summing up

The collection of much higher tax revenues and prudent public expenditure were needed to achieve the fiscal deficit target. It was stressed however that fiscal consolidation must be achieved through higher government revenue and reduction of unproductive expenditure to enable enough fiscal space for much higher public investment that would generate sustained high economic growth. The ideas, suggestions and proposals at the Annual Sessions should be valuable for formulating the Budget for 2017.

The keynote address by former Deputy Governor of the Central Bank W.A. Wijewardena and the speakers at the several technical sessions were of the view that fiscal consolidation was vital for sustained high growth. The technical sessions that followed had important in-depth analysis of the fiscal problem, the closely related issue of debt sustainability and reforms in trade policy that will be discussed in next sunday’s column.

Leave a Reply

Post Comment