Columns

What’s happening to the real economy this year?

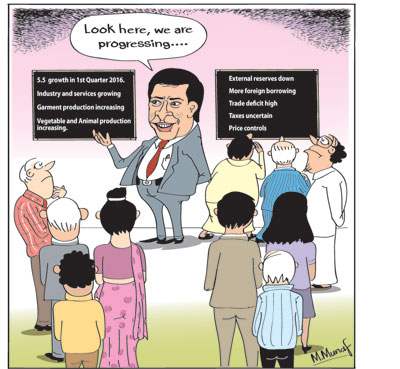

View(s):The foci of economic discussions this year have been on the balance of payments crisis, the IMF facility and its conditions, the bond issue, controversies on taxation, especially the increase in VAT, and the impact of BREXIT on the economy. These macroeconomic concerns and the country’s external financial vulnerability have been the dominant economic issues this year. There has been scant attention on how the real sectors of the economy are performing.

External vulnerability

External vulnerability

This concern on the external vulnerability of the economy is understandable as the country was facing a severe balance of payments crisis and the means of resolving it was of paramount importance. Furthermore as trade dependent economy, adverse developments in the external finances have extensive impacts on the economy. Nevertheless the performance of the economy has hardly been discussed.

Economic projections

Projections of the economy’s growth rate that would have taken into account the instability of the economy and the unfavourable global economic and financial developments. The real sectors of the economy were affected to different extents by the overall macroeconomic imbalances and the consequent policies. For instance the exchange rate and monetary policies to cope with the balance of payments have had impacts on them. However the actual performance of the real sectors—agriculture, industries and services— have not been adequately assessed.

IMF assessment

IMF assessment

The IMF predicted a growth of 5 per cent in GDP in 2016 and expects it to continue at 5 per cent till 2018. This expectation in growth was on the assumption that the reforms suggested by the IMF would be implemented. The latest IMF assessment in mid-June stated that “Sri Lanka’s prospects for the medium-term appear favourable if current macro-financial imbalances can be addressed. Real GDP is projected to rise to 5 per cent in 2016, supported by a recovery in construction and sustained momentum in services including tourism, transport, and IT.”

The IMF emphasised that the “growth momentum can be sustained with a solid commitment to reform, a clear direction on macroeconomic policies, and restoration of market confidence.” While acknowledging that “Sri Lanka’s medium-term growth prospects are generally favourable, given its strong base of human and physical capital and strategic position in a fast growing and dynamic region”, it went on to point out that “The key risks to the outlook, both short- and medium-term, stem from government inaction on key policies and a significant deterioration in the external environment.” These concerns have been paramount in the minds of Sri Lankan economists too.

Other projections

Most projections of GDP growth for this year have been between 4.5 and 5.5 per cent. The Central Bank’s Annual report for 2015 projected a growth of 5.8 percent. Moody’s that downgraded the country risk rating did recognise a growth potential in the economy and placed the growth at 5.5 per cent in 2016.

International institutions have been somewhat optimistic about the country’s medium term growth, though sceptical of the government’s commitment to achieve fiscal consolidation and implement economic reforms. The political state of affairs and political milieu are underlying reasons for this incapacity. Getting economic policies right would be essential for medium term economic growth.

First half of 2016

How has the economy actually performed in the first half of the year that has just been completed? Understandably the assessment of economic performance that is available is only for the first quarter, when the economy grew at over 5 per cent despite economic and financial stresses. Some less certain information has to be used to predict the growth of the second quarter in which there are some positive developments that indicate a healthy growth in the second half. Indications are that a growth of over 5 per cent could be achieved in the first half of the year and improved upon in the second half of the year.

First quarter

In the first quarter of 2016 GDP grew at 5.5 per cent much higher than the 2.5 per cent growth in the fourth quarter of last year. This growth of 5.5 percent in the first quarter of 2016 was achieved owing to increased production in all sectors: Agriculture, Industry and Services. Agricultural growth was the least at a modest 1.9 per cent owing to adverse weather conditions and depressed prices for tea. Industries that include construction grew at 8.3 per cent and services at 4.9 per cent.

Industries

There was a substantial increase of 8.3 per cent in the industrial sector in the first quarter of 2016 compared to 1.4 per cent in the first quarter of 2015. Among industrial activities, construction increased impressively by 12 per cent during this quarter compared with the first quarter of 2015. In addition, manufacture of textile and wearing apparel, rubber and plastic products and manufacture of food, beverages and tobacco have shown healthy growth rates in the first quarter of 2016.

Services

Services that contributed 52.4 per cent to GDP grew at 4.9 per cent in the first quarter of this year when compared to the first quarter of 2015. Services which grew significantly included financial services, wholesale and retail trade and education. Tourism and IR services are two of the most likely growth centres.

Agriculture

While agriculture’s overall growth was modest, vegetables, coconut and animal production grew at high rates. Vegetable production grew by 16.3 per cent, oleaginous fruits, including Coconut, grew by 10 percent and animal production by 5.1 percent during the first quarter of 2016, when compared to the first quarter of 2015. Meanwhile Tea production decreased by 11.6 percent, Rubber and marine fishing declined somewhat during the first quarter of this year. While tea and rubber production may take time to revive, marine fishing is likely to increase in the second half.

Implications and emerging prospects

These developments indicate that while there is considerable instability and uncertainty in the economy, vital economic activities have been productive. The industrial growth momentum could be expected to continue, especially as garments exports are doing well. Garments exports that account for around 50 per cent of total exports expanded by 6.2 per cent, despite manufactured exports decreasing by 4.2 per cent in the first quarter. Industry sources indicate that this growth momentum is continuing. Fishing that took a beating with the stoppage of fish exports to the EU has commenced exports. Growth in fishing is likely to contribute to GDP in the second half of the year. Sustained growth in tourism and IT services are likely to push growth up.

Leave a Reply

Post Comment