Columns

Budget 2017: Achieving its desired goals and targets

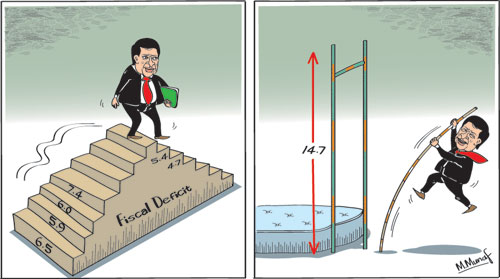

View(s):Finance Minister Ravi Karunanayake has announced the objectives and goals of the next budget. He expects to bring down the budget deficit to 4.7 percent of GDP, increase government revenues to around 14.2 percent of GDP and present a development-oriented budget. These sought-after objectives, if achieved, would improve the fiscal situation. They would pave the way for macroeconomic stability. However, achieving them would be no easy task.

Achieving these objectives would require vigilance in government expenditure to ensure that expenditures are kept within the budgeted amounts. Most importantly, the taxation proposals to garner the higher revenue must be pragmatic and effective unlike in the last two budgets and there must be an unwavering commitment to ensure that taxes are collected effectively.

Achieving these objectives would require vigilance in government expenditure to ensure that expenditures are kept within the budgeted amounts. Most importantly, the taxation proposals to garner the higher revenue must be pragmatic and effective unlike in the last two budgets and there must be an unwavering commitment to ensure that taxes are collected effectively.

Experience

Sri Lanka’s experience, recent and over a long time, has been one of being unable to contain expenditure within the budgeted figures and expected revenue not collected. Fiscal performance has been a far cry from budget expectations. Expenditure overruns and revenue shortfalls have been the repeated story year in, year out.

The fiscal performance of recent years was noteworthy for these lapses. The Budget 2015 that had as its objective the containment of the fiscal deficit at 4.4 percent of GDP ended with a 68 percent higher deficit of 7.4 percent. Nonetheless, the 2016 fiscal deficit is expected to be contained as targeted at 5.4 percent of GDP. The final figures we hope will turn out to be so.

Ambitious but imperative

Ambitious but imperative

In this context, the fiscal deficit target of 4.7 percent in 2017 is ambitious. It is, however, imperative to achieve economic stability and ensure that the public debt that is now at 75 percent of GDP does not grow much further. Much higher revenue collection than in the previous two years is needed to find the fiscal space for developmental and social expenditures that are vital for long term economic development.

There has been little accountability in public expenditure in recent years. The practice of passing supplementary estimates to cover additional expenditure has rendered budgeted expenditure figures a fiction. Containing expenditure to budgeted figures would be vital to ensure that expenditure is contained at the estimated levels to achieve the fiscal deficit target of 4.7 percent of GDP.

Assurances

The Finance Minister and the Prime Minister have given assurances that supplementary estimates would not be permitted. Earlier this week, Finance Minister Karunanayake told the International Monetary Fund’s Annual Meeting the government had a strong commitment to increase government revenue through further expanding the tax base and improvement in tax administration and to reduce the fiscal deficit to the targeted budget deficit of 5.4 percent in 2016 and 4.7 percent in 2017.

Despite these assurances, past experience makes one view these intentions sceptically. It is imperative to not overrun the budgeted expenditure figures. Fiscal discipline must be such that if there were to be some unforeseen expenditure that has to be incurred, then such expenditure must be met from savings from other expenditure.

Revenue

Government revenue has been declining precipitously from 2000 onwards from about 20 percent of GDP to as low as 11 percent in 2013. Despite fairly high economic growth and rise in per capita incomes, the proportion of revenue to GDP has been declining. However in 2015 it increased somewhat to 13 percent of GDP.

This decline in tax revenue when per capita incomes have been increasing has been attributed to tax exemptions, tax avoidance, tax evasion and lax tax administration. These no doubt have been important reasons for the low tax revenue. Some economists have even suggested that the proportion is inaccurate as the GDP was not as high as estimated.

Another reason is that GDP growth in the past five years has been driven by high expenditure in infrastructure. While this large expenditure adds to the GDP, it does not generate taxable income. This does not counteract the argument that tax exemptions, tax avoidance, tax evasion and lax and corrupt tax administration are important reasons for low tax gathering. It is through a system of pragmatic and progressive taxation and an efficient tax collection system that revenue could be increased significantly.

Taxation

Finance Minister Karunanayake’s tax proposals must be realistic ones that can garner in the budgeted revenue of Rs. 1,850 billion. The new taxation measures must take into account limitations in the tax administration that permits tax evasion and tax avoidance. The tax system must shift to being progressive in nature. Progressive taxation does not have to be necessarily direct taxes. Indirect taxes that fall on the affluent avoiders and evaders of direct taxes are progressive and more effectively collected. Licence fees on luxury vehicles, property taxes, stamp duties and capital gains taxes are examples of such taxes.

IMF tax proposals

At the conclusion of the last consultations with the IMF in Colombo, the IMF statement said that “it is important that the government expedites the legislative process of implementing the value added tax (VAT) amendments that are needed to support revenue targets for 2016 and 2017. The 2017 budget should also be underpinned by a well-crafted and high-quality tax policy strategy to raise Sri Lanka’s low tax revenue to GDP ratio. Commencing the legislative process for the new Inland Revenue Act would be an important step in rebalancing the tax system toward a more predictable, efficient and equitable structure and in generating the needed resources in support of the country’s ambitious social and development objectives.”

Conclusion

The budget of 2017 cannot be like the budgets of 2016 or 2015. It has to attain its goal of a lower fiscal deficit of 4.7 percent of GDP by achieving the revenue target, while ensuring that there are no expenditure overruns. This two pronged strategy of increased revenue collection and containment of expenditure are needed to achieve the target of a lower fiscal deficit and find space for development expenditure. Will the 2017 fiscal targets be achieved?

Fiscal deficits 2010-17 as Percent of GDP

2010 8.0

2011 6-9

2012 6.5

2013 5.9

2014 6.0

2015 7.4

2016 5.4*(projected)

2017 4.7**(target)

Sources: 2010-2015 Central Bank of Sri Lanka

Leave a Reply

Post Comment