Columns

Lessening trade deficit vital to avoid worsening balance of payments

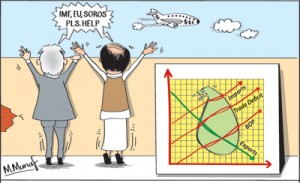

View(s):The large expanding trade deficits are the root cause for the balance of payments crisis. In 2015 the trade deficit widened as exports plunged and imports continued to be high. The trade deficit reached US$ 6.9 billion in the first ten months of last year. The trade deficit must be reduced this year to avoid worsening of the balance of payments.

Trade deficit

Trade deficit

The 2015 trade deficit is heading towards a massive US$ 8.5 billion owing to a decrease in export earnings by 3.9 percent in the first ten months of last year. During this period, though imports decreased by 1.2 percent compared to the first ten months of 2014, they were high at US$ 15.8 billion. Consequently the trade deficit reached US$ 6.9 billion in the first ten months of last year.

Balance of payments

This large trade deficit is the root cause of the increasing balance of payments (BOP) deficit of US$ 2.3 billion estimated by the Central Bank for the first ten months of 2015. In contrast, in the first ten months of 2014, despite a large trade deficit of US$ 6.7 billion, the balance of payments had a surplus of US$ 1.76 billion, owing to earnings from services, workers’ remittances and capital inflows offsetting it.

Unless the trade gap is reduced this year the country would continue to face severe balance of payments difficulties. As prospects for increased exports is tepid, the correction of the trade balance would have to come by constrains in imports.

Trade performance

Trade performance

The 2015 trade performance has been disappointing. In the first ten months of 2015, the trade deficit reached nearly US$ 7 billion, about 2.5 per cent higher than in the previous year’s (2014) large trade deficit of US$ 6.5 billion for the same period.

Exports declined by as much as 3.9 per cent, while imports decreased by only 1.2 per cent. Export earnings were only 56 per cent of import expenditure. Export earnings were seriously affected by global conditions. The decline in oil prices and collapse of the Russian economy reduced tea exports to Russia that is one of the main markets. Tumbling oil prices coupled with turbulent conditions in the Middle East affected the country’s tea export earnings. In the first ten months of this year tea exports fell by 16.6 per cent. This was mainly responsible for the reduction in exports by 3.9 per cent in the first ten months of 2015 compared to that of exports of the same period in 2014.

Industrial exports

Industrial exports too declined somewhat in the first ten months of 2014 compared to the first ten months of 2014. Industrial exports declined by 1.7 per cent. All significant manufactured exports fared badly last year. Garments exports, that are the largest manufactured export item declined by 1 per cent. Import expenditure.

The high import expenditure is a core reason for the large trade deficits in 2014 and 2015. In the first ten months of last year, imports were US$ 15.8 billion compared to export earnings of US$ 8.8 billion. Consumer, intermediate and investment goods imports increased by significant amounts.

Consumer imports that constituted about one fourth of imports (24.8 %) increased by 28.5 per cent, while intermediate imports that accounts for one half (50.9%) of imports, increased by 15.8 per cent and investment goods imports increased by 13 per cent.

A startling feature of consumer imports was the 70 per cent increase in vehicle imports that accounted for 7.5 per cent of all imports. In contrast, fuel imports decreased by 44.9 per cent and accounted for only 14 per cent of total imports due to the precipitous decline in oil prices. Despite this huge advantage, increased imports, especially vehicle imports, strained the trade balance. The increase in investment goods imports by 13 per cent to US$ 3.8 billion is also high. This analysis of imports indicates the need for a reduction of import expenditure in 2016.

Remittances

The country has been able to sustain high trade deficits in the past owing to the large remittances of expatriates that offset as much as 80 per cent of the trade deficits of some past years. However last year’s remittances slowed down during the second half of the year and increased by only a marginal 1.7 per cent in the first ten months of the year. This slowing down of remittances is ominous for the balance of payments as the turbulent conditions in the Middle East remains unresolved.

However remittances offset about 84 per cent of the trade deficit in the first ten months of 2015. Tourist earnings increased by 17.9 per cent from that of the same period last year to reach US$ 2.8 billion.

Averting a crisis

The trade imbalance has to be reduced this year to avert a balance of payments crisis. As the prospect of increasing exports is limited in the short run owing to global conditions, an improvement in the trade balance would have to be achieved largely by constraints in imports. While the long term and sustainable solution is to enhance exports, it is essential to contain aggregate demand to stem imports this year. Monetary and fiscal policies must ensure a restraint in imports. Public expenditure too must be sensitive to the high import propensity of government expenditure.

Unfavourable global conditions have been a primary reason for the decline in exports. This is particularly so with respect to tea exports that declined by 16 per cent owing to depressed demand in oil producing countries. There are serious political concerns in developed countries owing to the fear of ISIS terrorist attacks and the large refugee influx to European countries. Consequently investment inflows and expansion of exports are bleak. Therefore appropriate fiscal and monetary policies that would stem excessive demand for imports are vital. The increase in interest rates is inevitable.

The prudent management of public finances is crucial to achieve a healthier trade balance. It is important for policy makers and administrators to realise that public expenditure has a high propensity to import.

Leave a Reply

Post Comment