Columns

Who is responsible for the economic crisis?: Twofold increase in foreign debt 2010-14

View(s):There have been plenty of accusations and counter accusations on who caused the current economic crisis. The government accuses the previous government and the previous regime accuses the new government of causing the economic crisis. This politically biased debate is not based on economic facts and figures. Statements on both sides of the political divide lack substance and cogent arguments.

MR statement

MR statement

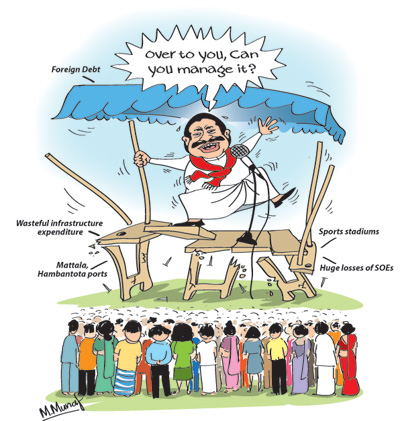

In this context of confused thinking, former President Mahinda Rajapaksa made a well crafted statement on the ides of March. He contends that the economy was strong when he left office and that it was the developments in the last 15 months of the present government that caused the crisis.

The statement cites several statistics and figures to show that the economy was sound when he relinquished power on January 8th 2015 and argues that it is the mismanagement of the new government that created the economic crisis. The current government places the entire blame for the crisis on the previous government citing mainly the huge debt profile it inherited. Where is the truth in this plethora of political rhetoric?

Foreign borrowing

Foreign borrowing

The crux of the issue is in the amounts, cost and use of foreign borrowing. The former President contends that in the 15 months that this government has been in power it has borrowed US$ 6,361 million. The pertinent question is whether this borrowing was needed to finance the current and capital expenditure in 2015 or was it for servicing the foreign debt? Adverse global conditions too aggravated the external finances.

Surely this large amount of foreign borrowing was necessitated mostly due to the debt servicing needs of the loans borrowed by the previous government. Loan repayments amounting to US$ 4 billion during the last few months was due mostly to debt servicing obligations of loans taken by the MR government and the state of the economy in 2015. These were not repayments of loans taken during the present government.

Fitch rating

The view that the Fitch rating would not have downgraded us had the debt repayments remained at a more manageable level is flawed as the loan repayments in 2015-16 were mostly of loans of the previous government. There were also global conditions that impacted adversely on the external finances of the country.

Foreign debt

A noteworthy feature of the post war economy is the rapid rise in foreign debt. The foreign debt that was US$ 21.4 billion in 2010 doubled to US$ 43 billion in 2014, when the previous government left office. The rise in foreign indebtedness was particularly sharp in the single year 2010-11, when it increased by US$ 11.3 billion as can be seen in the table. The foreign debt was as much as 57.4 percent of GDP in 2014.and debt servicing required one fifth of the country’s earnings from exports of goods and services in 2014. This is a huge burden for any country to carry.

Justification

Admittedly foreign borrowing is not inherently detrimental. In fact foreign borrowing could be beneficial when used sensibly. There are two justifications given by the former President for the foreign borrowing. First that the loans were long term and carried a low interest rate of 2 per cent and second that the massive borrowing was for needed infrastructure development and not for consumption.

The veracity of the interest rate has to be clarified by the present government and the Central Bank. There are claims that Chinese loans were in the neighbourhood of 6.3 to 7 per cent. Were the loans at a low interest rate of 2 percent, as claimed by the former President?

Infrastructure development

It is true that the MR government borrowed money to build infrastructure with long term loans. It is also true that there has been a significant improvement in the country’s infrastructure. However, the costs of this infrastructure development were very high. The fact that tenders were not called for competitive bidding lends support to this argument that the cost of this infrastructure development may have been overly high. Why were the best practices in awarding these contracts not observed?

Loss making

It is significant that most of the investments are not generating income and several are loss making. One hardly needs to name the massive uneconomic infrastructure projects that were foreign funded. Since many of these large investments have negative rates of return such infrastructure development has been a foreign debt burden rather than a benefit. The colossal losses of state enterprises are a huge burden to the present government.

Debt burden

It is true that when Ranil Wickremesinghe was the Prime Minister of the cohabiting or power sharing government led by Chandrika Bandaranaike, debt was above 102 per cent of GDP and that it has been brought down to about 73 per cent of GDP, which is still high. But recall the fact that the GDP figure was more reliable at that time than later and much of the increase in GDP was due to the foreign funded infrastructure expenditure rather than the production of tradable goods and services. Corrected for a better estimate of GDP, the debt to GDP ratio under the previous government could be higher.

Debt increasing

Apart from this statistical issue, this ratio has fallen not due to the debt decreasing but the GDP increasing. The nature and quality of the GDP growth has been such that it has increased debt without being able to reduce debt servicing costs. That is why in recent years, debt servicing was more than government revenue, thereby necessitating further borrowing for government expenditure that increased public debt.

Debt servicing burden

Nearly the entirety of revenue went for debt servicing in recent years. In 2013 debt servicing costs exceeded revenue (105 per cent of revenue) and in 2014, the last year of the Rajapaksa regime, debt servicing absorbed 95 per cent of revenue. This, in spite of the fact that debt figures are suspect, as some large expenditures financed from borrowing are not included in these figures. Debts incurred by government institutions are contingent liabilities of the government.

In conclusion

The Mahinda Rajapaksa statement has raised several other issues about the increasing fiscal deficit, budgeting of the present government and the conditions imposed by IMF that will be discussed next week.

Leave a Reply

Post Comment