Columns

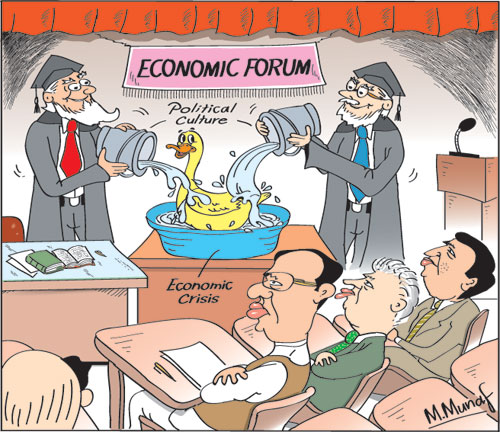

Advice from Economic Forum: Pouring water on a duck’s back

View(s):The two day Economic Summit organised by the Ceylon Chamber of Commerce brought out a forthright critique of current economic policies. The overall message was that fundamental weaknesses in the economy that included the lack of consistent economic policies, the need for a taxation system that ensures adequate revenue to reduce the fiscal deficit, appropriate and coordinated monetary and fiscal policies and consistency and predictability of economic policies rather than ad hoc measures to cope with emerging crises had to be put in place immediately.

Would these policy prescriptions be heeded? Was the Economic Forum another instance where the economic advice given was like pouring water on a duck’s back?

Would these policy prescriptions be heeded? Was the Economic Forum another instance where the economic advice given was like pouring water on a duck’s back?

Public finances

One of the critical problems facing the country is the need to bring down the fiscal deficit to a manageable proportion of GDP. This is recognized by the government that has set a target of a fiscal deficit of 5.5 per cent of GDP for this year and its progressive reduction in the next few years to achieve a fiscal deficit of 3.5 per cent of GDP in 2020. The question is whether there are policies in place to achieve these fiscal targets?

Professor Razeen Sally, Associate Professor of the Lee Kuan Yew School of Public Policy at the National University of Singapore and Chairman of the Institute of Policy Studies, Colombo, was outspoken in his comments on the current economic policy situation in the country: “There have been many ad hoc measures on taxation. Businesses are very vexed because of the high level of unpredictability and uncertainties, and excessive increase in state spending and salaries.” He said the government should refrain from further ad hoc tax measures, and should focus on fiscal consolidation and improving local business and investment climate.

VAT

Everyone is aware of the parlous state of the country’s fiscal policies and no one is aware of what the current tax measures are. The opposition to VAT and uncertainty in its enforcement has serious implications for government revenue. Beyond that the inability to enforce tax measures that are unpopular with sections of the population is a serious long term concern for the public finances of the country.

Inconsistency

There is ample evidence of inconsistencies, prevarication, contradictions and repeals of economic policies. The government has faced tremendous opposition to several key economic policies and has revoked several economic measures. This irresolute policy implementation has vitiated the government’s economic policy implementation and eroded confidence in the government’s capacity to resolve the serious economic crisis facing it.

Policy changes

Policy changes

For instance there was a divergence between the Economic Policy Statement of the Prime Minister of November 5th 2015 and the Budget presented a few days later. Sections of the government opposed several budget proposals and these were amended or deleted. Ultimately the amended budget was very different to the one proposed and the tax regime is ambiguous. The subsequent increase in VAT remains uncertain. Policies announced by the government have been changed by the President. These are not propitious for building confidence in the government’s economic policies.

Several changes in economic policies of this government have put in doubt the possibilities of achieving economic stability. As Razeen Sally pointed out there have been many ad hoc measures on taxation and businesses are very vexed because of the high level of unpredictability and uncertainties. He also argued that there were “excessive increase in state spending and salaries”.

Monetary and fiscal policy

Former Deputy Governor of the Central Bank Weerakoon Wijewardena made an important statement on the need to coordinate and complement monetary and fiscal policies. Far too often these two policies have had diverse and contradictory impacts, one negating the other. Wijewardena told the forum he believed the government’s fiscal and monetary policies were contradictory. He referred specifically to the Finance Ministry’s granting of tax concessions for vehicle imports for some public servants a few days after the Central Bank raised key interest rates by 50 basis points.

Wijewardena pointed out that monetary and fiscal policies are working in opposite directions and that in order to negate the tax concession the Central Bank will have to increase policy rates further in the near future. Otherwise the Central Bank’s interest rate increase would be in effective.

Bigger picture

At the root of the problem of economic policy making is the country’s political context and culture. Economists could give advice on what policies should be followed, but implementing these in Sri Lanka’s political context and culture has proven immensely difficult. The recent uproar over the increase in VAT is a dramatic illustration of the problem.

President Maithripala Sirisena portrayed the realistic position in economic policy formulation when he said “We have to pursue right economic policies over a considerable period of time to get over the economic malady accumulated in the past, but it has to be done without cutting down the public welfare component of the state expenditure”.

The President pointed out that “The country owes Rs. 9,000 billion. This has been a burden on the government as well as the people. We have taken measures towards fiscal consolidation to alleviate this crisis. We can’t adopt policies which have brought economic success to countries in this region because of the political culture that prevails here.

We have to consider political and social realities arising from policy decisions, therefore, the government will go ahead with its economic revival programme without cutting back funds allocated for education, public health services, Samurdhi etc. We have to recognize that balancing political and economic dynamics will always be a decisive factor”

Broader view

Balancing political and economic dynamics will always be a decisive factor and pursuing right economic policies are difficult in a country where the government has to appease the multitude. Pragmatic and realistic economic reforms are a vain hope in the political context and culture of the country. Good economic advice is like pouring water on a duck’s back. The serious implication of this is that the country’s prospect of rapid economic development is unrealistic, even though some economic strides are possible especially if global conditions turn favourable.

Leave a Reply

Post Comment