Columns

Sirisena faces May Day test of strength, growing challenge from pro-Rajapaksa ‘JO’

View(s):- Despite threats of disciplinary action, dissidents go full steam; President asks why UNP going soft on former leaders

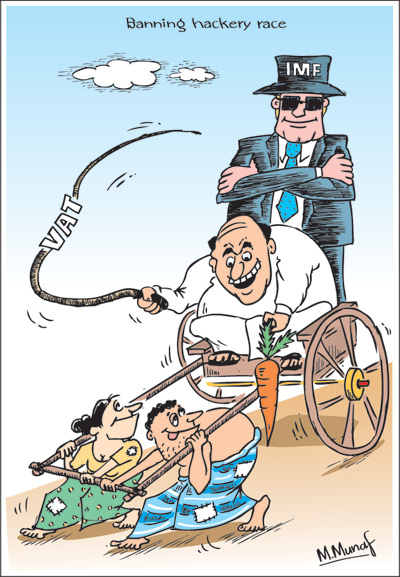

- Polonnaruwa VAT bombshell reverberates at crucial talks with IMF in Washington; major topic at Cabinet meeting

- Tax not withdrawn, experts not sacked, but major changes made in proposals to reduce burden on people

He neither put a halt to new taxes nor sent home the Government’s economic advisors who reportedly recommended them.

He neither put a halt to new taxes nor sent home the Government’s economic advisors who reportedly recommended them.

Yet, President Maithripala Sirisena was able to ensure a few concessions were offered when the Value Added Tax (VAT), the biggest burden for low and middle income groups, becomes effective. There is still an element of uncertainty when a VAT increase to 15% comes into effect though it is currently scheduled for May 2. Other tax measures have already been made effective from April 1.

State Minister for Finance, Lakshman Yapa Abeywardena told the Sunday Times an extraordinary Gazette notification was due on May 2 but would be backdated if there was a delay. The outcome of talks between the Government and the International Monetary Fund (IMF) in Washington DC was being awaited. The Government made a case for an IMF Extended Fund Facility of US$ 3 billion whilst talks in Colombo saw a possible offer of US$ 1.2 billion. Reports from Washington DC indicate that a sum above US$ 1.2 billion but below US$ 3 billion would be the likely outcome. Stating Sri Lanka’s case to the IMF for the enhanced facility was a delegation led by Finance Minister Ravi Karunanayake.

In what seemed a surprising turn of events, President Sirisena declared during a speech at the national New Year celebrations at Pulasthipura in Polonnaruwa, that he would not introduce any tax that would be a burden on the people. He said he had read reports in sections of the newspapers about the revision of VAT. He warned that if there were economic experts who made such proposals, he would send them home. The policy of the Government was to alleviate the burdens of the people and not to heap more, he said. Sirisena’s tough statement hit the headlines and reverberated in the Colombo-based diplomatic community. In Washington, where Finance Minister Karunanayake was negotiating for an extended facility with the IMF, and a promise that his Government would impose certain taxes in order to win an IMF loan, there was a barrage of queries for him. Has the Government gone back on its commitments to ensure financial discipline? How would it make up for the shortfall in revenue if VAT was not increased? These were some of the questions tossed at him. A Washington-based Sri Lankan told Karunanayake about the President’s tough comments and the minister confessed he was unaware of what had gone on in Sri Lanka. There was no official intimation to him from the President’s office or anyone in the Government if indeed VAT was not going to be increased. He was out on a limb, so to say.

President kept in the dark

This was naturally the focal point of discussion when ministers held their weekly meeting on Tuesday morning this week. Sirisena’s gaffe at Pulasthipura became clear. Yet, there were related issues that he was concerned about. Sources at the President’s office said Sirisena was livid that a Central Bank high official and an Economic Advisor who were among those who held official level talks with an IMF team when it was in Colombo just days ago had exceeded their brief. Both had lived abroad for many years and returned to take up their new jobs with the new Government last year. The President had not been kept informed about the commitments they made on behalf of his Government. This prompted Sirisena to propose that in future all fiscal matters should be discussed by him with Premier Wickremesinghe and Finance Minister Karunanayake. It appeared that what he was saying was that he too must be kept informed of what those in charge of the country’s finances were doing.

Making the situation worse were reports that Karunanayake’s push for an enhanced Extended Fund Facility during talks in Washington had been stymied by the commitments made by the duo. Sirisena also noted that he and Sri Lanka Freedom Party (SLFP) ministers should be consulted when it came to fiscal measures affecting the public. He was of course underscoring the need for a greater dialogue between the two parties that form the Consensus Government. Otherwise, all ministers gather for their cabinet session every week and there is weekly interaction there.

President Sirisena vowed at the Pulasthipura meeting he would not allow the imposition of taxes that would place hardships on the people. Ironic enough, it was Sirisena himself who urged a staffer at the Cabinet office to collect copies of a memorandum forwarded by Finance Minister Karunanayake at the ministerial meeting on March 2. In that, Karunanayake had recommended tax increases and referred to negotiations for an IMF Extended Fund Facility. Sirisena did not wish that any references be made to the IMF. Prime Minister Ranil Wickremesinghe then undertook to present another memorandum. A special ministerial meeting was fixed for March 4 for a discussion on the matter.

His ten page memorandum was titled “MINIMISING THE GLOBAL DOWNTURN ON THE SRI LANKAN ECONOMY AND CLEARING UP THE COLOSSAL AMOUNT OF REPORTED LIABILITIES AT PUBLIC SECTOR INSTITUTIONS.” A recommendation for introducing new taxation in five different areas was made. They were (1) Non-corporate income tax and corporate tax – to suspend budgetary proposals for one year and continue the 2015 rates. (2) Corporate income tax – to impose 17.50 % rate instead of budget 2016. (3) To implement the Capital Gains Tax. (4) Nation Building Tax (NBT) – to revise the budget 2016 proposals and lower the NBT from 4% to 2%. (5) To introduce a single VAT rate of 15%. Budget 2016 proposed a two band – 8% and 12% instead of a single rate of 11% before.

Premier Wickremesinghe’s memorandum which made no reference to the IMF but laid emphasis on the “global downturn” was accepted. Thereafter, the memorandum came up for study by the Cabinet’s Economic Affairs Management Committee which is chaired by the Premier. “We will soon explain to the public that the tax measures were necessitated because we are paying the bad debts of the previous Government,” Premier Wickremesinghe told the Sunday Times. He said ad hoc tax increases would not be made. “By late June or July we would have put in place a mechanism to improve the economic situation,” he added. The balance of payments issue is expected to form one of the main elements in his speech at the United National Party (UNP) May Day rally at Campbell Park, Borella.

VAT off utility services

State Minister Abeywardena told a news conference after Tuesday’s ministerial meeting that VAT was being increased to 15% due to a drop in state revenue. Over the years, he said, public sector salaries have increased but the Government had not cut down on welfare measures. He said: “There are about 77,000 registered to pay VAT. Only 35,000 are active. Of that only 15,000 pay VAT. The threshold to pay VAT has been reduced over the years. In 2013 those who were required to pay were those having a turnover of Rs. 500 million for three months. In 2014 it was reduced to Rs. 250 million for three months, in 2015 to Rs. 100 million for three months and in 2016 per quarter it was reduced to three million rupees.

“President Sirisena has now ordered that VAT should not affect electricity and water charges. We cannot proceed without increasing Government revenue. This is the best way to gain revenue. It should be mentioned that the increase is not on the advice of the IMF or the World Bank. This is a measure to bridge the deficit in the budget. We are a country which has welfare measures and therefore cannot impose direct taxes. Commodities that bring revenue to the country like tea exports have been affected. We have faced consequences of a world economic downturn. Due to this, we have been compelled to revise the VAT. It will not affect the pharmaceutical items. Some say it will affect the health sector. It will only cover the private sector health services. It will apply to those channeling doctors to obtain treatment. Pharmaceuticals have been exempted totally from VAT.

“The VAT will be applicable only for ‘luxury items.’ If a person purchases goods from a supermarket, the VAT will be added to the price of that particular item and will not been shown separately in the bill.”

Q: The Prime Minister also made a statement in Parliament regarding the implementation of the VAT. The President also has made some comments. Why did the President intervene?

Abeywardena: The President and the Prime Minister have said the same thing. Earlier there was an opinion that electricity and water too would be affected. The PM and the President have now discussed and decided that it will not affect electricity. Therefore we will be issuing instructions not to impose it for electricity.

Q: If a decision has been taken not to impose VAT on electricity, water and other essentials, the revenue target will be reduced?

A: No, the excise, tobacco, vehicle import taxes have increased. Revenue also has increased as a result of detection of illegally imported items. But the revenue is not adequate.

Q: How will it apply for the telecommunication services?

A: It will apply for fixed lines and mobile telephones.

Q: What about the private education sector?

A: Yes it will affect the private education sector. People who send their children to an international school can afford to pay VAT.

State Minister Abeywardena claims that the increase in VAT is “not on the advice of the IMF or the World Bank” and adds that it is “to bridge the deficit in the budget.” Other Government leaders have also remarked that the IMF was not imposing conditions for the Extended Fund Facility, a ridiculous suggestion indicating the IMF was so kindly granting such a facility for Sri Lanka to overcome a balance of payments crisis on grounds of generosity or sympathy. The reality is far from that. As revealed last week, Sri Lanka has already agreed to three different criteria laid down by the IMF. The main one is that the overall 2016 budget deficit should not exceed 5.4 percent. On the one hand the State Minister for Finance says there was no advice from the IMF but on the other a formal commitment has been made as part of measures to ensure financial discipline at IMF’s request.

In new measures that came into effect from April 1, the exclusion of profit-making businesses from Economic Service Charge (ESC) had been removed. Also removed will be the present maximum liability of Rs. 120 million per year. The rate has been increased from 0.25% to 0.50%. The period for carrying forward of ESC to be set off against income tax payable for any period commencing from April 1, 2016 has been reduced from five to three years. Petrol, diesel and kerosene retail trade shall be liable for ESC if the aggregate turnover for a quarter is Rs. 50 million. Tax is to be calculated at 1/10th of the liable turnover of such trade.

Corporate income tax rates for certain sectors is to be continued as in the year of assessment 2015/2016. Changes have been made in Banking and Financial services (28%), Insurance Industry (28%), Trading activities (28%), Liquor (40%), Tobacco (40%), Lottery (40%) and Betting and Gaming (40%). Progressive income tax rates, tax free allowance, the tax deduction and tax exemptions on the profit from employment, currently applicable to year of assessment 2015/2016 on personal income tax including Pay-As-You-Earn (PAYE) is to be continued. The Ministry of Finance, according to the office of the Commissioner General of Inland Revenue, has declared that provisions preventing employer settling employee’s PAYE tax liability (instead of deducting from employee’s remuneration) will be introduced.

Sirisena’s political bombshell

It was not only granting limited relief from the increase in VAT that engaged President Sirisena’s attention at the ministerial meeting last Tuesday. He also dropped a political bombshell when he said that most UNP ministers have stopped criticising the previous administration and his predecessor Mahinda Rajapaksa. The remarks come at a time when some SLFP ministers and parliamentarians expressed concerns to Sirisena over a meeting Rajapaksa had with Premier Wickremesinghe on April 5. They were seeking clarification on what was the position since they had taken up tough positions against them during the presidential and parliamentary elections. They were apparently unaware that Wickremesinghe had, soon after the meeting with Rajapaksa, briefed Sirisena on the outcome. He had explained that Rajapaksa and ‘Joint Opposition’ leader Dinesh Gunawardena had met him primarily to discuss issues relating to former President’s security.

This was ahead of the latter’s departure to China. As revealed in these columns, the duo discussed several matters including the Premier’s proposed discussions in China on projects in Hambantota, which is Rajapaksa’s home turf and the abolition of the Executive Presidency when a Constitution is formulated. It later transpired that during Premier Wickremesinghe’s talks, Sri Lanka mooted the conversion into equity the Chinese loans for two major projects in Hambantota — the Magampura Port and the Mahinda Rajapaksa International Airport. A third was the Norochcholai coal-fired power plant. This week, Rajapaksa also had a meeting with Health Minister Rajitha Senaratne though details of what they discussed are not known.

Sirisena also told the ministers at Tuesday’s meeting that the remaining Army component of the former President’s security detail would be withdrawn after May 1. It will be replaced by the commando arm of the Police, the Special Task Force (STF). Minister Sarath Fonseka was to point out that in terms of a ruling by the then Chief Justice Sarath N. Silva, personal security entitlement was limited to some twenty categories. He, however, did not elaborate.

Thajudeen case: More arrests soon

Sirisena’s remarks to his ministers came as different state agencies were wrapping up investigations into some cases which have remained in the public focus for several months. One such case is the CID probe on the death of national rugger player Wasim Thajudeen. During the Rajapaksa administration, the Police conducted investigations but it was later ruled that Thajudeen’s death was caused by an accident. However, the present Government leaders to whom the case became an election issue directed a CID investigation. Later, in February a court ruling said the death of Thajudeen appeared to be a murder and ordered that those involved be arrested. Later, in March the court gave two months extension to the CID to execute that order.

Investigations took a dramatic turn this week when the Officer-in-charge of Traffic at the Narahenpita Police made a statement to the CID that the former OIC Crimes there had allegedly withheld vital evidence. He has claimed that at 3 a.m. on the day Thajudeen’s body was found near Shalika Grounds; the then Senior DIG Anura Senanayake had visited the station and spoken to the former OIC Crimes. He has provided details of what he claims had taken place. A source said, “He (the former Narahenpita OIC Crimes) is fully co-operating with the investigations.” He has also alleged that another top Police officer who has since left the service was in the know of the incident and claimed he did not do anything at the time. He had closed the file on the basis that the incident was an accident. The former OIC Crimes, Sumith Chinthaka Perera, has been remanded till May 5. CID sources said yesterday that more arrests were to follow in the coming week.

Wasim Thajudeen’s death came into public focus first after what then appeared to be an innocuous incident. The rugger player’s purse had been found by a civilian along Park Road, at a junction which was the turn off to Issipathana College. He had taken the purse to the Kirillapone Police Station unaware the Havelock Town area belonged to the Narahenpita Police. The Officer-in-charge there has had the presence of mind to record a statement from the finder and inventorise the items in the purse. Days later when the Kirillapone Police conducted inquiries they realised that the purse belonged to Thajudeen. It raised questions on how a man who died in an accident near the Shalika Hall along Park Road could have dropped his purse a few hundred metres behind. And that too, in a car where all windows were closed. CID detectives have found that a controversial senior Police officer, now retired, had visited the Kirillapone Police one night and severely reprimanded the OIC for not bringing the finding of the purse to his attention. The OIC had later been transferred out.

Like the CID, the Financial Crimes Investigation Division (FCID) has also concluded discussions with the Attorney General’s Department over some high profile investigations. In one case, FCID sources said, an important personality and others associated with him are to be arrested in the coming week over allegations of money laundering and fraudulent acts.

Basil’s bid to strengthen new party

All in all, it is likely there will be a spurt of cases against leading personalities of the previous Rajapaksa administration. This, however, appears to have not deterred the former President from going ahead with plans for a new political party. Joining him in this effort now is his brother and former Economic Development Minister Basil Rajapaksa. The latter has successfully involved chairpersons and members of local councils who lost their positions due to dissolution of their institutions by the UNF Government. This includes groups who supported the UNF when they were serving members.

The one-time local councillor group has titled their organisation the Palaath Palana Manthri Sansadaya (Local Council Members Guild). Basil Rajapaksa told the Sunday Times, “This group will form the nucleus of the new party’s political bureau.” He said other leading civil society members, those from clergy, trade unions, university academics, teachers and other different work disciplines will also be members of this body. He pointed out that a similar political bureau was set up by the late Sirimavo Bandaranaike after the SLFP suffered an ignominious defeat at the parliamentary elections in 1977. She did this at that time to strengthen the party, he added. He said that the new party’s parliamentary group would work together with the political bureau.

This Guild will participate in the ‘Joint Opposition’ May Day rally at the Lalith Athulathmudali Grounds in Colombo’s Kirillapone area. However, Opposition sources said it was unlikely Rajapaksa would formally announce the formation of the new party on that day. Yet, for the organisers of the ‘Joint Opposition’ rally, the priority number one is to ensure a large turnout. Towards this end, buses are being arranged for participants to arrive in Colombo from different parts of the country. In a bid to ensure no SLFP parliamentarians or organisers in districts and electorate level attend the event, the leadership has threatened disciplinary action. However, they failed to take such action against those who took part in the Joint Opposition rally at Hyde Park early last month. They defied a warning of the SLFP Central Committee not to do so. With equal vigour, the pro-Sirisena faction in the SLFP is also making arrangements to hold its rally at the Ramparts in Galle.

Even for the pro-Sirisena SLFP group, the salary increases to state and private sector employees will be a highlight. Minister John Seneviratne told the Sunday Times, “We will re-iterate the need for a minimum wage of Rs. 10,000 for all workers and allowances amounting to Rs. 2,500 be given to them.” He said District Committees had been set up to ensure that larger crowds turn up for the rally under the patronage of President Sirisena. He said it was proposed to announce other perks to be given to workers. An amendment to the Shop and Office Act will also ensure maternity payments are granted by those in the private sector, he added.

The nearly disgraced Basil Rajapaksa’s return to Opposition politics, particularly after the parliamentary elections of August last year, has also seen other developments. He has closed ranks with National Freedom Front (NFF) leader Wimal Weerawansa with whom there was some political acrimony.

Weerawansa told the Sunday Times, “The NFF will participate in the Joint Opposition rally. We will continue to remain with them.” He said different May Day resolutions were now being formulated. They would be adopted at the rally, he said. He declared that among the resolutions was one which would refer to the burdens placed on the people by the increase in taxes, particularly the VAT.

Others included condemnation of the Government for the measures it had adopted posing threats to national security, suppression of trade unions and people’s rights and the sell-out of state enterprises.

JVP focus on new economy

Like the ‘Joint Opposition’, an appeal to the Government to relieve the tax burdens on the people is one of the highlights of the Janatha Vimukthi Peramuna (JVP) May Day rally. JVP parliamentarian and Information Secretary Vijitha Herath told the Sunday Times, “Our May Day rally will be on the theme ‘New Economy-New Society-empowering the masses.” The JVP procession willேூstart from the S.deS. Jayasinghe playground in Dehiwala and proceed to the Burgher Recreation Club (BRC) grounds in Colombo for the rally. He said his party hoped to pass a series of resolutions on a wide range of issues. Among them will be reducing the tax burden on the public, improving national unity, abolishing the Executive Presidential system, taking legal action on acts of corruption and fraud, resolving the northern and eastern land issues and finding a solution to the issues concerning the fishermen in the northern province.” Other resolutions will include protecting the free health system, putting a stop to the Economic and Technical Co-operation Agreement (ECTA) with India and one on the United States intervention in foreign countries.

The UNP resolutions are still being formulated and Media Minister Gayantha Karunatilleke said he was unable to say what they were, He said a resolution would take note of the pay increase the Government had granted both to employees in the state and private sectors (in 2015).

For President Sirisena who is still trying hard to take full control of the SLFP, the upcoming May Day will be a serious political challenge. That it comes at a time when he entertains a perception that some UNPers in the Cabinet of Ministers are not criticising the previous Government or more particularly Mahinda Rajapaksa adds to that test of strength. One of the major drawbacks for the UNP component in the Government is the absence of a communications strategy to educate the people on different issues and ward off suspicions. They have not gone beyond the previous Government’s practice of issuing media releases whilst their own members are making contradictory statements on issues. These do not bode well for Prime Minister Wickremesinghe.

Leave a Reply

Post Comment